Page 78 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 78

JSE - ALP Profile’s Stock Exchange Handbook: 2025 - Issue 3

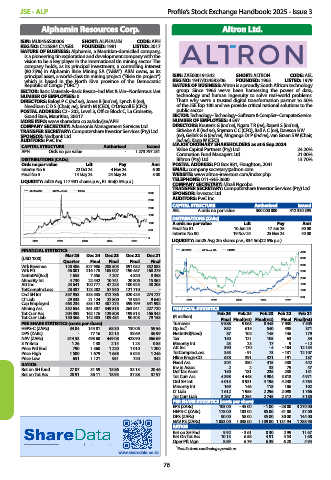

Alphamin Resources Corp. Altron Ltd.

ISIN: MU0456S00006 SHORT: ALPHAMIN CODE: APH

REG NO: C125884 C1/GBL FOUNDED: 1981 LISTED: 2017

NATURE OF BUSINESS: Alphamin, a Mauritian-domiciled company,

is a pioneering tin exploration and development company with the

vision to be a key player in the international tin mining sector. The

company holds, as its principal investment, a controlling interest

(80.75%) in Alphamin Bisie Mining SA (“ABM”). ABM owns, as its

principal asset, a world-class tin mining project (“Bisie tin project”) ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL

which is based in the North Kivu province of the Democratic REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979

Republic of Congo (“DRC”). NATURE OF BUSINESS: Altron is a proudly South African technology

SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--Nonferrous Met group. Since 1965 we’ve been harnessing the power of data,

NUMBER OF EMPLOYEES: 0 technology and human ingenuity to solve real-world problems.

DIRECTORS: Baloyi P C (ind ne), Jones B (ind ne), Lynch B (ne), That’s why we’re a trusted digital transformation partner to 50%

Needham C D S (Chair, ne), Smith M (CEO), O’Driscoll E (CFO) of the JSE Top 100 and we provide critical national solutions to the

POSTAL ADDRESS: C2 - 202, Level 3, Office Block C, La Croisette, public sector.

Grand Baie, Mauritius, 30517 SECTOR: Technology--Technology--Software & CompSer--ComputerService

MORE INFO: www.sharedata.co.za/sdo/jse/APH NUMBER OF EMPLOYEES: 4 597

COMPANY SECRETARY: Adansonia Management Services Ltd. DIRECTORS: Kouteris G (ind ne), Ngara T R (ne), Rapeti S (ind ne),

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Sithebe A K (ind ne), Snyman C C (CFO), Ball A C (ne), Dawson B W

SPONSOR: Nedbank Ltd. (ne), Gelink G G (ind ne), Mnganga Dr P (ind ne), van Graan S W (Chair,

AUDITORS: PwC Inc. ind ne), Kapp W (CEO)

CAPITAL STRUCTURE Authorised Issued MAJOR ORDINARY SHAREHOLDERS as at 6 Sep 2024

APH Ords no par value - 1 273 797 231 Value Capital Partners (Pty) Ltd. 24.20%

Coronation Fund Managers Ltd. 21.00%

DISTRIBUTIONS [CADc] Biltron (Pty) Ltd. 13.70%

Ords no par value Ldt Pay Amt POSTAL ADDRESS: PO Box 981, Houghton, 2041

Interim No 6 22 Oct 24 4 Nov 24 6.00 EMAIL: company.secretary@altron.com

Final No 5 14 May 24 24 May 24 3.00 WEBSITE: www.altron-investors.com/index.php

LIQUIDITY: Jul25 Avg 117 931 shares p.w., R1.4m(0.5% p.a.) TELEPHONE: 011-645-3600

COMPANY SECRETARY: Mbali Ngcobo

ALPHAMIN 40 Week MA INDM TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Ltd.

