Page 158 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 158

JSE - NUT Profile’s Stock Exchange Handbook: 2025 - Issue 3

Nutun Ltd. Nu-World Holdings Ltd.

ISIN: ZAE000167391 SHORT: NUTUN CODE: NTU ISIN: ZAE000005070

REG NO: 2002/031730/06 FOUNDED: 2007 LISTED: 2012 SHORT: NUWORLD

NATURE OF BUSINESS: The Nutun business consists of two focused CODE: NWL

and distinct customer-centric divisions: Nutun International and REG NO: 1968/002490/06

Nutun South Africa. The operating structure enables each division FOUNDED: 1946

to focus solely on its respective target markets, utilising their core LISTED: 1987

competencies and competitive advantages under the single Nutun NATURE OF BUSINESS: The company is a holding company listed

brand to deliver superior service to clients while leveraging group on the JSE. Its subsidiaries import and export a diversified range of

resources. electrical appliances, consumer electronics and branded consumer

SECTOR: Fins--FinServcs--Finance&CreditServcs--Consumer Lending durables.

NUMBER OF EMPLOYEES: 5 615 SECTOR: ConsDiscr--ConsPdts&Servcs--LeisureGds--ConsumerElec

DIRECTORS: Kekana A (ind ne), Huddy R B (CFO), Jawno J (CEO), NUMBER OF EMPLOYEES: 298

Mendelowitz M, Rossi R (ne), Kirk I M (Chair, ind ne, Ire), DIRECTORS: Davidson F J (ind ne), Judin J M (ld ind ne), Goldberg M S

Radley D (ind ne), Wapnick S (ind ne), Kana Dr S P (ld ind ne) (Chair, ne), Goldberg J A (CEO & MD), Hindle G R (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 10 Jun 2025 MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2024

Coronation Asset Management (Pty) Ltd. 29.00% Inhlanhla Ventures (Pty) Ltd. 32.42%

Directors of Transaction Capital 16.23% LTG Bank AG 23.66%

Coronation Fund Managers 12.70% Citibank 6.10%

POSTAL ADDRESS: PO Box 41888, Craighall, 2024 POSTAL ADDRESS: PO Box 8964, Johannesburg, 2000

MORE INFO: www.sharedata.co.za/sdo/jse/NTU EMAIL: ghindle@nuworld.co.za

COMPANY SECRETARY: Lisa Lill WEBSITE: www.nuworld.co.za

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TELEPHONE: 011-321-2111

SPONSOR: Investec Bank Ltd. COMPANY SECRETARY:

AUDITORS: PwC Inc. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco Corporate Advisory (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued AUDITORS: RSM South Africa

NTU Ords no par 1 000 000 000 784 313 142 CAPITAL STRUCTURE Authorised Issued

DISTRIBUTIONS [ZARc] NWL Ords 1c ea 30 000 000 21 793 785

Ords no par Ldt Pay Amt

Final No 19 29 Nov 22 5 Dec 22 13.00 DISTRIBUTIONS [ZARc]

Interim No 18 7 Jun 22 13 Jun 22 11.59 Ords 1c ea Ldt Pay Amt

LIQUIDITY: Jul25 Avg 8m shares p.w., R19.8m(56.1% p.a.) Final No 31 10 Dec 24 17 Dec 24 135.70

Final No 30 11 Dec 23 18 Dec 23 125.30

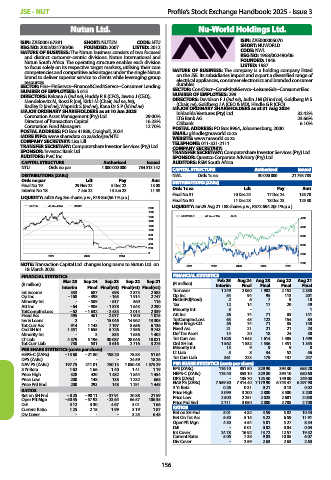

NUTUN 40 Week MA JS3021 LIQUIDITY: Jun25 Avg 21 188 shares p.w., R572 694.2(5.1% p.a.)

