Page 174 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 174

JSE - RED Profile’s Stock Exchange Handbook: 2025 - Issue 3

Redefine Properties Ltd.

ISIN: ZAE000190252

SHORT: REDEFINE

CODE: RDF

REG NO: 1999/018591/06

FOUNDED: 1999

LISTED: 2000

NATURE OF BUSINESS: Redefine Properties Ltd. is a Real Estate

Investment Trust (REIT) with a sectoral and geographically

diversified property asset platform valued at R99.4 billion.

Redefine’s portfolio is predominately anchored in South Africa

through directly held and managed retail, office and industrial

properties, which is complemented by a strong presence in retail

and logistics property assets in Poland.

SECTOR: RealEstate--RealEstate--REITS--Diversified

NUMBER OF EMPLOYEES: 759

DIRECTORS: Boshard C (ind ne), Dambuza A S P (ind ne), Fernandez C

(ind ne), Fifield S (ind ne), Langa-Royds N B (ind ne), Radley D (ind ne),

Sennelo L J (ind ne), Pityana S M (Chair, ind ne), Konig A J (CEO), Kok L C

(COO), Nyawo N G (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

Public Investment Corporation (SOC) Ltd. 19.50%

Ninety One (Cape Town) 8.70%

Meago Asset Managers (Pty) Ltd. 5.20%

POSTAL ADDRESS: PostNet Suite 264, Private Bag X31, Saxonwold, 2132

EMAIL: investorenquiries@redefine.co.za

WEBSITE: www.redefine.co.za

TELEPHONE: 011-283-0000

COMPANY SECRETARY: Anda Matwa

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital (Pty) Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE Authorised Issued

RDF Ords no par value 10 000 000 000 7 202 600 656

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Scr/100

Interim No 69 27 May 25 2 Jun 25 20.42 -

Final No 68 26 Nov 24 2 Dec 24 22.25 5.00

LIQUIDITY: Jun25 Avg 74m shares p.w., R333.5m(53.5% p.a.)

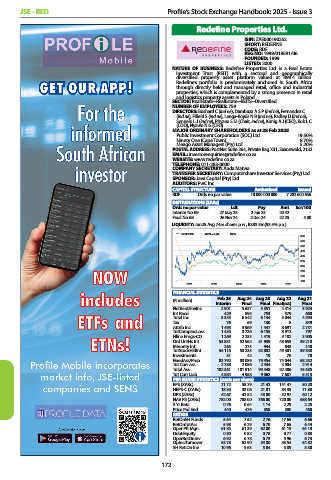

REDEFINE 40 Week MA REIV

600

550

500

450

400

350

300

250

200

150

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

Feb 25 Aug 24 Aug 23 Aug 22 Aug 21

(R million)

Interim Final Final Final(rst) Final

NetRent/InvInc 2 901 5 637 5 351 4 414 3 924

Int Recd 429 895 753 579 660

Total Inc 3 335 6 542 6 144 5 044 4 594

Tax 76 69 130 8 849

Attrib Inc 1 495 3 969 1 447 8 691 2 731

TotCompIncLoss 1 435 3 736 6 155 8 912 797

Hline Erngs-CO 1 269 2 233 1 419 5 182 3 905

Ord UntHs Int 53 851 52 962 51 939 48 653 39 218

Minority Int 265 273 944 648 140

TotStockHldInt 54 116 53 235 52 882 49 301 39 358

Investments 31 42 19 70 70

FixedAss/Prop 83 792 83 089 79 454 74 044 58 252

Tot Curr Ass 2 758 2 086 2 434 3 904 2 914

Total Ass 102 361 101 914 99 448 92 406 75 635

Tot Curr Liab 4 584 4 958 9 062 7 687 5 513

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 21.72 58.79 21.42 141.47 50.28

HEPS-C (ZARc) 18.30 33.06 21.01 84.35 71.88

DPS (ZARc) 42.67 42.52 43.80 42.97 60.12

NAV PS (ZARc) 782.00 788.00 766.00 720.00 688.64

3 Yr Beta 0.76 0.64 1.14 2.29 2.25

Price Prd End 440 476 358 380 460

RATIOS

RetOnSH Funds 5.54 7.52 2.76 17.65 6.66

RetOnTotAss 5.98 6.29 6.70 7.65 6.44

Oper Pft Mgn 61.84 61.39 62.00 61.19 64.18

Debt:Equity 0.80 0.82 0.78 0.77 0.83

OperRetOnInv 6.92 6.78 6.73 5.96 6.73

OpInc:Turnover 53.78 52.90 54.00 53.54 54.82

SH Ret On Inv 10.96 5.63 5.84 5.89 8.30

172