Page 80 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 80

JSE - ANG Profile’s Stock Exchange Handbook: 2025 - Issue 3

AngloGold Ashanti plc Anheuser-Busch InBev SA/NV

ISIN: GB00BRXH2664 SHORT: ANGGOLD CODE: ANG ISIN: BE0974293251 SHORT: AB INBEV CODE: ANH

REG NO: 1944/017354/06 FOUNDED: 1944 LISTED: 1944 REG NO: 0417.497.106. FOUNDED: 1977 LISTED: 2016

NATURE OF BUSINESS: AngloGold Ashanti plc, with its head office NATURE OF BUSINESS: Anheuser-Busch InBev is a publicly traded

in South Africa, is an independent, global gold mining company company (Euronext: ABI) based in Leuven, Belgium, with secondary

with a diverse, high-quality portfolio of operations, projects and listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH)

exploration activities across nine countries on four continents. stock exchanges and with American Depositary Receipts on the

While gold is our principal product, we also produce silver New York Stock Exchange (NYSE: BUD).

(Argentina) and sulphuric acid (Brazil) as by-products. In Colombia, SECTOR: CnsStp--FoodBev&Tob--Beverages--Brewers

feasibility studies are currently underway at two of our projects, NUMBER OF EMPLOYEES: 171 915

one of which will produce both gold and copper. DIRECTORS: Aramburuzabala M A (ne, Mex), Burns M (ind ne, USA),

SECTOR: Basic Materials--Basic Resrcs--Precious Met & Min--Gold Min Chalmers S (ne, USA), de Spoelberch G (ne, Blgm),

NUMBER OF EMPLOYEES: 36 952 de Ways Ruart P C (ne, Blgm), Garcia C (ne, Brazil), Gifford W F (ne,

DIRECTORS: Busia Dr K (ind ne, Ghana), Cleaver B (ind ne), Ferguson A USA), Lemann P (ne, Brazil), Liu Dr X (ind ne, German), Motta R T (ne),

(ld ind ne, UK), Garner A (ind ne, USA), Magie J (ind ne), Newton-King N Nohria N (ne), Santo Domingo A (ne, Col), Sceti E L (ind ne, It), Sicupira

(ind ne), Richter M (ind ne, USA), Sands D (ind ne), Tilk J (ind ne, Can), C (ne, Brazil), Thomas R (ne), van Damme A (ne, Blgm), Barrington M J

Calderon A (CEO), Doran G (CFO) (Chair, ne, USA), Doukeris M (CEO), Dutra F (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Apr 2025 MAJOR ORDINARY SHAREHOLDERS as at 20 Jun 2025

Public Investment Corporation of SA 16.36% Stichting Anheuser-Busch InBev 33.42%

BlackRock, Inc. 8.15% EPS Participations Sàrl 6.75%

Van Eck Assciates Corporation 6.35% BlackRock, Inc. 3.09%

POSTAL ADDRESS: PO Box 62117, Marshalltown, 2107 POSTAL ADDRESS: Grand-Place/Grote Markt 1, 1000 Brussels,

MORE INFO: www.sharedata.co.za/sdo/jse/ANG Belgium

COMPANY SECRETARY: Lucy Mokoka MORE INFO: www.sharedata.co.za/sdo/jse/ANH

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Sabine Chalmers

SPONSOR: Standard Bank of SA Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued AUDITORS: Deloitte

ANG Ords 25c ea 600 000 000 504 744 430 CAPITAL STRUCTURE Authorised Issued

ANH Ords no par value - 1 797 199 808

DISTRIBUTIONS [USDc]

Ords 25c ea Ldt Pay Amt DISTRIBUTIONS [EURc]

Quarterly No 131 27 May 25 13 Jun 25 12.50 Ords no par value Ldt Pay Amt

Final No 130 11 Mar 25 28 Mar 25 69.00 Interim No 2 15 Nov 16 21 Nov 16 160.00

LIQUIDITY: Jul25 Avg 8m shares p.w., R4 714.2m(83.2% p.a.) Final No 1 28 Apr 16 9 May 16 200.00

LIQUIDITY: Jul25 Avg 2m shares p.w., R2 588.6m(7.0% p.a.)

