Page 168 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 168

JSE - PRI Profile’s Stock Exchange Handbook: 2025 - Issue 3

Primeserv Group Ltd. Prosus NV

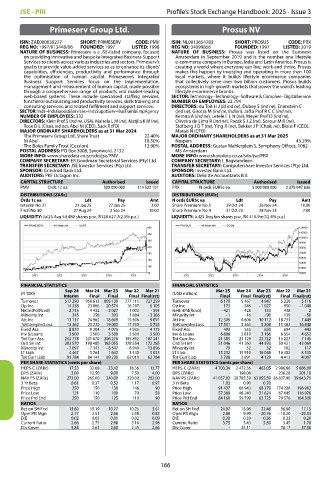

ISIN: ZAE000039277 SHORT: PRIMESERV CODE: PMV ISIN: NL0013654783 SHORT: PROSUS CODE: PRX

REG NO: 1997/013448/06 FOUNDED: 1997 LISTED: 1998 REG NO: 34099856 FOUNDED: 1997 LISTED: 2019

NATURE OF BUSINESS: Primeserv is a JSE-listed company, focused NATURE OF BUSINESS: Prosus was listed on the Euronext

on providing innovative and bespoke Integrated Business Support Amsterdam in September 2019 and is the number one lifestyle

Services to clients across various industries and sectors. Primeserv’s e-commerce company in Europe, India and Latin America. Prosus is

goal is to provide value-added services so as to enhance its clients’ creating a world where everyone can live, work and thrive. Prosus

capabilities, efficiencies, productivity and performance through makes this happen by investing and operating in more than 100

the optimisation of human capital. Primeserve’s Integrated local markets, where it builds lifestyle ecommerce companies

Business Support Services focus on the implementation, that collectively serve over two billion customers. Prosus builds

management and measurement of human capital, made possible ecosystems in high-growth markets that power the world’s leading

through a comprehensive range of products and market-leading lifestyle e-commerce brands.

web-based systems. These include specialised staffing services, SECTOR: Technology--Technology--Software & CompSer--DigitalService

functional outsourcing and productivity services, skills training and NUMBER OF EMPLOYEES: 22 794

consulting services, and related fulfilment and support services. DIRECTORS: du Toit H J (ld ind ne), Dubey S (ind ne), Enenstein C

SECTOR: Inds--IndsGoods&Services--IndsSupptServ--BusTrain&EmpAgency (ind ne), Girotra M (ind ne, Indian), Jafta Prof R C C (ind ne),

NUMBER OF EMPLOYEES: 332 Kemna A (ind ne), Letele F L N (ne), Meyer Prof D (ind ne),

DIRECTORS: Klein Prof S (ind ne, USA), Maisela L M (ne), Matjila K M (ne), Oliveira de Lima R (ind ne), Pacak S J Z (ne), Sorour M R (ne),

Rose D L (Chair, ind ne), Abel M (CEO), Sack R (FD) Stofberg J D T (ne), Ying X (ne), Bekker J P (Chair, ne), Bloisi F (CEO),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Marais N (CFO)

The Primeserv Group Ltd. Share Trust 22.40% MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025

M Abel 18.50% Naspers 43.29%

The Boles Family Trust (Cession) 13.90% POSTAL ADDRESS: Gustav Mahlerplein 5, Symphony Offices, 1082

POSTAL ADDRESS: PO Box 3008, Saxonwold, 2132 MS Amsterdam

MORE INFO: www.sharedata.co.za/sdo/jse/PMV MORE INFO: www.sharedata.co.za/sdo/jse/PRX

COMPANY SECRETARY: ER Goodman Secretarial Services (Pty) Ltd. COMPANY SECRETARY: L Bagwandeen

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Grindrod Bank Ltd. SPONSOR: Investec Bank Ltd.

AUDITORS: PKF Octagon Inc. AUDITORS: Deloitte Accountants B.V.

CAPITAL STRUCTURE Authorised Issued CAPITAL STRUCTURE Authorised Issued

PMV Ords 1c ea 500 000 000 114 522 101 PRX N ords EUR5c ea 5 000 000 000 2 378 947 836

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [EURc]

Ords 1c ea Ldt Pay Amt N ords EUR5c ea Ldt Pay Amt

Interim No 31 21 Jan 25 27 Jan 25 3.00 Share Premium No 5 29 Oct 24 26 Nov 24 10.00

Final No 30 27 Aug 24 2 Sep 24 10.00 Share Premium No 4 31 Oct 23 28 Nov 23 7.00

LIQUIDITY: Jul25 Avg 54 480 shares p.w., R128 627.7(2.5% p.a.) LIQUIDITY: Jul25 Avg 6m shares p.w., R4 416.9m(12.4% p.a.)

