Page 154 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 154

JSE - NET Profile’s Stock Exchange Handbook: 2025 - Issue 3

Netcare Ltd. Newpark REIT Ltd.

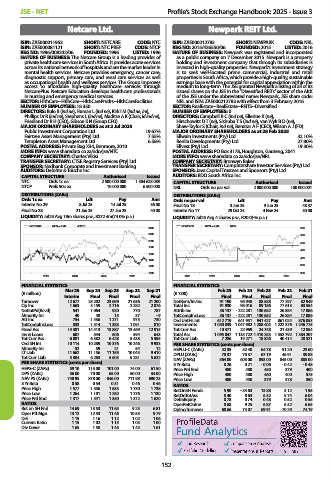

ISIN: ZAE000011953 SHORT: NETCARE CODE: NTC ISIN: ZAE000212783 SHORT: NEWPARK CODE: NRL

ISIN: ZAE000081121 SHORT: NTC PREF CODE: NTCP REG NO: 2015/436550/06 FOUNDED: 2015 LISTED: 2016

REG NO: 1996/008242/06 FOUNDED: 1996 LISTED: 1996 NATURE OF BUSINESS: Newpark was registered and incorporated

NATURE OF BUSINESS: The Netcare Group is a leading provider of as a public company on 7 December 2015. Newpark is a property

private healthcare services in South Africa. It provides acute services holding and investment company that through its subsidiaries is

across its national network of hospitals and are the market leader in invested in high-quality properties. Newpark’s investment strategy

mental health services. Netcare provides emergency, cancer care, is to seek well-located prime commercial, industrial and retail

diagnostic support, primary care, and renal care services as well properties in South Africa, which provide a high-quality, sustainable

as occupational health and wellness services. The Group improves earnings base with the potential for capital appreciation within the

access to affordable high-quality healthcare services through medium to long-term. The JSE granted Newpark a listing of all of its

NetcarePlus. Netcare Education develops healthcare professionals issued shares on the JSE in the “Diversified REITs” sector of the AltX

in nursing and emergency medical services. of the JSE under the abbreviated name: Newpark, JSE share code:

SECTOR: HlthCare--HtlhCare--HlthCarePrvdrs--HlthCareFacilities NRL and ISIN: ZAE000212783 with effect from 3 February 2016.

NUMBER OF EMPLOYEES: 18 350 SECTOR: RealEstate--RealEstate--REITS--Diversified

DIRECTORS: Bulo B (ind ne), Human L (ind ne), Kirk I M (ind ne, Ire), NUMBER OF EMPLOYEES: 0

Phillips Dr R (ind ne), Stephens L (ind ne), Maditse A K (Chair, ld ind ne), DIRECTORS: Campbell R C (ind ne), Ellerine K (ne),

Friedland Dr R H (CEO), Gibson K N (Group CFO) Hirschowitz D T (ne), Sishuba T S (ind ne), van Wyk B D (ne),

MAJOR ORDINARY SHAREHOLDERS as at 2 Jul 2025 Shaw-Taylor S (Chair, ind ne), Benatar A F (CEO), Wilson A J (FD)

Public Investment Corporation Ltd. 19.67% MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

Fairtree Asset Management (Pty) Ltd. 7.55% Ellwain Investments (Pty) Ltd. 32.10%

Templeton Asset Management Ltd. 6.58% Renlia Developments (Pty) Ltd. 27.80%

POSTAL ADDRESS: Private Bag X34, Benmore, 2010 Ellvest (Pty) Ltd. 19.30%

MORE INFO: www.sharedata.co.za/sdo/jse/NTC POSTAL ADDRESS: PO Box 3178, Houghton, Gauteng, 2041

COMPANY SECRETARY: Charles Vikisi MORE INFO: www.sharedata.co.za/sdo/jse/NRL

TRANSFER SECRETARY: CTSE Registry Services (Pty) Ltd. COMPANY SECRETARY: Bronwyn Baker

SPONSOR: Nedbank Corporate and Investment Banking TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc. SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued AUDITORS: BDO South Africa Inc.