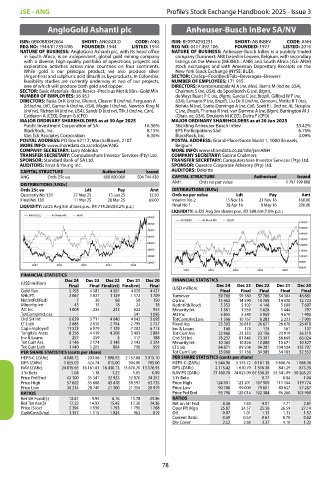

ANGGOLD 40 Week MA MINI

90000

AB INBEV 40 Week MA BEVR

80000 160000

150000

70000

140000

60000

130000

50000

120000

40000 110000

30000 100000

20000 90000

2021 2022 2023 2024 2025

80000

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

(USD million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 FINANCIAL STATISTICS

Final Final Final(rst) Final(rst) Final (USD million) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Gold Rev 5 793 4 582 4 501 4 029 4 427 Final Final Final Final Final

Wrk Pft 2 067 1 027 1 129 1 172 1 709 Turnover 59 768 59 380 57 786 54 304 46 881

NetIntPd(Rcd) 7 30 68 58 150 Op Inc 15 462 14 590 14 768 14 438 12 723

Minority Int 45 13 18 24 18 NetIntPd(Rcvd) 5 353 5 102 4 148 5 609 7 697

Att Inc 1 004 - 235 233 622 953 Minority Int 1 561 1 550 1 628 1 444 797

TotCompIncLoss - - - 541 1 095 Att Inc 5 855 5 340 5 969 4 670 1 405

Ord SH Int 6 629 3 711 4 040 4 042 3 695 TotCompIncLoss - 1 396 10 767 6 283 2 233 - 7 901

LT Liab 2 685 2 835 2 754 2 795 2 727 Fixed Ass 23 503 26 818 26 671 26 678 26 419

Cap Employed 11 523 6 970 7 129 7 202 6 713 Inv & Loans 168 178 175 161 137

Tangible Assts 8 256 4 419 4 208 3 493 2 884 Tot Curr Ass 22 966 23 333 23 156 23 919 26 519

Inv & Loans 257 359 3 117 188 Ord SH Int 78 237 81 848 73 397 68 669 68 024

Tot Curr Ass 3 146 2 174 2 145 2 143 2 334 Minority Int 10 463 10 828 10 880 10 671 10 327

Tot Curr Liab 1 440 1 205 884 798 959 LT Liab 84 871 89 508 94 281 104 104 115 707

PER SHARE STATISTICS (cents per share) Tot Curr Liab 33 066 37 156 34 385 34 183 32 352

HEPS-C (ZARc) 4 048.72 - 203.06 1 898.92 2 157.88 3 915.10 PER SHARE STATISTICS (cents per share)

DPS (ZARc) 1 655.03 424.74 815.00 304.00 705.00 HEPS-C (ZARc) 5 544.96 5 375.72 6 161.18 3 608.76 1 086.36

NAV (ZARc) 24 815.65 16 161.83 16 430.13 15 670.20 13 176.93 DPS (ZARc) 2 115.42 1 670.70 1 516.38 841.29 873.35

3 Yr Beta 1.04 1.18 1.22 1.05 0.89 NAV PS (ZARc) 73 160.76 74 623.09 67 536.25 55 541.09 50 265.21

Price Prd End 42 100 35 341 32 923 32 870 34 252 3 Yr Beta - - 0.77 0.84 1.04

Price High 57 602 55 688 43 478 38 597 63 735 Price High 124 901 123 201 107 900 111 164 119 774

Price Low 30 214 28 740 21 300 21 356 20 979 Price Low 90 788 99 000 79 601 80 627 57 267

RATIOS Price Prd End 93 798 120 014 102 384 96 268 103 900

Ret SH Fund($) 12.61 - 5.94 6.16 15.78 25.96 RATIOS

Ret Tot Ass($) 17.22 14.92 15.45 17.30 24.36 Ret on SH Fnd 8.36 7.43 9.01 7.71 2.81

Price ($/oz) 2 394 1 930 1 793 1 796 1 768 Oper Pft Mgn 25.87 24.57 25.56 26.59 27.14

CashCost($/oz) 1 157 1 115 1 024 963 819 D:E 0.97 1.01 1.13 1.33 1.52

Current Ratio 0.69 0.63 0.67 0.70 0.82

Div Cover 2.52 2.88 3.37 4.10 1.32

78