Page 178 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 178

JSE - REN Profile’s Stock Exchange Handbook: 2025 - Issue 3

Renergen Ltd. Resilient REIT Ltd.

ISIN: ZAE000202610 SHORT: RENERGEN CODE: REN ISIN: ZAE000209557 SHORT: RESILIENT CODE: RES

REG NO: 2014/195093/06 FOUNDED: 2014 LISTED: 2015 REG NO: 2002/016851/06 FOUNDED: 2002 LISTED: 2002

NATURE OF BUSINESS: Renergen Ltd. is an energy company focused NATURE OF BUSINESS: Resilient has been listed on the JSE since

on alternative and renewable energy in South Africa and sub- 6 December 2002 and is a retail-focused Real Estate Investment

Saharan Africa. The company is listed on three stock exchanges Trust (“REIT”). Its strategy is to invest in dominant retail centres

with a primary listing on the JSE Alternative Exchange (“AltX”) and with a minimum of three anchor tenants and let predominantly to

secondary listings on the A2X Markets and the Australian Securities national retailers.

Exchange (“ASX”). SECTOR: RealEstate--RealEstate--REITS--Retail

SECTOR: Energy--Energy--AltEnergy--AltFuels NUMBER OF EMPLOYEES: 30

NUMBER OF EMPLOYEES: 75 DIRECTORS: Bird S (ind ne), de Beer D (ne), Gordon D K (ind ne),

DIRECTORS: Hlatshwayo D (ind ne), Swana M B (ind ne), King D C Marole M L D (ind ne), Martin S (ind ne), Phili P (ind ne), Sishuba T S

(Chair, ne, UK), Marani S (CEO), Harvey B (FD), Mitchell N (COO) (ind ne), Stuhler B (ne), van Wyk B D (ind ne), Olivier A (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025 Kriek J J (CEO), Muller M (CFO)

Government Employees Pension Fund 6.46% MAJOR ORDINARY SHAREHOLDERS as at 10 Jan 2025

MATC Investment (Pty) Ltd. 5.62% Public Investment Corporation SOC Ltd. 15.71%

CRT Investment Holding (Pty) Ltd. 5.55% Delsa Investments (Pty) Ltd. 8.80%

POSTAL ADDRESS: Postnet Suite 610, Private Bag X10030, Randburg, Resilient Properties (Pty) Ltd. 8.26%

2125 POSTAL ADDRESS: PO Box 2555, Rivonia, 2128

MORE INFO: www.sharedata.co.za/sdo/jse/REN MORE INFO: www.sharedata.co.za/sdo/jse/RES

COMPANY SECRETARY: Acorim (Pty) Ltd. COMPANY SECRETARY: Sue Hsieh

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: BDO South Africa Inc. AUDITORS: PwC Inc.

CAPITAL STRUCTURE Authorised Issued CAPITAL STRUCTURE Authorised Issued

REN Ords no par value 500 000 000 155 170 891 RES Ords no par value 1 000 000 000 365 204 738

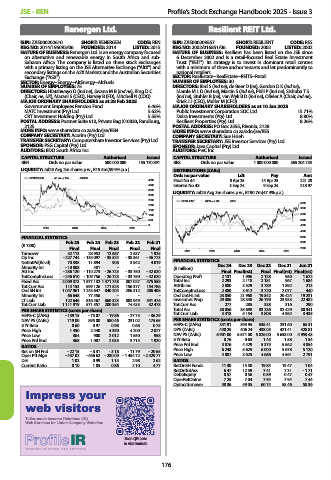

LIQUIDITY: Jul25 Avg 2m shares p.w., R15.3m(59.9% p.a.) DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

