Page 173 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 173

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - RCL

RCL Foods Ltd.

ISIN: ZAE000179438 SHORT: RCL CODE: RCL

REG NO: 1966/004972/06 FOUNDED: 1891 LISTED: 1989

NATURE OF BUSINESS: RCL Foods is one of South Africa’s leading

food manufacturers, producing a broad basket of branded and

private label food products in multiple categories, from household

staples to value-added and speciality offerings.

RCL Foods operates through:

*Nearly 16 500 employees across its value-added and Rainbow

businesses

*In 200 operations

*Producing 30 much-loved brands

*With its DO More foundation

SECTOR: ConsStaples--Food,Beverage&Tobacco--Food Producers--Farmers

NUMBER OF EMPLOYEES: 9 963

DIRECTORS: Dingaan G P (ind ne), Kruythoff G C J (ne), Moumakwa P (ne),

Msibi D T V (ind ne), Osiris Dr P (ne), Rushton R M (ind ne), Vosloo C (ne),

Zingitwa L (ne), Zondi G C (ne), Steyn G M (Chair, ld ind ne),

Cruickshank P D (CEO), Field R H (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Remgro Ltd. 80.20%

Oasis Asset Management Ltd. 8.60%

M&G Investment Managers (Pty) Ltd. 5.00%

POSTAL ADDRESS: PO Box 2734, Westway Office Park, 3635

MORE INFO: www.sharedata.co.za/sdo/jse/RCL

COMPANY SECRETARY: Lauren Kelso

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: RAND MERCHANT BANK ( A division of FirstRand Bank Ltd.)

AUDITORS: Ernst & Young Inc.

CAPITAL STRUCTURE Authorised Issued

RCL Ords no par value 2 000 000 000 897 079 351

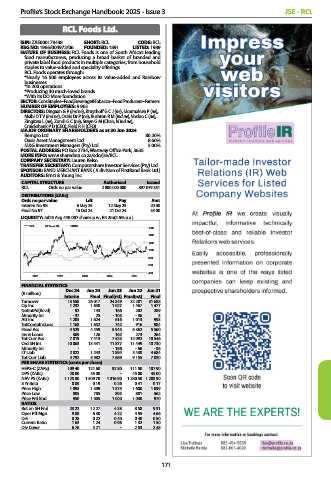

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Interim No 98 6 May 25 12 May 25 20.00

Final No 97 15 Oct 24 21 Oct 24 35.00

LIQUIDITY: Jul25 Avg 448 007 shares p.w., R4.2m(2.6% p.a.)

RCL 40 Week MA FOOD

1600

1400

1200

1000

800

600

400

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

(R million)

Interim Final Final(rst) Final(rst) Final

Turnover 13 558 26 017 24 349 32 201 31 688

Op Inc 1 232 1 638 1 027 1 467 1 477

NetIntPd(Rcvd) 92 143 166 202 289

Minority Int - 37 25 - 103 - 36 3

Att Inc 1 205 1 624 616 1 013 993

TotCompIncLoss 1 168 1 652 742 916 984

Fixed Ass 4 529 4 459 5 945 6 362 5 560

Inv & Loans 369 126 162 273 264

Tot Curr Ass 7 819 7 413 7 523 12 092 10 546

Ord SH Int 10 063 13 441 11 877 11 449 10 730

Minority Int - - - 156 - 60 - 36

LT Liab 2 822 1 243 1 894 3 430 4 684

Tot Curr Liab 4 792 5 982 7 689 9 155 7 030

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 109.40 121.60 92.80 111.50 107.90

DPS (ZARc) 20.00 35.00 - 45.00 45.00

NAV PS (ZARc) 1 125.80 1 509.70 1 316.90 1 280.50 1 203.90

3 Yr Beta 0.09 0.19 0.26 0.41 0.17

Price High 1 095 1 309 1 375 1 600 1 099

Price Low 805 785 895 881 562

Price Prd End 950 1 005 1 000 1 030 970

RATIOS

Ret on SH Fnd 23.22 12.27 4.38 8.58 9.31

Oper Pft Mgn 9.08 6.30 4.22 4.55 4.66

D:E 0.28 0.22 0.40 0.40 0.50

Current Ratio 1.63 1.24 0.98 1.32 1.50

Div Cover 6.76 5.21 - 2.53 2.48

171