Page 172 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 172

JSE - RAN Profile’s Stock Exchange Handbook: 2025 - Issue 3

Randgold & Exploration Co Ltd. Raubex Group Ltd.

ISIN: ZAE000008819 SHORT: RANGOLD CODE: RNG ISIN: ZAE000093183 SHORT: RAUBEX CODE: RBX

REG NO: 1992/005642/06 FOUNDED: 1992 LISTED: 1993 REG NO: 2006/023666/06 FOUNDED: 1974 LISTED: 2007

NATURE OF BUSINESS: Randgold & Exploration Company Ltd. (R&E) NATURE OF BUSINESS: Raubex is one of South Africa’s leading

is a company that invests its cash reserves and currently pursues infrastructure development and construction materials supply

legal claims. R&E was incorporated in South Africa as a public groups. Established in 1974, Raubex listed on the JSE in March 2007

company on 29 September 1992 to take over the gold interests of and operates throughout southern Africa and Western Australia. As

Rand Mines Ltd., being South Africa’s oldest mining house. a Level 1 B-BBEE Group, Raubex has over 8 276 employees and is

SECTOR: Basic Materials--Basic Resrcs--Precious Met & Min--Gold Min focused on ensuring high levels of integrity, professionalism and

NUMBER OF EMPLOYEES: 0 quality in all of its work.

DIRECTORS: Steyn M (CEO & FD), Burton P E (ind ne), Dube T S (ind ne), SECTOR: Inds--Constr&Mats--Constr&Mats--Construction

Gischen H, Kesler J M (ne), Fehrsen R J (Chair, ind ne) NUMBER OF EMPLOYEES: 8 276

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 DIRECTORS: Bogatsu S R (ld ind ne), Fubu N (ind ne), Hlobo Dr M

Zerbans Cake & Coffee Shop CC 28.56% (ind ne), Kent B H (ind ne), Ndese M Z (ind ne), Fourie R J (Chair, ne),

Pacol Investments (Pty) Ltd. 22.77% Msiza N F (CEO), Lourens D (COO), Odendaal S (FD)

Mar Holdings (Pty) Ltd. 8.60% MAJOR ORDINARY SHAREHOLDERS as at 15 May 2025

POSTAL ADDRESS: PO Box 202, Stellenbosch, 7600 Public Investment Company SOC Ltd. 30.63%

MORE INFO: www.sharedata.co.za/sdo/jse/RNG Old Mutual Ltd. 25.90%

COMPANY SECRETARY: Statucor (Pty) Ltd. PSG 7.20%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 3722, Bloemfontein, 9300

SPONSOR: PSG Capital (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/RBX

AUDITORS: KPMG Inc. COMPANY SECRETARY: Grace Chemaly

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

RNG Ords 1c ea 105 000 000 74 585 065 SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE Authorised Issued

Ords 1c ea Ldt Pay Amt RBX Ords 1c ea 500 000 000 181 750 036

Special No 2 18 Jul 14 28 Jul 14 225.00

Share Premium No 1 7 Jan 11 17 Jan 11 253.81 DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul25 Avg 26 609 shares p.w., R20 147.0(1.9% p.a.) Ords 1c ea Ldt Pay Amt

Final No 66 17 Jun 25 23 Jun 25 104.00

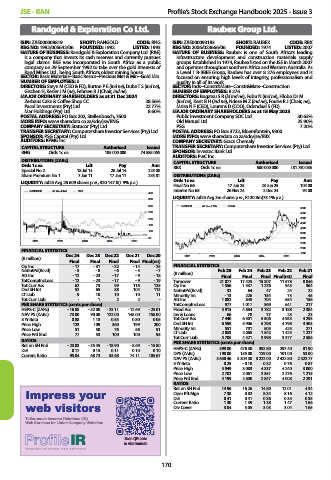

RANGOLD 40 Week MA MINI Interim No 65 26 Nov 24 2 Dec 24 94.00

400

LIQUIDITY: Jul25 Avg 3m shares p.w., R120.8m(73.1% p.a.)

350

300 RAUBEX 40 Week MA CONM

6000

250 5500

200 5000

4500

150

4000

100 3500

50 3000

2021 2022 2023 2024 2025

2500

2000

FINANCIAL STATISTICS

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 2021 2022 2023 2024 2025 1500

(R million)

Final Final Final Final Final(rst)

Op Inc - 17 - 31 - 22 - 14 - 25 FINANCIAL STATISTICS

NetIntPd(Rcvd) - 5 - 8 - 6 - 5 - 7 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

Att Inc - 12 - 23 - 17 - 9 - 18 (R million) Final Final Final Final(rst) Final

TotCompIncLoss - 12 - 23 - 17 - 9 - 19 Turnover 21 077 17 425 15 307 11 578 8 846

Tot Curr Ass 62 75 99 116 125 Op Inc 1 556 1 537 1 276 945 364

Ord SH Int 52 65 88 104 113 NetIntPd(Rcvd) 32 64 47 24 22

LT Liab 9 10 10 10 11 Minority Int - 13 226 154 73 45

Tot Curr Liab - 1 2 2 - Att Inc 1 082 848 704 554 158

PER SHARE STATISTICS (cents per share) TotCompIncLoss 977 1 017 969 641 217

HEPS-C (ZARc) - 16.88 - 32.00 - 23.11 - 12.69 - 25.01 Fixed Ass 5 915 4 884 3 782 3 188 2 384

NAV PS (ZARc) 73.00 90.00 122.00 145.00 158.00 Inv & Loans 66 78 77 23 23

3 Yr Beta 0.88 1.18 0.55 0.80 0.05 Tot Curr Ass 7 440 6 301 5 506 4 953 4 293

Price High 123 109 360 199 200 Ord SH Int 6 598 5 906 5 298 4 798 4 403

Price Low 51 50 76 56 91 Minority Int 551 701 505 425 271

Price Prd End 77 53 100 100 95 LT Liab 2 053 2 068 1 542 1 425 1 227

5 705

Tot Curr Liab

3 377

3 998

4 521

2 586

RATIOS PER SHARE STATISTICS (cents per share)

Ret on SH Fnd - 23.03 - 35.45 - 18.90 - 8.69 - 15.80

D:E 0.17 0.15 0.11 0.10 0.10 HEPS-C (ZARc) 599.80 476.30 392.80 297.40 81.90

Current Ratio 95.04 68.73 53.68 74.11 185.67 DPS (ZARc) 198.00 155.00 129.00 101.00 53.00

NAV PS (ZARc) 3 630.46 3 304.30 3 222.00 2 422.80 2 422.77

3 Yr Beta 0.25 - 0.10 0.32 0.76 0.87

Price High 5 949 3 083 4 337 4 240 3 000

Price Low 2 702 2 061 2 351 2 276 1 215

Price Prd End 4 199 2 800 2 847 4 008 2 291

RATIOS 14.96 16.26 14.80 12.01 4.34

Ret on SH Fnd

Impr

ess y

our

Impress your Oper Pft Mgn 7.38 8.82 8.34 8.16 4.12

0.41

0.36

D:E

0.35

0.41

0.35

w e b visitor s Current Ratio 1.30 1.39 1.38 1.47 1.66

web visitors

3.04

1.65

3.03

3.05

Div Cover

3.04

Tailor-made Investor Relations (IR)

Web Services for Listed Company Websites

Scan QR code

to visit website

170