Page 171 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 171

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - QUI

Quilter plc Rainbow Chicken Ltd.

ISIN: GB00BNHSJN34 SHORT: QUILTER CODE: QLT ISIN: ZAE000334850 SHORT: RAINBOW CODE: RBO

REG NO: 06404270 FOUNDED: 2007 LISTED: 2018 REG NO: 2024/200346/06 FOUNDED: 2024 LISTED: 2024

NATURE OF BUSINESS: Quilter is a UK focused wealth manager. NATURE OF BUSINESS: The business of Rainbow Chicken Ltd.,

Supporting financial advice is central to Quilter’s propositions. and its principal activity, is to act as a listed holding company for

Quilter offers services to clients and their advisers. Quilter’s the poultry and animal feed agri-processing businesses (namely

Platform and investment solutions are available on similar terms to the chicken, animal feed and waste-to-value businesses), via its

both its own advisers and independent advisers, enabling Quilter shareholding in its wholly owned subsidiaries (“Rainbow Group”).

to remain competitive with third party market offerings in terms of SECTOR: CnsStp--FoodBev&Tob--Food Producers--Food Products

pricing and proposition, thereby ensuring good client outcomes. NUMBER OF EMPLOYEES: 0

SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs--AssMgrs&Custodians DIRECTORS: Brinkhuis A (ind ne), Louw P R (ne), Moloi Z P Z (ind ne),

NUMBER OF EMPLOYEES: 3 028 Parsons S M (ind ne), Robertson C J (ld ind ne), van Wyk W O (ne),

DIRECTORS: Atkar N (snr ind ne), Hill C (ind ne), Kilcoyne M (ind ne, USA), Stander M P (CEO), De Wet W A (COO), van der Merwe K R (CFO)

Morris A (ind ne), Reid G (ind ne, UK), Samuel C (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 4 Jul 2024

Markland R (Chair, ind ne), Levin S (CEO), Satchel M (CFO) Remgro Ltd. 80.20%

MAJOR ORDINARY SHAREHOLDERS as at 8 Jul 2025 MandG Investment Managers (Pty) Ltd. 5.07%

Coronation Fund Managers 18.03% POSTAL ADDRESS: Southdowns Ridge Office Park, Suite 12,

Public Investment Corporation 10.77% Cnr John Vorster and Nelmapius Drive, Irene, Centurion, 0062

abrdn 5.94% MORE INFO: www.sharedata.co.za/sdo/jse/RBO

POSTAL ADDRESS: Senator House, 85 Queen Victoria Street, COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

London, EC4V 4AB TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/QLT SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

COMPANY SECRETARY: Clare Barrett AUDITORS: Ernst & Young Inc., PwC Inc.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd. RBO Ords no par value 2 000 000 000 893 029 748

AUDITORS: PricewaterhouseCoopers LLP

CAPITAL STRUCTURE Authorised Issued LIQUIDITY: Jul25 Avg 2m shares p.w., R7.2m(11.9% p.a.)

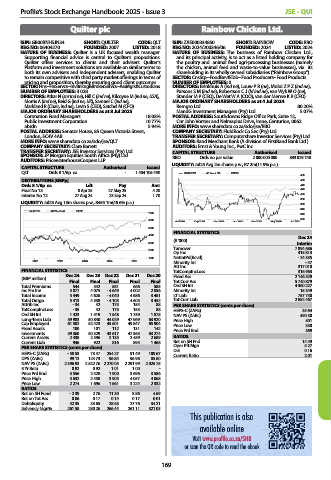

QLT Ords 8 1/6p ea - 1 404 105 498 RAINBOW 40 Week MA CONG

480

DISTRIBUTIONS [GBPp] 460

Ords 8 1/6p ea Ldt Pay Amt 440

Final No 13 8 Apr 25 27 May 25 4.20 420

Interim No 12 27 Aug 24 23 Sep 24 1.70 400

LIQUIDITY: Jul25 Avg 13m shares p.w., R455.1m(46.6% p.a.) 380

360

340

QUILTER 40 Week MA GENF

7000

320

6000 300

Jul 2024 Sep 2024 Nov 2024 Jan 2025 Mar 2025 May 2025 Jul 2025

5000

FINANCIAL STATISTICS

4000 Dec 24

(R ‘000)

3000 Interim

Turnover 7 894 686

2000

Op Inc 415 813

1000 NetIntPd(Rcvd) - 24 335

2021 2022 2023 2024 2025 Minority Int - 47

Att Inc 317 010

FINANCIAL STATISTICS TotCompIncLoss 316 963

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 Fixed Ass 2 146 529

(GBP million)

Final Final Final Final Final Tot Curr Ass 5 740 879

Total Premiums 544 542 581 666 585 Ord SH Int 4 360 227

Inc Fm Inv 4 877 4 075 - 4 649 4 002 2 856 Minority Int 15 349

Total Income 5 449 4 626 - 4 040 4 686 3 461 LT Liab 757 730

Total Outgo 5 413 4 538 - 4 105 4 603 3 452 Tot Curr Liab 2 852 467

Attrib Inc - 34 42 175 154 88 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 35 42 175 153 88 HEPS-C (ZARc) 35.64

Ord SH Int 1 423 1 519 1 548 1 739 1 878 NAV PS (ZARc) 490.30

Long-Term Liab 59 983 50 840 44 029 47 969 63 920 Price High 501

Cap Employed 61 502 52 423 45 601 49 847 65 904 Price Low 330

Fixed Assets 100 101 112 131 142 Price Prd End 369

Investments 59 360 50 329 43 617 47 565 63 274

Current Assets 2 438 2 396 2 135 2 459 2 689 RATIOS

Current Liab 946 922 816 893 1 468 Ret on SH Fnd 14.49

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 5.27

D:E

0.16

HEPS-C (ZARc) - 58.53 73.47 254.27 91.49 109.67 Current Ratio 2.01

DPS (ZARc) 99.12 124.73 96.84 96.98 85.60

NAV PS (ZARc) 2 396.93 2 522.76 2 270.05 2 291.99 2 025.75

3 Yr Beta 0.92 0.92 1.01 1.00 -

Price Prd End 3 556 2 428 1 900 3 696 3 586

Price High 3 632 2 450 3 903 4 057 4 068

Price Low 2 274 1 696 1 661 3 224 2 332

RATIOS

Ret on SH Fund - 2.39 2.76 11.30 8.86 4.69

Ret on Tot Ass 0.06 0.17 0.14 0.17 0.01

Debt:Equity 42.35 33.65 28.63 27.76 34.21

Solvency Mgn% 261.58 280.26 266.44 261.11 321.03

This publication is also

available online

Visit www.profile.co.za/SHB

or scan the QR code to read the ebook

169