Page 156 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 156

JSE - NIN Profile’s Stock Exchange Handbook: 2025 - Issue 3

Ninety One plc Northam Platinum Holdings Ltd.

ISIN: GB00BJHPLV88 SHORT: NINETY 1P CODE: N91 ISIN: ZAE000298253 SHORT: NORTHAM CODE: NPH

REG NO: 12245293 FOUNDED: 2019 LISTED: 2020 REG NO: 2020/905346/06 FOUNDED: 2020 LISTED: 2021

NATURE OF BUSINESS: Ninety One is an independent investment NATURE OF BUSINESS: Northam is an independent, empowered,

manager, founded in South Africa in 1991. It operates and invests integrated primary producer of PGMs and associated base metals

globally and offers a range of active strategies to its global client benefitting from the full mine to market value chain. Northam

base. Ninety One is listed on the London and Johannesburg Stock Platinum Holdings Ltd. shares are listed on the Main Board of

Exchanges. the securities exchange operated by the JSE Ltd. (JSE) under

SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs--AssMgrs&Custodians equity share code NPH. The debt instruments (issued by Northam

NUMBER OF EMPLOYEES: 1 230 Platinum Ltd.) are listed on the interest rate market of the JSE under

DIRECTORS: Aranda I F B (ind ne, Esp), Cochrane V S (ind ne, UK), the debt issuer code NHMI.Northam Platinum Holdings Ltd. were

Keogh C D (snr ind ne, UK), Mabuza B A (ind ne), Shuenyane K L (ind ne), initially listed in 1987 as Northam Platinum Ltd. (JSE equity share

Penny G P H (Chair, ind ne, UK), du Toit H J (CEO), code NHM). In 2021, Northam Platinum Holdings Ltd. was listed,

McFarland K (FD, UK) and Northam Platinum Ltd. became its operating subsidiary and

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025 was consequently delisted.

Forty Two Point Two 33.45% SECTOR: Basic Materials--Basic Resrcs--PreciousMet&Min--Plat&PrecMet

Investec Investments 14.95% NUMBER OF EMPLOYEES: 22 691

Public Investment Corporation (SOC) Ltd. 9.26% DIRECTORS: Hanekom W A (ind ne), Hickey H H (ld ind ne), Jekwa Dr N Y

POSTAL ADDRESS: 55 Gresham Street, London, United Kingdom, (ind ne), Kgosi T E (ne), Lewis G T (ind ne, UK), Smithies J G (ind ne, UK),

EC2V 7EL Wildschutt G (ind ne), Jonas M H (Chair, ind ne), Dunne P A (CEO, UK),

MORE INFO: www.sharedata.co.za/sdo/jse/N91 Coetzee A H (CFO)

COMPANY SECRETARY: Amina Rasool MAJOR ORDINARY SHAREHOLDERS as at 7 Jul 2025

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Public Investment Corporation (SOC) Ltd. 20.40%

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd. Coronation Asset Management (Pty) Ltd. 15.05%

AUDITORS: PwC Inc. M&G Plc 10.88%

CAPITAL STRUCTURE Authorised Issued POSTAL ADDRESS: PO Box 412694, Craighall, 2024

N91 Ords of GBP0.01p ea - 628 572 786 MORE INFO: www.sharedata.co.za/sdo/jse/NPH

COMPANY SECRETARY: Patricia Beatrice Beale

DISTRIBUTIONS [GBPp] TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Ords of GBP0.01p ea Ldt Pay Amt SPONSOR: One Capital

Final No 10 15 Jul 25 7 Aug 25 6.80 AUDITORS: PricewaterhouseCoopers Inc.

Interim No 9 10 Dec 24 31 Dec 24 5.40 CAPITAL STRUCTURE Authorised Issued

LIQUIDITY: Jul25 Avg 4m shares p.w., R152.2m(33.4% p.a.) NPH Ords no par value 2 000 000 000 400 102 916

DISTRIBUTIONS [ZARc]

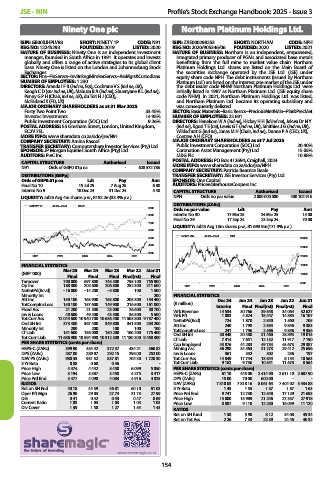

NINETY 1P 40 Week MA GENF

9000

Ords no par value Ldt Pay Amt

8000 Interim No 30 17 Mar 25 24 Mar 25 15.00

Final No 29 17 Sep 24 23 Sep 24 70.00

7000

LIQUIDITY: Jul25 Avg 13m shares p.w., R1 693.9m(171.3% p.a.)