NTC Ords 1c ea 2 500 000 000 1 364 628 089 CAPITAL STRUCTURE Authorised Issued

NTCP Prefs 50c ea 10 000 000 6 500 000 NRL Ords no par val 2 000 000 000 100 000 001

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt Ords no par val Ldt Pay Amt

Interim No 29 8 Jul 25 14 Jul 25 36.00 Final No 18 3 Jun 25 9 Jun 25 48.37

Final No 28 21 Jan 25 27 Jan 25 40.00 Interim No 17 29 Oct 24 4 Nov 24 30.00

LIQUIDITY: Jul25 Avg 19m shares p.w., R272.4m(74.0% p.a.) LIQUIDITY: Jul25 Avg 4 shares p.w., R20.0(-% p.a.)

NETCARE 40 Week MA JS2011 NEWPARK 40 Week MA REIV

2400 600

2200 550

2000

500

1800

450

1600

400

1400

350

1200

1000 300

2022 2023 2024 2025 2021 2022 2023 2024 2025

FINANCIAL STATISTICS FINANCIAL STATISTICS

Mar 25 Sep 24 Sep 23 Sep 22 Sep 21 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R million) (R ’000)

Interim Final Final Final Final Final Final Final Final Final

Turnover 12 677 25 202 23 699 21 636 21 200 NetRent/InvInc 91 190 96 948 88 558 77 297 82 949

Op Inc 1 663 3 159 2 716 2 282 2 076 Total Inc 91 930 98 016 89 186 77 613 83 554

NetIntPd(Rcvd) 541 1 064 920 770 787 Attrib Inc 36 137 - 222 281 130 652 26 884 17 086

Minority Int 40 48 15 37 - 9 TotCompIncLoss 36 137 - 222 281 130 652 26 884 17 086

Att Inc 754 1 436 1 271 975 730 Ord UntHs Int 612 719 641 951 941 427 861 024 876 053

TotCompIncLoss 833 1 514 1 383 1 091 810 Investments 1 050 839 1 047 982 1 288 404 1 222 376 1 246 775

Fixed Ass 14 381 14 413 13 887 13 469 12 915 Tot Curr Ass 10 471 22 969 24 748 21 439 12 854

Inv & Loans 607 544 606 594 643 Total Ass 1 095 047 1 135 722 1 410 253 1 352 792 1 384 207

Tot Curr Ass 6 081 6 382 6 428 5 438 5 595 Tot Curr Liab 7 286 19 271 18 826 40 414 28 521

Ord SH Int 10 114 10 289 10 376 10 246 9 933 PER SHARE STATISTICS (cents per share)

Minority Int 52 39 21 54 12 HEPLU-C (ZARc) 42.35 52.40 64.78 51.20 23.60

LT Liab 11 662 11 156 11 159 10 045 9 410 DPLU (ZARc) 78.37 70.37 67.19 46.91 39.88

Tot Curr Liab 5 304 6 263 5 603 5 281 5 622 NAV (ZARc) 564.00 603.00 893.00 845.00 885.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.26 0.21 - 0.06 - 0.42 - 0.48

HEPS-C (ZARc) 59.10 113.00 101.00 74.00 61.50 Price Prd End 480 480 450 379 400

DPS (ZARc) 36.00 70.00 65.00 50.00 34.00 Price High 480 480 460 400 575

NAV PS (ZARc) 740.95 878.00 846.00 711.98 690.23 Price Low 480 450 379 378 350

3 Yr Beta 0.58 0.54 0.31 0.46 0.46 RATIOS

Price High 1 577 1 556 1 633 1 730 1 738 RetOnSH Funds 5.90 - 34.63 13.88 3.12 1.95

Price Low 1 264 1 101 1 262 1 276 1 130 RetOnTotAss 8.40 8.63 6.32 5.74 6.04

Price Prd End 1 317 1 541 1 350 1 372 1 620 Debt:Equity 0.78 0.74 0.48 0.52 0.55

RATIOS OperRetOnInv 8.68 9.25 6.87 6.32 6.65

Ret on SH Fnd 14.69 13.53 11.65 9.25 6.81 OpInc:Turnover 68.66 74.07 69.91 70.29 74.19

Oper Pft Mgn 13.12 12.53 11.46 10.55 9.79

D:E 1.15 1.16 1.12 1.02 1.06

Current Ratio 1.15 1.02 1.15 1.03 1.00

Div Cover 1.65 1.58 1.45 1.45 1.61

152