Page 179 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 179

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - REU

Reunert Ltd. POSTAL ADDRESS: PO Box 784391, Sandton, 2146

EMAIL: invest@reunert.co.za

WEBSITE: www.reunert.co.za

TELEPHONE: 011-517-9000

COMPANY SECRETARY: Reunert Management

Services (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services

(Pty) Ltd.

SPONSOR: One Capital

Scan the QR code to AUDITORS: KPMG Inc.

visit our website BANKERS: Nedbank Ltd., Rand Merchant Bank,

Standard Bank

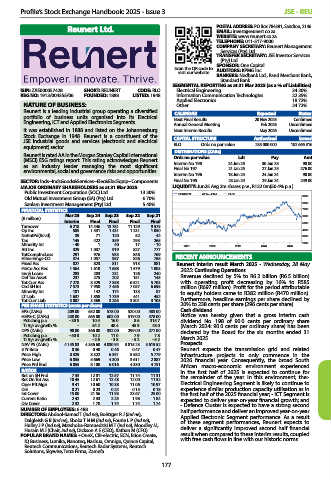

SEGMENTAL REPORTING as at 31 Mar 2025 (as a % of Liabilities)

ISIN: ZAE000057428 SHORT: REUNERT CODE: RLO Electrical Engineering 34.20%

REG NO: 1913/004355/06 FOUNDED: 1888 LISTED: 1948 Information Communication Technologies 22.35%

Applied Electronics 18.72%

NATURE OF BUSINESS: Other 24.72%

Reunert is a leading industrial group operating a diversified CALENDAR Expected Status

portfolio of business units organised into its Electrical Next Final Results 20 Nov 2025 Confirmed

Engineering, ICT and Applied Electronics Segments. Annual General Meeting Feb 2026 Unconfirmed

It was established in 1888 and listed on the Johannesburg Next Interim Results May 2026 Unconfirmed

Stock Exchange in 1948. Reunert is a constituent of the CAPITAL STRUCTURE Authorised Issued

JSE industrial goods and services (electronic and electrical

equipment) sector. RLO Ords no par value 235 000 000 182 665 316

Reunert is rated AA in the Morgan Stanley Capital International DISTRIBUTIONS [ZARc]

(MSCI) ESG ratings report. This rating acknowledges Reunert Ords no par value Ldt Pay Amt

as an industry leader managing the most significant Interim No 198 24 Jun 25 30 Jun 25 90.00

environmental, social and governance risks and opportunities. Final No 197 21 Jan 25 27 Jan 25 276.00

Interim No 196 18 Jun 24 24 Jun 24 90.00

SECTOR: Inds--IndsGoods&Services--Elec&ElecEquip--Components Final No 195 23 Jan 24 29 Jan 24 249.00

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 LIQUIDITY: Jun25 Avg 2m shares p.w., R122.0m(50.4% p.a.)

Public Investment Corporation (SOC) Ltd. 13.30% REUNERT 40 Week MA ELEE

Old Mutual Investment Group (SA) (Pty) Ltd. 6.70% 9000

Sanlam Investment Management (Pty) Ltd. 5.40% 8000

FINANCIAL STATISTICS 7000

Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 6000

(R million)

Interim Final Final Final Final 5000

Turnover 6 218 14 446 13 781 11 129 9 575

Op Inc 585 1 531 1 431 1 231 1 050 4000

NetIntPd(Rcvd) 39 71 120 52 42 3000

Tax 145 422 359 293 265

Minority Int - 40 1 40 17 - 10 2021 2022 2023 2024 2025 2000

Att Inc 329 1 037 919 827 777

TotCompIncLoss 291 976 933 846 769 RECENT ANNOUNCEMENTS

Hline Erngs-CO 374 1 057 957 826 768

Fixed Ass 827 823 811 913 881 Reunert interim result March 2025 - Wednesday, 28 May

FinCo Acc Rec 1 564 1 610 1 688 1 579 1 803 2025: Continuing Operations

Inv & Loans 283 283 231 126 240

Def Tax Asset 237 275 202 151 145 Revenue declined by 5% to R6.2 billion (R6.5 billion)

Tot Curr Ass 7 278 8 329 7 358 6 521 5 703 with operating profit decreasing by 16% to R585

Ord SH Int 7 573 7 958 7 456 7 057 6 695 million (R697 million). Profit for the period attributable

Minority Int 101 142 174 133 87 to equity holders came to R382 million (R470 million).

