Page 165 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 165

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - PIC

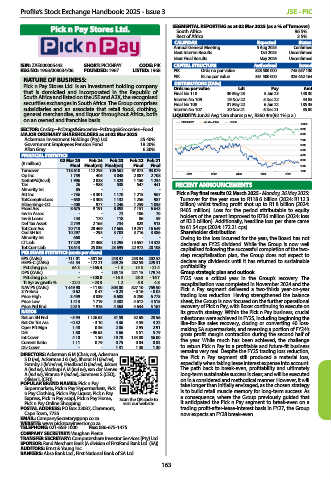

Pick n Pay Stores Ltd. SEGMENTAL REPORTING as at 02 Mar 2025 (as a % of Turnover)

South Africa

96.5%

Rest of Africa 3.5%

CALENDAR Expected Status

Annual General Meeting 5 Aug 2025 Confirmed

Next Interim Results Oct 2025 Unconfirmed

Next Final Results May 2026 Unconfirmed

ISIN: ZAE000005443 SHORT: PICKNPAY CODE: PIK CAPITAL STRUCTURE Authorised Issued

REG NO: 1968/008034/06 FOUNDED: 1967 LISTED: 1968 PIK Ords no par value 828 500 000 745 657 130

PIK Bs no par value 361 500 000 325 462 164

NATURE OF BUSINESS: DISTRIBUTIONS [ZARc]

Pick n Pay Stores Ltd. is an investment holding company Ords no par value Ldt Pay Amt

that is domiciled and incorporated in the Republic of Final No 110 30 May 23 5 Jun 23 140.30

South Africa and listed on the JSE and A2X, the recognised Interim No 109 29 Nov 22 5 Dec 22 44.85

securities exchanges in South Africa. The Group comprises Final No 108 31 May 22 6 Jun 22 185.35

subsidiaries and an associate that retail food, clothing, Interim No 107 30 Nov 21 6 Dec 21 35.80

general merchandise, and liquor throughout Africa, both LIQUIDITY: Jun25 Avg 13m shares p.w., R360.4m(92.1% p.a.)

on an owned and franchise basis. PICKNPAY 40 Week MA FOOR

10000

SECTOR: CnsStp--PcDrugs&Groceries--PcDrugs&Groceries--Food 9000

MAJOR ORDINARY SHAREHOLDERS as at 02 Mar 2025 8000

Ackerman Investment Holdings (Pty) Ltd. 25.40% 7000

Government Employees Pension Fund 18.20% 6000

Allan Gray 6.30% 5000

FINANCIAL STATISTICS 4000

02 Mar 25 Feb 24 Feb 23 Feb 22 Feb 21 3000

(R million) Final Final(rst) Final(rst) Final Final 2000

Turnover 118 610 112 295 106 562 97 873 93 079 1000

Op Inc 1 759 405 3 048 2 887 2 708 2021 2022 2023 2024 2025

NetIntPd(Rcvd) 1 996 2 038 1 323 1 150 1 234

Tax 26 - 988 538 547 441 RECENT ANNOUNCEMENTS

Minority Int 85 - - - -

Att Inc - 736 - 3 301 1 170 1 215 967 Pick n Pay final results 02 March 2025 - Monday, 26 May 2025:

TotCompIncLoss - 658 - 3 308 1 132 1 256 987 Turnover for the year rose to R118.6 billion (2024: R112.3

Hline Erngs-CO - 408 977 1 246 1 259 1 095 billion) whilst trading profit shot up to R1.8 billion (2024:

Fixed Ass 8 675 9 191 8 893 7 151 6 643 R405 million). Loss for the period attributable to equity

Inv in Assoc - - 72 106 70 holders of the parent improved to R736 million (2024: loss

Inv & Loans 143 170 118 86 59

Def Tax Asset 2 749 2 165 734 823 913 of R3.3 billion). Additionally, headline loss per share came

Tot Curr Ass 20 718 20 469 17 665 19 251 16 649 to 61.54 cps (2024: 172.21 cps).