3000

2500 AUDITORS: PwC Inc.

CAPITAL STRUCTURE Authorised Issued

2000

AEL A ords no par value 500 000 000 412 330 395

1500

DISTRIBUTIONS [ZARc]

1000 A ords no par value Ldt Pay Amt

500 Final No 81 10 Jun 25 17 Jun 25 50.00

Interim No 80 19 Nov 24 25 Nov 24 40.00

0

2021 2022 2023 2024 2025 LIQUIDITY: Jun25 Avg 2m shares p.w., R34.5m(22.5% p.a.)

FINANCIAL STATISTICS ALTRON 40 Week MA SCOM 4000

(USD ’000) Mar 25 Dec 24 Dec 23 Dec 22 Dec 21 3500

Quarter Final Final Final Final

Wrk Revenue 120 486 527 986 288 505 391 052 352 883 3000

Wrk Pft 46 001 216 178 105 007 190 467 168 279 2500

NetIntPd(Rcd) 1 653 7 556 7 207 4 820 8 358

Minority Int 4 730 22 442 10 741 20 806 15 362 2000

Att Inc 23 641 100 777 47 223 100 925 48 205 1500

TotCompIncLoss 28 387 123 202 57 940 121 710 - 1000

Ord SH Int 357 953 333 535 312 786 320 425 274 727

LT Liab 29 333 21 124 22 800 13 934 9 640 2021 2022 2023 2024 2025 500

Cap Employed 463 234 435 192 407 275 399 799 341 992

Mining Ass 352 654 361 387 349 518 263 041 227 720 FINANCIAL STATISTICS

Tot Curr Ass 204 393 162 176 129 508 199 513 166 342 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

Tot Curr Liab 150 366 142 585 109 484 90 303 79 158 (R million) Final Final(rst) Final(rst) Final Final(rst)

PER SHARE STATISTICS (cents per share) Turnover 9 588 9 063 8 445 7 930 7 505

HEPS-C (ZARc) 34.04 144.81 68.30 130.06 59.56 Op Inc1 852 615 540 498 371

DPS (ZARc) - 77.16 82.15 38.69 36.99 NetIntPd(Rcvd) 87 102 145 146 179

NAV (ZARc) 514.53 493.60 449.08 428.90 366.69 Tax 150 121 105 63 34

3 Yr Beta 1.26 1.38 2.14 1.23 0.85 Minority Int 25 23 17 9 - 12

Price Prd End 790 1 360 1 220 1 010 1 200 Att Inc 390 - 170 - 4 - 104 12 154

Price High 1 500 1 679 1 658 5 025 1 246 TotCompIncLoss 355 - 91 73 - 131 12 107

Price Low 651 1 121 951 720 342 Hline Erngs-CO 678 391 321 191 137

RATIOS Fixed Ass 304 350 415 438 442

Ret on SH fund 27.07 31.59 15.86 33.13 20.46 Inv in Assoc 2 2 33 79 47

Ret on Tot Ass 28.91 36.11 18.93 37.88 37.97 Def Tax Asset 150 181 235 238 151

Tot Curr Ass 4 398 4 448 4 904 3 818 4 971

Ord SH Int 4 015 3 931 4 196 4 248 4 764

Minority Int 169 146 118 106 102

LT Liab 1 612 1 955 2 296 2 098 1 766

Tot Curr Liab 3 267 3 254 2 745 2 312 3 180

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 103.00 - 45.00 - 1.00 - 28.00 3 270.00

HEPS-C (ZARc) 178.00 103.00 85.00 51.00 37.00

DPS (ZARc) 90.00 58.00 35.00 30.00 144.00

NAV PS (ZARc) 1 053.00 1 038.00 1 109.00 1 131.94 1 288.98

RATIOS

Ret on SH Fnd 9.92 - 3.61 0.30 2.99 11.67

Ret On Tot Ass 10.15 6.58 4.91 4.53 1.68

Oper Pft Mgn 8.89 6.79 6.39 6.28 4.94

1Results from continuing operations

www.sharedata.co.za

76