PRIMESERV 40 Week MA SUPS PROSUS 40 Week MA SCOM

400 120000

110000

350

100000

300

90000

250 80000

200 70000

60000

150

50000

100

40000

50 30000

2021 2022 2023 2024 2025 2021 2022 2023 2024 2025

FINANCIAL STATISTICS FINANCIAL STATISTICS

Sep 24 Mar 24 Mar 23 Mar 22 Mar 21 Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

(R ’000) (USD million)

Interim Final Final Final Final(rst) Final Final Final(rst) Final Final(rst)

Turnover 517 290 950 613 805 139 777 111 737 259 Turnover 6 170 5 467 4 947 5 220 5 116

Op Inc 14 338 23 866 20 574 16 197 6 105 Op Inc 173 - 546 - 1 027 - 950 - 1 040

NetIntPd(Rcvd) - 2 715 - 4 432 - 3 027 - 1 003 - 595 NetIntPd(Rcvd) - 421 - 428 133 438 2

Minority Int 245 258 393 1 884 - 3 366 Minority Int - 1 - 16 - 90 - 139 - 50

Att Inc 13 117 24 962 18 609 15 506 9 091 Att Inc 12 305 6 606 10 112 18 733 7 449

TotCompIncLoss 13 362 25 220 19 002 17 390 5 725 TotCompIncLoss 17 531 3 364 5 208 15 483 16 448

Fixed Ass 8 870 9 204 4 075 4 935 4 175 Fixed Ass 493 555 620 604 443

Inv & Loans 3 500 3 500 3 500 3 500 3 500 Inv & Loans 6 806 2 819 3 186 6 554 4 652

Tot Curr Ass 243 778 231 670 206 276 195 892 187 341 Tot Curr Ass 21 385 21 129 22 722 15 227 7 145

Ord SH Int 203 570 198 480 185 055 178 554 172 285 Ord SH Int 51 046 41 260 44 593 50 421 43 069

Minority Int - 7 097 - 7 343 - 8 547 - 8 940 - 13 896 Minority Int 79 32 32 102 117

LT Liab 4 467 5 764 1 642 3 440 5 053 LT Liab 15 232 15 910 16 048 16 402 8 535

Tot Curr Liab 91 784 84 141 69 230 62 019 62 764 Tot Curr Liab 5 708 3 891 4 129 4 413 4 007

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 17.53 32.68 23.42 18.36 13.77 HEPS-C (ZARc) 4 703.34 2 472.36 463.05 2 986.86 5 886.00

DPS (ZARc) 3.00 12.50 9.00 7.50 4.00 DPS (ZARc) - 198.08 - 236.28 201.18

NAV PS (ZARc) 273.00 265.00 240.00 220.00 202.00 NAV PS (ZARc) 41 057.02 30 785.59 63 055.59 36 837.90 39 843.71

3 Yr Beta 0.61 0.37 0.52 1.17 0.97 3 Yr Beta 1.03 0.90 0.70 - -

Price High 250 150 130 148 90 Price High 91 437 66 943 68 279 174 208 196 982

Price Low 121 110 100 70 58 Price Low 57 389 48 240 31 624 67 645 116 976

Price Prd End 250 150 125 110 90 Price Prd End 84 160 59 799 63 725 79 576 164 300

RATIOS RATIOS

Ret on SH Fnd 13.60 13.19 10.77 10.25 3.61 Ret on SH Fnd 24.07 15.96 22.46 36.80 17.13

Oper Pft Mgn 2.77 2.51 2.56 2.08 0.83 Oper Pft Mgn 2.80 - 9.99 - 20.76 - 18.20 - 20.33

D:E 0.02 0.03 0.01 0.02 0.09 D:E 0.30 0.39 0.36 0.33 0.20

Current Ratio 2.66 2.75 2.98 3.16 2.98 Current Ratio 3.75 5.43 5.50 3.45 1.78

Div Cover 5.84 2.61 2.60 2.45 2.66 Div Cover - 24.11 - 78.17 37.30

166