Ord SH Int 10 297 - 293 3 703 3 716 3 386 Shareholder distribution

Minority Int 668 - - - - Owing to the loss incurred for the year, the Board has not

LT Liab 17 229 21 368 15 295 13 657 14 323 declared an FY25 dividend. While the Group is now well

Tot Curr Liab 18 613 25 835 23 699 22 972 20 108 capitalised following the successful completion of the two-

PER SHARE STATISTICS (cents per share) step recapitalisation plan, the Group does not expect to

EPS (ZARc) - 111.01 - 581.85 243.37 253.34 202.52

HEPS-C (ZARc) - 61.54 - 172.21 259.25 262.59 229.31 declare any dividends until it has returned to sustainable

Pct chng p.a. 64.3 - 166.4 - 1.3 14.5 - 21.4 profitability.

DPS (ZARc) - - 185.15 221.15 179.74 Group strategic plan and outlook

Pct chng p.a. - - 100.0 - 16.3 23.0 - 16.7 FY25 was a critical year in the Group’s recovery. The

Tr 5yr av grwth % - 22.0 - 23.3 1.2 5.8 4.8 recapitalisation was completed in November 2024 and the

NAV PS (ZARc) 1 449.90 - 11.90 803.00 827.10 769.90 Pick n Pay segment delivered a two-thirds year-on-year

3 Yr Beta 0.62 0.47 - 0.23 - 0.16 - 0.02

Price High 3 499 3 839 6 688 6 250 6 778 trading loss reduction. Having strengthened the balance

Price Low 1 413 1 719 4 302 4 612 4 515 sheet, the Group is now focused on the further operational

Price Prd End 2 815 1 976 4 563 4 644 5 167 recovery of Pick n Pay, with Boxer continuing to execute on

RATIOS its growth strategy. Within the Pick n Pay business, crucial

Ret on SH Fnd - 5.94 1 126.62 31.59 32.69 28.56 milestones were achieved in FY25, including beginning the

Ret On Tot Ass - 0.52 - 3.10 4.36 4.59 4.22 like-for-like sales recovery, closing or converting 40 loss-

Oper Pft Mgn 1.48 0.36 2.86 2.95 2.91 making SA supermarkets, and reversing a portion of FY24’s

D:E 1.60 - 96.63 5.66 5.51 5.79 gross profit margin contraction during the second half of

Int Cover 4.10 1.50 19.70 154.80 56.00

Current Ratio 1.11 0.79 0.75 0.84 0.83 the year. While much has been achieved, the challenge

Div Cover - - 1.31 1.30 1.30 to return Pick n Pay to a profitable and future-fit business

DIRECTORS: Ackerman G M (Chair, ne), Ackerman remains very real. Despite the FY25 trading loss reduction,

S D (ne), Ackerman J G (ne), Bhorat H I (ind ne), the Pick n Pay segment still produced a material loss,

Formby J (ld ind ne), Friedland D (ind ne), Jakoet especially when taking lease interest expense into account.

A (ind ne), Mothupi A M (ind ne), van der Merwe The path back to break-even, profitability and ultimately

A (ind ne), Viranna P (ind ne), Summers S (CEO), long-term sustainable success is clear; and will be executed

Olivier L (CFO) on in a considered and methodical manner. However, it will

POPULAR BRAND NAMES: Pick n Pay take longer than initially envisaged, as the chosen strategy

Supermarkets, Pick n Pay Hypermarkets, Pick is to build retail muscle memory for long-term success. As

n Pay Clothing, Pick n Pay Liquor, Pick n Pay

Express, Pick n Pay asap!, Pick n Pay Home, Scan the QR code to a consequence, where the Group previously guided that

Pick n Pay Online Shopping visit our website it anticipated the Pick n Pay segment to break-even on a

POSTAL ADDRESS: PO Box 23087, Claremont, trading profit-after-lease-interest basis in FY27, the Group

Cape Town, 7735 now expects an FY28 break-even.

EMAIL: CompanySecretary@pnp.co.za

WEBSITE: www.picknpayinvestor.co.za

TELEPHONE: 021-658-1000 Fax: 086-675-1475

COMPANY SECRETARY: Vaughan Pierce

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd. (SA))

AUDITORS: Ernst & Young Inc.

BANKERS: Absa Bank Ltd., First National Bank of SA Ltd.

163