Page 152 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 152

JSE - NAM Profile’s Stock Exchange Handbook: 2025 - Issue 3

Nampak Ltd. Naspers Ltd.

ISIN: ZAE000322095 SHORT: NAMPAK CODE: NPK ISIN: ZAE000325783 SHORT: NASPERS-N CODE: NPN

ISIN: ZAE000004958 SHORT: NAMPAK 6%P CODE: NPKP REG NO: 1925/001431/06 FOUNDED: 1925 LISTED: 1994

ISIN: ZAE000004966 SHORT: NAMPAK 6.5 CODE: NPP1 NATURE OF BUSINESS: Established in 1915, Naspers has

REG NO: 1968/008070/06 FOUNDED: 1968 LISTED: 1969 transformed itself to become a global consumer internet company

NATURE OF BUSINESS: Nampak is Africa’s leading diversified and one of the largest technology investors in the world. Through

packaging manufacturer, and has been listed on the JSE since Prosus, the group operates and invests globally in markets with

1969. Nampak operates from 19 sites in South Africa, contributing long-term growth potential, building leading consumer internet

approximately 68% to group revenue, 14 sites in the rest of Africa, companies that empower people and enrich communities. Prosus

contributing 32% to group revenue. has its primary listing on Euronext Amsterdam, and a secondary

SECTOR: Inds--IndsGoods&Services--GeneralIndustr--Cont&Pckgng listing on the Johannesburg Stock Exchange and Naspers is the

NUMBER OF EMPLOYEES: 2 463 majority owner of Prosus.

DIRECTORS: Mnisi P J (ind ne), Mzondeki K (ind ne), Ridley S (ind ne), SECTOR: Technology--Technology--Software & CompSer--DigitalService

Siyotula N (ind ne), van der Veen A (Chair, ind ne), Roux P M (CEO), NUMBER OF EMPLOYEES: 33 246

Fullerton G (CFO), Hood A (COO) DIRECTORS: Dubey S (ind ne), Kemna A (ind ne), Mahanyele-Dabengwa

MAJOR ORDINARY SHAREHOLDERS as at 13 Nov 2024 P, Bloisi F (CEO), Marais N (CFO), Bekker J P (Chair, ne),

PSG Asset Management 11.11% du Toit H J (ld ind ne), Enenstein C (ind ne), Girotra M (ind ne, Indian),

Allan Gray 10.43% Jafta Prof R C C (ind ne), Letele F L N (ind ne), Meyer Prof D (ind ne),

M&G Investment Management (Pty) Ltd. 10.23% Oliveira de Lima R (ind ne), Pacak S J Z (ind ne), Sorour M R (ne),

POSTAL ADDRESS: PO Box 69983, Bryanston, 2021 Stofberg J D T (Alternate, ind ne), Xu Y (ind ne, China)

MORE INFO: www.sharedata.co.za/sdo/jse/NPK MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2025

COMPANY SECRETARY: Omeshnee Pillay Public Investment Corporation Group 23.38%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 2271, Cape Town, 8000

SPONSOR: PSG Capital (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/NPN

AUDITORS: PwC Inc. COMPANY SECRETARY: Lynelle Bagwandeen

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

NPK Ords no par val 600 000 000 8 476 184 SPONSOR: Investec Bank Ltd.

NPKP Prefs 200c ea 400 000 400 000 AUDITORS: Deloitte & Touche Inc.

NPP1 Prefs 200c ea 100 000 100 000 CAPITAL STRUCTURE Authorised Issued

NPN N Ords no par value 500 000 000 164 431 276

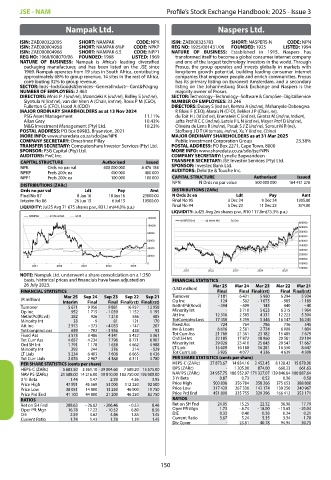

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 87 8 Jan 16 18 Jan 16 23000.00 N Ords 2c ea Ldt Pay Amt

Interim No 86 26 Jun 15 6 Jul 15 10500.00 Final No 95 3 Dec 24 9 Dec 24 1205.00

LIQUIDITY: Jul25 Avg 71 675 shares p.w., R31.1m(44.0% p.a.) Final No 94 5 Dec 23 11 Dec 23 874.00

LIQUIDITY: Jul25 Avg 2m shares p.w., R10 117.8m(73.3% p.a.)