6000

NORTHAM 40 Week MA MINI

5000 30000

4000 25000

3000

2021 2022 2023 2024 2025 20000

FINANCIAL STATISTICS 15000

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

(GBP ’000) 10000

Final Final Final Final(rst) Final

Turnover 700 000 697 800 745 500 795 100 755 900 5000

Op Inc 188 300 202 600 206 800 252 300 211 600 2021 2022 2023 2024 2025

NetIntPd(Rcvd) - 16 000 - 14 200 - 5 800 100 1 500

Minority Int - - - - 200 FINANCIAL STATISTICS

Att Inc 150 100 163 900 163 800 205 300 154 400 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

TotCompIncLoss 150 100 157 600 149 900 216 500 161 000 (R million) Interim Final Final(rst) Final(rst) Final

Fixed Ass 21 200 21 300 23 000 26 600 30 700 Wrk Revenue 14 534 30 766 39 548 34 064 32 627

Inv & Loans 48 600 49 400 43 500 36 300 5 500 Wrk Pft 1 083 4 824 15 447 14 885 16 107

Tot Curr Ass 12 044 600 10 940 700 10 636 400 11 503 800 9 737 400 NetIntPd(Rcd) 724 1 870 2 540 1 560 705

Ord SH Int 373 400 367 400 349 800 341 500 253 200 Att Inc 240 1 798 2 554 9 846 9 383

Minority Int 200 200 100 100 100 TotCompIncLoss 241 1 796 2 566 9 856 9 356

LT Liab 151 600 156 000 150 200 160 200 175 400 Ord SH Int 30 448 30 480 31 460 28 893 19 015

Tot Curr Liab 11 686 900 10 594 900 10 312 300 11 180 300 9 468 300 LT Liab 7 414 7 651 12 152 11 917 7 190

PER SHARE STATISTICS (cents per share) Cap Employed 43 876 44 283 49 734 45 673 29 387

HEPS-C (ZARc) 399.90 434.42 372.37 434.21 360.82 Mining Ass 36 298 34 563 31 273 29 412 25 696

DPS (ZARc) 287.00 289.07 292.15 295.00 252.00 Inv & Loans 361 332 302 236 197

NAV PS (ZARc) 988.53 951.52 837.81 704.30 1 720.30 Tot Curr Ass 14 849 17 744 13 844 8 154 10 563

3 Yr Beta 0.88 0.68 0.46 - - Tot Curr Liab 9 162 9 736 10 541 11 678 8 564

Price High 4 474 4 442 5 450 6 099 5 050 PER SHARE STATISTICS (cents per share)

Price Low 3 194 3 587 3 458 4 275 3 417 HEPS-C (ZARc) 61.10 445.00 2 414.90 2 611.10 2 687.90

Price Prd End 3 477 4 090 4 083 4 916 4 825 DPS (ZARc) 15.00 70.00 600.00 - -

RATIOS NAV (ZARc) 7 810.03 7 818.16 8 061.64 7 404.02 5 434.88

Ret on SH Fnd 40.18 44.59 46.81 60.10 61.03 3 Yr Beta 1.45 1.55 1.37 1.87 1.63

Oper Pft Mgn 26.90 29.03 27.74 31.73 27.99 Price Prd End 9 741 12 730 12 548 17 129 21 693

D:E 0.41 0.42 0.43 0.47 0.69 Price High 15 000 15 989 21 246 27 357 27 918

Current Ratio 1.03 1.03 1.03 1.03 1.03 Price Low 8 887 9 110 12 250 16 059 11 120

Div Cover 1.39 1.50 1.27 1.55 1.43 RATIOS

Ret on SH fund 1.58 5.90 8.12 34.08 49.34

Ret on Tot Ass 2.26 7.33 22.39 24.46 40.32

154