2000

1800

1600 NUWORLD 40 Week MA ALSH 4500

1400

1200

4000

1000

800 3500

600

400 3000

200

0 2500

2022 2023 2024

NOTE: Transaction Capital Ltd. changes long name to Nutun Ltd. on 2021 2022 2023 2024 2025 2000

18 March 2025.

FINANCIAL STATISTICS FINANCIAL STATISTICS

Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 Feb 25 Aug 24 Aug 23 Aug 22 Aug 21

(R million) (R million) Interim Final Final Final Final

Interim Final Final(rst) Final(rst) Final(rst)

Int income 333 687 698 2 875 2 583 Turnover 1 249 2 060 1 902 2 152 2 358

Op Inc - 168 - 398 - 165 1 914 2 747 Op Inc 54 94 95 113 201

Minority Int - - 509 - 617 360 116 NetIntPd(Rcvd) 2 6 7 9 10

Att Inc - 64 - 985 - 1 878 1 643 2 290 Tax 12 14 17 20 49

TotCompIncLoss - 62 - 1 632 - 2 433 2 014 2 339 Minority Int 3 - - - 1

Fixed Ass 495 461 2 077 1 900 1 075 Att Inc 36 74 71 85 141

Inv & Loans 2 - 15 046 14 962 13 305 TotCompIncLoss 63 45 122 154 84

Tot Curr Ass 914 1 143 7 197 8 656 6 136 Hline Erngs-CO 36 74 71 85 140

Ord SH Int 1 551 1 655 5 726 7 956 9 743 Fixed Ass 21 21 21 21 23

Minority Int - 3 855 1 636 1 402 Def Tax Asset 14 20 18 24 30

LT Liab 4 379 5 196 30 087 28 046 18 021 Tot Curr Ass 1 826 1 643 1 614 1 485 1 499

Tot Curr Liab 730 531 3 616 2 716 3 275 Ord SH Int 1 562 1 532 1 536 1 451 1 355

PER SHARE STATISTICS (cents per share) Minority Int 13 9 9 9 8

HEPS-C (ZARc) - 15.60 - 21.80 198.20 78.83 51.64 LT Liab 5 8 34 52 56

DPS (ZARc) - - - 24.59 18.26 Tot Curr Liab 361 223 179 137 247

NAV PS (ZARc) 197.75 211.01 750.15 1 050.48 1 375.29 PER SHARE STATISTICS (cents per share)

3 Yr Beta 1.62 1.66 1.40 1.41 1.19 EPS (ZARc) 176.10 351.50 329.90 394.30 655.20

Price High 328 420 1 482 1 844 1 454 HEPS-C (ZARc) 175.40 353.10 329.80 394.10 650.60

Price Low 200 148 138 1 232 668 DPS (ZARc) - 135.70 125.30 149.80 249.00

Price Prd End 200 293 148 1 291 1 448 NAV PS (ZARc) 7 559.30 7 414.40 7 179.90 6 745.47 6 297.90

RATIOS 3 Yr Beta 0.26 0.31 0.21 0.13 0.02

Ret on SH Fnd - 8.25 - 90.11 - 37.91 20.88 21.59 Price High 3 099 3 200 2 800 3 500 3 200

2 025

Price Low

2 500

2 050

2 251

2 601

Oper Pft Mgn - 50.45 - 57.93 - 23.64 66.57 106.35 Price Prd End 2 711 3 050 2 800 2 788 2 700

D:E 3.12 3.30 4.67 3.01 1.66

Current Ratio 1.25 2.15 1.99 3.19 1.87 RATIOS

Div Cover - - - 3.25 6.48 Ret on SH Fnd 5.01 4.82 4.59 5.82 10.43

Ret On Tot Ass 5.50 5.15 5.22 6.59 11.91

Oper Pft Mgn 4.30 4.54 5.01 5.27 8.54

D:E - 0.01 0.02 0.04 0.04

Int Cover 24.78 16.92 13.72 12.57 19.52

Current Ratio 5.06 7.38 9.03 10.85 6.07

Div Cover - 2.59 2.63 2.63 2.63

156