Page 167 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 167

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - PRE

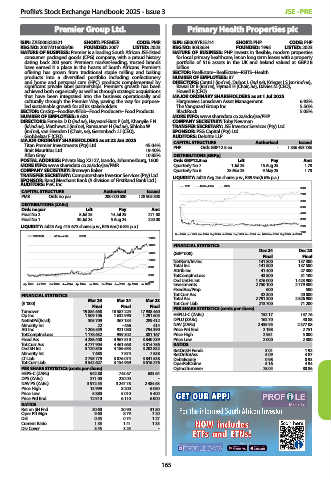

Premier Group Ltd. Primary Health Properties plc

ISIN: ZAE000320321 SHORT: PREMIER CODE: PMR ISIN: GB00BYRJ5J14 SHORT: PHP CODE: PHP

REG NO: 2007/016008/06 FOUNDED: 2007 LISTED: 2023 REG NO: 3033634 FOUNDED: 1995 LISTED: 2023

NATURE OF BUSINESS: Premier is a leading South African JSE-listed NATURE OF BUSINESS: PHP invests in flexible, modern properties

consumer packaged goods (CPG) company, with a proud history for local primary healthcare, let on long term leases with a property

dating back 200 years. Premier’s market-leading, trusted brands portfolio of 516 assets in the UK and Ireland valued at GBP2.8

have earned it a place in the hearts of South Africans. Premier’s billion.

offering has grown from traditional staple milling and baking SECTOR: RealEstate--RealEstate--REITS--Health

products into a diversified portfolio including confectionery NUMBER OF EMPLOYEES: 87

and home and personal care (HPC) products complemented by DIRECTORS: Cantú I (ind ne), Duhot L (ind ne), Krieger I S (snr ind ne),

significant private label partnerships. Premier’s growth has been Rawal Dr B (ind ne), Hyman H (Chair, ne), Davies M (CEO),

achieved both organically as well as through strategic acquisitions Howell R (CFO)

that have been integrated into the business operationally and MAJOR ORDINARY SHAREHOLDERS as at 1 Jul 2025

culturally through the Premier Way, paving the way for purpose- Hargreaves Lansdown Asset Management 6.93%

led sustainable growth for all its stakeholders. The Vanguard Group Inc. 5.50%

SECTOR: CnsStp--FoodBev&Tob--Food Producers--Food Products BlackRock 5.05%

NUMBER OF EMPLOYEES: 8 600 MORE INFO: www.sharedata.co.za/sdo/jse/PHP

DIRECTORS: Ferreira D D (ind ne), Hayward-Butt P (alt), Khanyile F N COMPANY SECRETARY: Toby Newman

(ld ind ne), Matthews J (ind ne), Ramsumer H (ind ne), Sihlobo W TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

(ind ne), van Heerden I (Chair, ne), Gertenbach J J (CEO), SPONSOR: PSG Capital (Pty) Ltd.

Grobbelaar F (CFO) AUDITORS: Deloitte LLP

MAJOR ORDINARY SHAREHOLDERS as at 22 Jan 2025 CAPITAL STRUCTURE Authorised Issued

Titan Premier Investments (Pty) Ltd. 45.04% PHP Ords GBP12.5 ea - 1 336 493 786

Brait Mauritius Ltd. 19.40%

Allan Gray 10.85% DISTRIBUTIONS [GBPp]

POSTAL ADDRESS: Private Bag X2127, Isando, Johannesburg, 1600 Ords GBP12.5 ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/PMR Quarterly No 7 1 Jul 25 15 Aug 25 1.78

COMPANY SECRETARY: Bronwyn Baker Quarterly No 6 25 Mar 25 9 May 25 1.78

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul25 Avg 2m shares p.w., R39.9m(6.6% p.a.)

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc. PHP 40 Week MA REIV

CAPITAL STRUCTURE Authorised Issued 8000

PMR Ords no par 200 000 000 128 905 800 7000

6000

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt 5000

Final No 2 8 Jul 25 14 Jul 25 271.00 4000

Final No 1 30 Jul 24 5 Aug 24 220.00 3000

LIQUIDITY: Jul25 Avg 415 673 shares p.w., R45.6m(16.8% p.a.) 2000

1000

PREMIER 40 Week MA FOOD Nov 2023 Jan 2024 Mar 2024 May 2024 Jul 2024 Sep 2024 Nov 2024 Jan 2025 Mar 2025 May 2025 Jul 2025

16000

14000 FINANCIAL STATISTICS

Dec 24 Dec 23

12000 (GBP ‘000) Final Final

10000

NetRent/InvInc 141 800 137 300

8000 Total Inc 141 800 137 500

Attrib Inc 41 400 27 300

6000 TotCompIncLoss 43 800 31 100

Ord UntHs Int 1 376 000 1 423 900

4000

Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 Oct 2024 Jan 2025 Apr 2025 Jul 2025 Investments 2 750 100 2 779 300

FixedAss/Prop 600 500

FINANCIAL STATISTICS Tot Curr Ass 32 300 40 000

Mar 25 Mar 24 Mar 23 Total Ass 2 791 300 2 826 900

(R ‘000) Tot Curr Liab 213 700 71 200

Final Final Final

Turnover 19 884 658 18 587 224 17 938 460 PER SHARE STATISTICS (cents per share)

Op Inc 1 909 106 1 632 990 1 291 605 HEPLU-C (ZARc) 152.17 137.76

NetIntPd(Rcvd) 305 709 367 184 289 412 DPLU (ZARc) 162.70 40.88

Minority Int 22 - 466 414 NAV (ZARc) 2 435.95 2 377.08

Att Inc 1 206 559 921 080 794 390 Price Prd End 2 198 2 751

TotCompIncLoss 1 178 632 959 302 881 167 Price High 2 951 5 000

Fixed Ass 4 286 400 3 967 510 3 840 239 Price Low 2 000 2 300

Tot Curr Ass 4 777 904 4 461 668 4 814 756 RATIOS

Ord SH Int 5 120 846 4 186 583 3 202 832 RetOnSH Funds 3.01 1.92

Minority Int 7 685 7 874 7 538 RetOnTotAss 5.09 4.87

LT Liab 2 795 779 3 076 074 3 841 538 Debt:Equity 0.98 0.93

Tot Curr Liab 3 542 627 3 154 969 3 616 276 OperRetOnInv 5.16 4.94

PER SHARE STATISTICS (cents per share) OpInc:Turnover 78.04 80.86

HEPS-C (ZARc) 942.80 743.67 633.64

DPS (ZARc) 271.00 220.00 -

NAV PS (ZARc) 3 972.55 3 247.78 2 484.63

Price High 13 999 8 200 6 050

Price Low 5 880 5 010 5 400

Price Prd End 12 910 6 110 6 000

RATIOS

Ret on SH Fnd 30.60 30.90 31.50

Oper Pft Mgn 9.60 8.79 7.20

D:E 0.55 0.74 1.27

Current Ratio 1.35 1.41 1.33

Div Cover 3.45 3.25 -

165