Page 164 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 164

JSE - PBT Profile’s Stock Exchange Handbook: 2025 - Issue 3

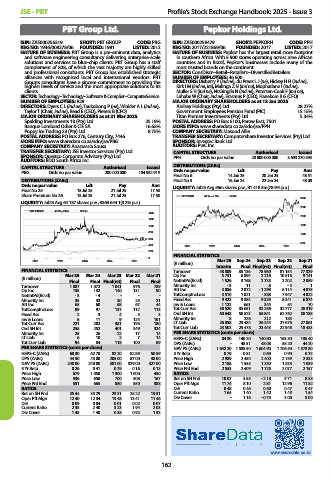

PBT Group Ltd. Pepkor Holdings Ltd.

ISIN: ZAE000256319 SHORT: PBT GROUP CODE: PBG ISIN: ZAE000259479 SHORT: PEPKORH CODE: PPH

REG NO: 1936/008278/06 FOUNDED: 1981 LISTED: 2012 REG NO: 2017/221869/06 FOUNDED: 2017 LISTED: 2017

NATURE OF BUSINESS: PBT Group is a pre-eminent data, analytics NATURE OF BUSINESS: Pepkor has the largest retail store footprint

and software engineering consultancy delivering enterprise-scale in southern Africa. With 5 900 stores operating across nine African

solutions and services to blue-chip clients. PBT Group has a staff countries and in Brazil, Pepkor’s businesses include many of the

complement of 828, of which the vast majority are highly skilled most trusted brands on the continent.

and professional consultants. PBT Group has established strategic SECTOR: ConsDiscr--Retail--Retailers--DiversifiedRetailers

alliances with recognised local and international vendors. PBT NUMBER OF EMPLOYEES: 46 600

Group’s consultants have a sincere commitment to providing the DIRECTORS: Disberry P (ind ne), du Preez L J (ne), Hickey H H (ind ne),

highest levels of service and the most appropriate solutions to its Kirk I M (ind ne, Ire), Malinga Z N (ind ne), Mophatlane I (ind ne),

clients. Muller S H (ind ne), Ntshingila N (ind ne), Petersen-Cook F (ind ne),

SECTOR: Technology--Technology--Software & CompSer--ComputerService Luhabe W (Chair, ind ne), Erasmus P (CEO), Hanekom R G (CFO)

NUMBER OF EMPLOYEES: 828 MAJOR ORDINARY SHAREHOLDERS as at 13 Jan 2025

DIRECTORS: Dyers C L (ind ne), Taukobong P (ne), Winkler A L (ind ne), Ainlsey Holdings (Pty) Ltd. 28.27%

Taylor T (Chair, ind ne), Read E (CEO), Pieters B (CFO) Government Employees Pension Fund (PIC) 15.15%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 Titan Premier Investments (Pty) Ltd. 5.34%

Spalding Investments 10 (Pty) Ltd. 25.19% POSTAL ADDRESS: PO Box 6100, Parow East, 7501

Banque Lombard Odier & CIE SA 16.63% MORE INFO: www.sharedata.co.za/sdo/jse/PPH

Poppy Ice Trading 23 (Pty) Ltd. 8.75% COMPANY SECRETARY: Masood Allie

POSTAL ADDRESS: PO Box 276, Century City, 7446 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/PBG SPONSOR: Investec Bank Ltd.

COMPANY SECRETARY: Anastassia Sousa AUDITORS: PwC Inc.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

SPONSOR: Questco Corporate Advisory (Pty) Ltd. PPH Ords no par value 20 000 000 000 3 693 270 593

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE Authorised Issued DISTRIBUTIONS [ZARc]

Pay

Amt

Ldt

PBG Ords no par value 200 000 000 104 932 919 Ords no par value 14 Jan 25 20 Jan 25 48.51

Final No 6

DISTRIBUTIONS [ZARc] Final No 5 16 Jan 24 22 Jan 24 48.08

Ords no par value Ldt Pay Amt LIQUIDITY: Jul25 Avg 56m shares p.w., R1 418.5m(78.9% p.a.)

