Page 163 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 163

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - OUT

OUTsurance Group Ltd. Pan African Resources plc

ISIN: ZAE000314084 SHORT: OUTSURE CODE: OUT ISIN: GB0004300496 SHORT: PAN-AF CODE: PAN

REG NO: 2010/005770/06 FOUNDED: 2011 LISTED: 2011 REG NO: 3937466 FOUNDED: 2000 LISTED: 2007

NATURE OF BUSINESS: The OUTsurance Group is a multinational NATURE OF BUSINESS: Pan African is an African-focused mid-tier

insurance group that specialises in Property and Casualty gold producer, dual primary listed on the AIM of the LSE (ticker:

insurance.OUTsurance was founded in 1998 by three entrepreneurs PAF) and the main board of the JSE (ticker: PAN) as well as the A2X

and backed by the RMB Holdings Group. The Group’s activities are Market (A2X). Our shares trade on the OTCQX Best Market (OTCQX)

focused on the South African and Australian insurance markets in the United States of America (USA) through a Level 1 American

with the recent expansion into the Republic of Ireland. Depository Receipt (ADR) programme (ticker: PAFRY), sponsored

SECTOR: Fins--Insurance--Non-life Insurance--Full Line Insurance by the Bank of New York Mellon, and ordinary shares (ticker: PAFRF).

NUMBER OF EMPLOYEES: 7 049 SECTOR: Basic Materials--Basic Resrcs--Precious Met & Min--Gold Min

DIRECTORS: Kekana A (ne), Knoetze F (alt), Lucht U (alt), Mahlare M M NUMBER OF EMPLOYEES: 2 198

(ind ne), Moabi T (ind ne), Naidoo S (ind ne), Ndlovu R (ind ne), DIRECTORS: Earp D (ld ind ne), Mosololi T F (ind ne), Needham C D S

Pillay K (ld ind ne), Roos W T (ind ne), Teeger J (ind ne), (ind ne), Themba Y (ind ne), Spencer K C (Chair, ind ne), Loots C (CEO),

van Heerden H (ind ne), Visser M (CEO), Hofmeyr J (FD), Kok M (FD)

Bosman H L (Chair, ne), Durand J J (ne) MAJOR ORDINARY SHAREHOLDERS as at 4 Jul 2025

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024 Allan Gray Investment Management 19.63%

Remgro 30.50% Public Investment Corporation (SOC) Ltd. 14.82%

Royal Bafokeng Holdings (Pty) Ltd. 14.10% PAR Gold (Pty) Ltd. 13.78%

Public Investment Corporation 11.00% POSTAL ADDRESS: PO Box 2768, Pinegowrie, 2123

POSTAL ADDRESS: PO Box 8443, Centurion, 0046 MORE INFO: www.sharedata.co.za/sdo/jse/PAN

MORE INFO: www.sharedata.co.za/sdo/jse/OUT COMPANY SECRETARY: St James’s Corporate Services

COMPANY SECRETARY: J S Human TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Questco (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) AUDITORS: PwC LLP

AUDITORS: KPMG CAPITAL STRUCTURE Authorised Issued

CAPITAL STRUCTURE Authorised Issued PAN Ords GBP1p ea - 2 335 675 263

OUT Ords 0.01c ea 2 000 000 000 1 547 231 505 DISTRIBUTIONS [GBPp]

DISTRIBUTIONS [ZARc] Ords GBP1p ea Ldt Pay Amt

Ords 0.01c ea Ldt Pay Amt Final No 14 26 Nov 24 10 Dec 24 0.96

Interim No 28 1 Apr 25 7 Apr 25 88.60 Final No 13 28 Nov 23 12 Dec 23 0.76

Final No 27 15 Oct 24 21 Oct 24 113.20 LIQUIDITY: Jul25 Avg 35m shares p.w., R324.1m(78.4% p.a.)

LIQUIDITY: Jul25 Avg 15m shares p.w., R988.6m(50.8% p.a.)