LT Liab 1 637 1 858 1 739 441 452 Furthermore, headline earnings per share declined by

Tot Curr Liab 3 007 3 569 3 263 3 301 3 103

PER SHARE STATISTICS (cents per share) 20% to 238 cents per share (296 cents per share)

EPS (ZARc) 209.00 652.00 578.00 520.00 483.00 Cash dividend

HEPS-C (ZARc) 238.00 665.00 602.00 519.00 478.00 Notice was hereby given that a gross interim cash

Pct chng p.a. - 30.5 10.5 16.0 8.6 315.7 dividend No. 198 of 90.0 cents per ordinary share

Tr 5yr av grwth % - 54.2 48.4 45.9 48.0 (March 2024: 90.0 cents per ordinary share) has been

DPS (ZARc) 90.00 366.00 332.00 299.00 277.00 declared by the Board for the six months ended 31

Pct chng p.a. - 50.8 10.2 11.0 7.9 7.8

Tr 5yr av grwth % - - 2.6 - 3.8 - 5.2 - 5.2 March 2025.

NAV PS (ZARc) 4 145.83 4 356.60 4 030.94 3 815.23 3 619.52 Prospects

3 Yr Beta 0.36 0.40 0.46 0.47 0.47 Reunert expects the transmission grid and related

Price High 8 329 8 322 6 391 5 582 5 779 infrastructure projects to only commence in the

Price Low 6 055 5 669 4 300 3 611 2 887 2026 financial year. Consequently, the broad South

Price Prd End 6 055 8 100 6 016 4 330 4 751 African macro-economic environment experienced

RATIOS in the first half of 2025 is expected to continue for

Ret on SH Fnd 7.53 12.81 12.57 11.74 11.31 the remainder of the year. In this environment, the:-

Ret On Tot Ass 10.45 12.61 12.48 12.00 11.52

Oper Pft Mgn 9.41 10.60 10.38 11.06 10.97 Electrical Engineering Segment is likely to continue to

D:E 0.21 0.23 0.24 0.15 0.18 experience similar production capacity utilisation as in

Int Cover 15.00 21.56 11.93 23.67 25.00 the first half of the 2025 financial year; - ICT Segment is

Current Ratio 2.42 2.33 2.25 1.98 1.84 expected to deliver year-on-year financial growth; and

Div Cover 2.32 1.78 1.74 1.74 1.74 - Defence Cluster is expected to have a strong second

NUMBER OF EMPLOYEES: 6 488 half performance and deliver an improved year-on-year

DIRECTORS: Abdool-Samad T (ind ne), Boëttger R J (ind ne), Applied Electronic Segment performance. As a result

Dalgleish G B (ind ne), Eboka T N M (ind ne), Fourie L P (ind ne), of these segment performances, Reunert expects to

Hulley J P (ind ne), Matshoba-Ramuedzisi M T (ind ne), Moodley M, deliver a significantly improved second half financial

Husain M J (Chair, ind ne), Dickson A E (CEO), Kathan M (CFO)

POPULAR BRAND NAMES: +OneX, CBI-electric, ECN, Etion Create, result when compared to these interim results, coupled

IQ Business, Lumika, Nanoteq, Nashua, Omnigo, Quince Capital, with free cash flows in line with our historic norms.

Reutech Communications, Reutech Radar Systems, Reutech

Solutions, Skywire, Terra Firma, Zamefa

177