NAMPAK 40 Week MA GENI

120000

NASPERS-N 40 Week MA SCOM

600000

100000

550000

80000 500000

450000

60000 400000

350000

40000

300000

20000 250000

200000

0 150000

2021 2022 2023 2024 2025

100000

2021 2022 2023 2024 2025

NOTE: Nampak Ltd. underwent a share consolidation on a 1:250

basis, historical prices and financials have been adjusted on FINANCIAL STATISTICS

26 July 2023. Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

FINANCIAL STATISTICS (USD million) Final Final Final(rst) Final Final(rst)

5 934

5 960

(R million) Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 Turnover 7 181 6 431 - 1 073 6 294 - 1 189

- 985

Op Inc

124

- 562

Interim Final Final Final(rst) Final(rst)

Turnover 5 671 9 956 9 881 16 937 13 958 NetIntPd(Rcvd) - 394 - 409 143 440 - 40

Op Inc 952 1 715 - 1 039 1 152 1 195 Minority Int - 3 710 5 623 6 315 1 964

NetIntPd(Rcvd) 282 926 1 218 586 485 Att Inc 12 316 2 585 4 331 12 223 5 304

Minority Int 33 - 9 81 121 170 TotCompIncLoss 17 450 3 259 5 346 16 147 16 241

Att Inc 2 973 - 373 - 4 033 - 147 207 Fixed Ass 724 764 786 736 545

TotCompIncLoss 659 - 702 - 3 936 438 93 Inv & Loans 6 616 2 581 2 734 6 008 1 804

Fixed Ass 3 573 3 486 4 341 5 452 5 361 Tot Curr Ass 21 760 21 361 23 182 15 485 7 679

Tot Curr Ass 4 657 4 234 7 796 8 771 6 907 Ord SH Int 22 185 17 872 18 960 20 581 29 194

Ord SH Int 1 791 1 178 1 638 4 662 4 988 Minority Int 29 026 23 410 25 645 29 547 11 667

Minority Int 292 244 276 214 - 529 LT Liab 15 609 16 188 16 281 16 550 8 647

LT Liab 5 234 6 403 7 608 6 665 6 436 Tot Curr Liab 5 925 4 077 4 336 4 639 4 309

Tot Curr Liab 2 676 2 967 4 388 6 311 4 780 PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 27 873.67 14 834.16 2 452.45 8 128.42 15 878.90

HEPS-C (ZARc) 5 683.50 3 361.10 - 39 004.60 7 589.20 15 575.00 DPS (ZARc) - 1 205.00 874.00 660.23 661.63

NAV PS (ZARc) 21 588.00 14 216.00 19 810.00 183 750.00 193 000.00 NAV PS (ZARc) 24 957.75 186 552.97 171 327.07 139 846.84 100 887.64

3 Yr Beta 1.44 1.47 2.39 4.36 3.95 3 Yr Beta 0.87 0.73 0.52 0.36 0.58

Price High 47 991 45 569 53 000 112 250 92 500 Price High 500 838 356 784 358 266 375 653 388 800

Price Low 38 051 14 800 13 250 46 000 19 750 Price Low 317 429 267 330 142 174 139 250 240 967

Price Prd End 41 100 44 800 21 200 46 250 83 750 Price Prd End 451 800 335 755 329 296 166 412 353 171

RATIOS RATIOS

Ret on SH Fnd 288.63 - 26.82 - 206.46 - 0.53 8.46 Ret on SH Fnd 24.05 15.25 22.32 36.98 17.79

Oper Pft Mgn 16.78 17.22 - 10.52 6.80 8.56 Oper Pft Mgn 1.73 - 8.74 - 18.00 - 15.65 - 20.04

D:E 2.59 4.62 4.46 1.85 1.45 D:E 0.33 0.40 0.38 0.34 0.21

Current Ratio 1.74 1.43 1.78 1.39 1.45 Current Ratio 3.67 5.24 5.35 3.34 1.78

Div Cover - 23.81 40.78 94.94 30.75

150