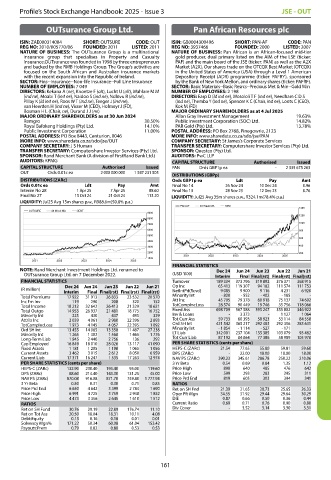

PAN-AF 40 Week MA MINI

1400

OUTSURE 40 Week MA GENF

9000

1200

8000

1000

7000

6000 800

5000

600

4000

400

3000

2000 200

2021 2022 2023 2024 2025

1000

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

NOTE: Rand Merchant Investment Holdings Ltd. renamed to Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

OUTsurance Group Ltd. on 7 December 2022. (USD ’000) Interim Final Final(rst) Final(rst) Final(rst)

FINANCIAL STATISTICS Turnover 189 334 373 796 319 892 376 371 368 915

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Op Inc 65 413 119 307 94 182 111 574 111 753

(R million) NetIntPd(Rcvd) 9 085 9 900 9 116 4 231 6 920

Interim Final Final(rst) Final(rst) Final(rst)

Total Premiums 17 922 31 913 26 833 23 532 20 570 Minority Int - 820 - 552 - 402 - 185 -

Inc Fm Inv 119 290 208 320 152 Att Inc 45 705 79 378 60 918 75 137 74 692

Total Income 18 212 32 642 26 413 21 329 18 621 TotCompIncLoss 28 574 90 449 19 746 35 756 118 066

Total Outgo 14 953 26 937 21 481 18 775 16 752 Fixed Ass 698 709 567 588 395 247 355 802 346 922

Minority Int 225 430 437 495 329 Inv & Loans - 3 373 - 1 127 1 064

Attrib Inc 2 039 4 061 2 980 22 396 2 893 Tot Curr Ass 59 733 60 393 58 923 53 114 84 558

TotCompIncLoss 1 973 4 145 4 057 22 395 1 892 Ord SH Int 421 542 365 217 292 483 292 356 283 631

Ord SH Int 13 455 14 085 13 358 11 487 27 238 Minority Int - 1 854 - 1 114 - 527 - 171 -

Minority Int 1 265 1 302 1 568 1 465 1 776 LT Liab 342 001 237 104 135 385 103 079 93 482

Long-Term Liab 1 945 2 440 2 756 136 292 Tot Curr Liab 87 192 84 864 77 386 58 989 105 978

Cap Employed 16 849 18 010 28 026 13 117 41 090 PER SHARE STATISTICS (cents per share)

Fixed Assets 1 181 1 205 1 198 1 065 1 056 HEPS-C (ZARc) 21.54 77.65 55.80 59.81 59.60

Current Assets 3 462 3 015 2 612 8 050 6 959 DPS (ZARc) - 22.00 18.00 18.00 18.00

Current Liab 17 371 16 247 1 535 17 263 12 974 NAV PS (ZARc) 390.23 345.61 286.78 250.22 210.06

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.54 0.69 0.84 1.35 1.12

HEPS-C (ZARc) 132.90 230.40 193.40 95.00 119.60 Price High 898 640 485 476 642

DPS (ZARc) 88.60 214.40 143.30 131.25 45.00 Price Low 599 293 283 295 311

NAV PS (ZARc) 870.08 916.08 871.70 749.80 1 777.94 Price Prd End 819 605 303 394 341

3 Yr Beta 0.50 0.31 0.30 0.71 0.85 RATIOS

Price Prd End 6 650 4 642 3 399 2 784 1 690 Ret on SH Fnd 21.39 21.65 20.73 25.65 26.33

Price High 6 991 4 725 3 759 2 948 1 852 Oper Pft Mgn 34.55 31.92 29.44 29.64 30.29

Price Low 4 473 3 356 2 645 1 610 1 512 D:E 0.87 0.66 0.50 0.36 0.44

RATIOS Current Ratio 0.69 0.71 0.76 0.90 0.80

Ret on SH Fund 30.76 29.19 22.89 176.74 11.10 Div Cover - 3.52 3.14 3.30 3.31

Ret on Tot Ass 20.50 18.04 18.31 10.11 4.08

Debt:Equity 0.13 0.16 0.18 0.01 0.01

Solvency Mgn% 171.22 50.34 60.08 61.04 153.42

Payouts:Prem 0.79 0.82 0.80 0.53 0.53

161