Final No 25 15 Jul 25 21 Jul 25 17.50

Share Premium No 26 15 Jul 25 21 Jul 25 17.50 PEPKORH 40 Week MA GERE

3000

LIQUIDITY: Jul25 Avg 64 187 shares p.w., R363 644.1(3.2% p.a.)

2500

PBT GROUP 40 Week MA SCOM

1400

2000

1200

1000 1500

800

1000

600

500

400 2021 2022 2023 2024 2025

200

FINANCIAL STATISTICS

0

2021 2022 2023 2024 2025 Mar 25 Sep 24 Sep 23 Sep 22 Sep 21

(R million) Interim Final Final(rst) Final(rst) Final

FINANCIAL STATISTICS Turnover 48 809 85 136 78 960 81 154 77 329

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 Op Inc 5 731 6 894 2 216 10 516 9 141

(R million)

Final Final Final(rst) Final Final NetIntPd(Rcvd) 1 526 3 168 2 725 2 202 2 059

Turnover 1 087 1 072 1 041 976 789 Minority Int - 3 11 8 - 5 1

Op Inc 135 132 140 131 90 Att Inc 3 056 2 072 - 1 298 6 114 4 875

NetIntPd(Rcvd) - 3 - 4 - - - TotCompIncLoss 3 510 1 021 - 388 7 947 4 022

Minority Int 35 33 30 25 21 Fixed Ass 9 422 9 384 9 329 8 341 6 874

Att Inc 65 60 68 67 44 Inv & Loans 1 122 661 344 54 70

TotCompIncLoss 99 97 137 117 113 Tot Curr Ass 38 520 35 651 33 256 32 777 28 319

Fixed Ass 2 3 4 3 3 Ord SH Int 60 648 58 523 58 841 62 762 58 188

Inv & Loans 6 11 9 124 101 Minority Int 8 226 212 183 -

Tot Curr Ass 221 202 381 195 180 LT Liab 26 858 23 484 26 244 27 676 27 061

Ord SH Int 255 252 401 349 324 Tot Curr Liab 23 502 25 478 23 443 22 946 18 433

Minority Int 25 26 22 17 14 PER SHARE STATISTICS (cents per share)

LT Liab 6 10 2 7 14 HEPS-C (ZARc) 84.30 140.20 140.80 163.30 135.40

Tot Curr Liab 94 84 118 100 89 DPS (ZARc) - 48.51 48.08 55.20 44.20

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 1 642.20 1 588.50 1 604.90 1 706.50 1 573.80

HEPS-C (ZARc) 60.30 62.70 82.20 82.89 50.59 3 Yr Beta 0.79 0.81 0.69 0.90 0.72

DPS (ZARc) 44.50 43.00 205.00 87.00 38.00 Price High 2 989 2 450 2 400 2 759 2 333

NAV PS (ZARc) 240.00 240.00 381.00 329.00 327.00 Price Low 2 186 1 555 1 330 1 878 1 039

3 Yr Beta 0.26 0.41 0.29 0.16 0.13 Price Prd End 2 553 2 409 1 725 2 077 2 157

Price High 679 1 050 1 300 1 000 450 RATIOS

Price Low 536 650 700 308 167 Ret on SH Fnd 10.07 3.55 - 2.18 9.71 8.38

Price Prd End 551 665 850 850 388 Oper Pft Mgn 11.74 8.10 2.81 12.96 11.82

RATIOS D:E 0.48 0.46 0.50 0.47 0.47

Ret on SH Fnd 35.44 33.29 23.31 25.22 19.31 Current Ratio 1.64 1.40 1.42 1.43 1.54

Oper Pft Mgn 12.40 12.34 13.48 13.41 11.46 Div Cover - 1.16 - 0.74 3.00 3.00

D:E 0.09 0.04 0.01 0.02 0.07

Current Ratio 2.35 2.40 3.23 1.94 2.03

Div Cover 1.45 1.40 0.38 0.92 1.33

www.sharedata.co.za

162