Page 166 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 166

JSE - POW Profile’s Stock Exchange Handbook: 2025 - Issue 3

Powerfleet Inc. PPC Ltd.

ISIN: US73931J1097 SHORT: POWER CODE: PWR ISIN: ZAE000170049 SHORT: PPC CODE: PPC

REG NO: 7272486 FOUNDED: 2019 LISTED: 2024 REG NO: 1892/000667/06 FOUNDED: 1892 LISTED: 1910

NATURE OF BUSINESS: Powerfleet is a global leader of Internet-of- NATURE OF BUSINESS: PPC Ltd., its subsidiaries and equity-

Things (“IoT”) solutions providing valuable business intelligence for accounted investments operate in Africa as producers of cement,

managing high-value enterprise assets that improve operational aggregates, readymix and fly ash.

efficiencies.Powerfleet is headquartered in Woodcliff Lake, New SECTOR: Inds--Constr&Mats--Constr&Mats--Cement

Jersey, with offices located around the globe. NUMBER OF EMPLOYEES: 0

SECTOR: Telecoms--Telecoms--TelecomEquipment--TelecomEquipment DIRECTORS: Gobodo N (ind ne), Hansen B M (ne), Maphisa K (ne),

NUMBER OF EMPLOYEES: 0 Mkhondo N L (ind ne), Naude C H (ind ne), Smith D L (ne),

DIRECTORS: Jacobs I (ind ne, USA), Martin A (ind ne), McConnell M Thompson M (ind ne), Moleketi P J (Chair, ind ne), Cardarelli M (CEO),

(ind ne, USA), Brodsky M (Chair, ind ne, USA), Towe S (CEO, UK) Berlin B (Group CFO)

MAJOR ORDINARY SHAREHOLDERS as at 25 Mar 2024 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025

ABRY Senior Equity Holdings V, LLC 18.07% Value Capital Partners 15.85%

Cannell Capital, LLC 15.22% M&G Investments 13.86%

Lynrock Lake LP 9.69% Camissa Asset Management (Pty) Ltd. 11.19%

POSTAL ADDRESS: 123 Tice Boulevard, Woodcliff Lake, New Jersey, POSTAL ADDRESS: PO Box 787416, Sandton, 2146

07677, USA MORE INFO: www.sharedata.co.za/sdo/jse/PPC

MORE INFO: www.sharedata.co.za/sdo/jse/PWR COMPANY SECRETARY: Kevin Ross

COMPANY SECRETARY: David Wilson TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. AUDITORS: PwC Inc.

AUDITORS: Ernst & Young LLP CAPITAL STRUCTURE Authorised Issued

CAPITAL STRUCTURE Authorised Issued PPC Ords no par value 10 000 000 000 1 553 764 624

PWR Ords USD0.01 ea - 133 926 955 DISTRIBUTIONS [ZARc]

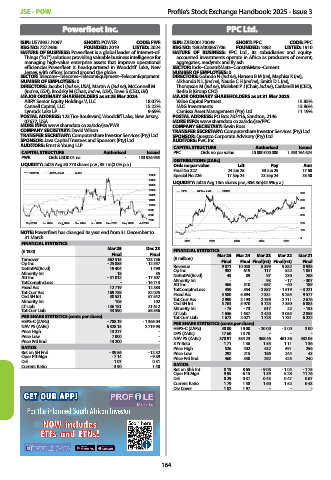

LIQUIDITY: Jul25 Avg 50 773 shares p.w., R5.1m(2.0% p.a.) Ords no par value Ldt Pay Amt

Final No 227 24 Jun 25 30 Jun 25 17.60

POWER 40 Week MA ALSH

16000 Special No 226 17 Sep 24 23 Sep 24 33.50

15000 LIQUIDITY: Jul25 Avg 13m shares p.w., R56.3m(42.5% p.a.)

14000

13000

PPC 40 Week MA CONM

12000 600

11000 500

10000

400

9000

8000 300

7000

May 2024 Jul 2024 Sep 2024 Nov 2024 Jan 2025 Mar 2025 May 2025 Jul 2025 200

NOTE: Powerfleet has changed its year end from 31 December to 100

31 March. 0

FINANCIAL STATISTICS 2021 2022 2023 2024 2025

(R ‘000) Mar 25 Dec 23 FINANCIAL STATISTICS

Final Final Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

Turnover 362 515 133 736 (R million)

Op Inc - 25 885 - 12 557 Final Final Final(rst) Final(rst) Final

NetIntPd(Rcvd) 19 404 1 499 Revenue 9 871 10 058 8 399 9 882 8 938

Minority Int 18 35 Op Inc 982 619 117 522 1 051

Att Inc - 51 012 - 17 307 NetIntPd(Rcvd) 43 89 97 230 268

TotCompIncLoss - - 16 713 Minority Int - - 93 - 17 - 307

Fixed Ass 12 719 12 383 Att Inc 466 510 - 667 - 60 189

Tot Curr Ass 169 788 82 025 TotCompIncLoss 459 554 - 2 887 - 1 519 - 3 221

Ord SH Int 38 531 57 542 Fixed Ass 5 580 5 894 7 331 9 255 9 577

Minority Int 105 102 Tot Curr Ass 2 990 3 193 2 759 2 711 2 676

LT Liab 136 181 21 612 Ord SH Int 5 763 5 970 5 725 7 350 6 883

22

- 73

- 153

617

- 75

Tot Curr Liab 43 590 58 556 Minority Int 1 656 1 637 2 420 3 053 2 855

LT Liab

PER SHARE STATISTICS (cents per share) Tot Curr Liab 1 672 2 021 1 725 1 781 6 222

HEPS-C (ZARc) - 788.19 - 1 366.04 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 6 328.15 2 719.93 HEPS-C (ZARc) 40.00 19.00 - 20.00 - 3.00 3.00

Price High 13 277 - DPS (ZARc) 17.60 13.70 - - -

Price Low 7 000 - NAV PS (ZARc) 370.91 384.23 368.46 461.36 432.05

Price Prd End 13 200 - 3 Yr Beta 1.71 1.36 1.55 1.11 1.36

RATIOS Price High 526 402 432 591 256

Ret on SH Fnd - 39.56 - 12.52 Price Low 292 215 186 244 43

Oper Pft Mgn - 7.14 - 9.39 Price Prd End 460 330 292 425 240

D:E 1.07 0.31

Current Ratio 3.90 1.40 RATIOS

Ret on Shh Int 8.19 8.65 - 9.05 - 1.04 - 1.75

Oper Pft Mgn 9.95 6.15 1.39 5.28 11.76

D:E 0.29 0.37 0.43 0.47 0.67

Current Ratio 1.79 1.58 1.60 1.52 0.43

Div Cover 1.82 1.97 - - -

164