RENERGEN 40 Week MA JS6012

4500 Final No 44 8 Apr 25 14 Apr 25 221.28

4000 Interim No 43 3 Sep 24 9 Sep 24 218.97

3500 LIQUIDITY: Jul25 Avg 3m shares p.w., R190.7m(47.4% p.a.)

3000

2500 RESILIENT 40 Week MA REIV

6500

2000

6000

1500

1000 5500

500 5000

0 4500

2022 2023 2024 2025

4000

FINANCIAL STATISTICS 3500

(R ’000) Feb 25 Feb 24 Feb 23 Feb 22 Feb 21 3000

Final Final Final Final Final 2500

Turnover 52 113 28 952 12 687 2 637 1 925 2021 2022 2023 2024 2025

Op Inc - 227 744 - 135 097 - 35 524 - 38 361 - 46 773

NetIntPd(Rcvd) 70 335 11 894 908 3 942 4 019 FINANCIAL STATISTICS

Minority Int - 10 808 481 - - - (R million) Dec 24 Dec 23 Dec 22 Dec 21 Jun 21

Att Inc - 236 120 - 110 273 - 26 725 - 33 750 - 42 620 Final Final(rst) Final Final(rst) Final(rst)

TotCompIncLoss - 246 610 - 109 756 - 26 725 - 33 750 - 42 620 Operatng Proft 2 131 1 996 2 128 950 1 672

Fixed Ass 2 009 373 1 877 132 1 371 748 807 027 475 558 Total Inc 2 293 2 118 2 181 967 1 684

Tot Curr Ass 113 153 599 126 171 525 156 377 154 786 Attrib Inc 2 880 3 529 3 789 1 892 213

Ord SH Int 1 047 961 1 243 647 840 204 286 312 206 408 TotCompIncLoss 2 380 3 612 3 720 2 077 440

Minority Int 66 648 77 456 - - - Ord UntHs Int 23 050 21 968 19 842 20 424 19 231

LT Liab 122 646 816 467 860 323 803 949 541 476 Investmnt Prop 29 386 28 348 26 799 23 933 22 482

Tot Curr Liab 1 111 919 571 557 200 354 74 433 32 478 Tot Curr Ass 277 285 338 316 290

PER SHARE STATISTICS (cents per share) Total Ass 38 056 35 698 33 236 32 429 30 341

HEPS-C (ZARc) - 159.15 - 75.07 - 19.86 - 27.73 - 36.29 Tot Curr Liab 3 418 5 154 3 808 4 982 3 435

NAV PS (ZARc) 719.00 895.00 580.46 231.02 175.65 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.60 0.97 0.98 0.68 0.75 HEPS-C (ZARc) 341.91 393.95 536.41 231.60 65.31

Price High 1 450 2 440 4 390 4 200 2 077 DPS (ZARc) 440.25 406.24 438.03 421.41 428.81

Price Low 364 900 2 012 1 550 958 NAV PS (ZARc) 6 901.00 6 571.00 5 826.00 5 658.00 4 959.43

Price Prd End 368 1 087 2 035 3 713 1 920 3 Yr Beta 0.76 0.63 1.45 1.58 1.54

RATIOS Price Prd End 5 876 4 429 5 375 5 562 4 854

Ret on SH Fnd - 22.15 - 8.31 - 3.18 - 11.79 - 20.65 Price High 6 248 5 625 6 000 5 678 5 120

Oper Pft Mgn - 437.02 - 466.62 - 280.00 - 1 454.72 - 2 429.77 Price Low 4 087 3 625 4 686 4 561 2 791

D:E 1.02 0.99 1.15 2.98 2.62 RATIOS

Current Ratio 0.10 1.05 0.86 2.10 4.77 RetOnSH Funds 11.30 15.50 19.84 19.47 1.04

RetOnTotAss 6.47 12.59 7.41 7.31 - 1.71

Debt:Equity 0.57 0.56 0.59 0.47 0.47

OperRetOnInv 7.25 7.04 7.94 7.94 7.44

OpInc:Turnover 58.36 59.05 60.74 58.46 58.36

Impress your

Impr ess y our

e

w

web visitors

s

b visitor

Tailor-made Investor Relations (IR)

Web Services for Listed Company Websites

Scan QR code

to visit website

176