Page 189 - shbh24_complete

P. 189

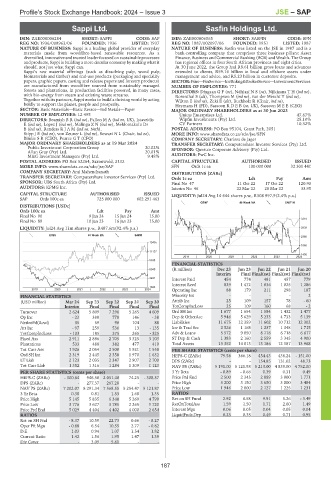

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – SAP

Sappi Ltd. Sasfin Holdings Ltd.

SAP SAS

ISIN: ZAE000006284 SHORT: SAPPI CODE: SAP ISIN: ZAE000006565 SHORT: SASFIN CODE: SFN

REG NO: 1936/008963/06 FOUNDED: 1936 LISTED: 1937 REG NO: 1987/002097/06 FOUNDED: 1951 LISTED: 1987

NATURE OF BUSINESS: Sappi is a leading global provider of everyday NATURE OF BUSINESS: Sasfin was listed on the JSE in 1987 and is a

materials made from woodfibre-based renewable resources. As a bank-controlling company that comprises three business pillars: Asset

diversified, innovative and trusted leader focused on sustainable processes Finance, Business and Commercial Banking (BCB) and Wealth. The Group

and products, Sappi is building a more circular economy by making what it has regional offices in four South African provinces and eight cities.

should, not just what Sappi can. At 30 June 2022, the Group had R8.61 billion gross loans and advances

Sappi’s raw material offerings (such as dissolving pulp, wood pulp, extended to clients, R59.16 billion in local and offshore assets under

biomaterials and timber) and end-use products (packaging and speciality management and advice, and R5.23 billion in customer deposits.

papers, graphic papers, casting and release papers and forestry products) SECTOR:Fins—FinServcs—InvBnkng&BrokerServcs—InvestmentServices

are manufactured from woodfibre sourced from sustainably managed NUMBER OF EMPLOYEES: 771

forests and plantations, in production facilities powered, in many cases, DIRECTORS: DingaanGP(ne), NdhlaziNS(ne), NjikizanaTH(ind ne),

with bio-energy from steam and existing waste streams. Rosenthal S (alt), Thompson M (ind ne), van der Mescht T (ind ne),

Together with its partners, Sappi works to build a thriving world by acting Wilton E (ind ne), Zeki E (alt), Buchholz R (Chair, ind ne),

boldly to support the planet, people and prosperity. Heymans H (FD), SassoonRDEB(ne, UK), SassoonMEE (CEO)

SECTOR: Basic Materials—Basic Resrcs—Ind Metals—Paper MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

NUMBER OF EMPLOYEES: 12 495 Unitas Enterprises Ltd. 47.67%

DIRECTORS: BeamishBR(ind ne), FallonMA(ind ne, UK), Istavridis Wipfin Investments (Pty) Ltd. 25.10%

E(ind ne), Lopez J (ind ne), MalingaZN(ind ne), Mehlomakulu Dr CV Partners 10.32%

B(ind ne), RendersRJAM(ind ne, Neth), POSTAL ADDRESS: PO Box 95104, Grant Park, 2051

StippJE(ind ne), von Zeuner L (ind ne), Sowazi N L (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/SFN

Binnie S R (CEO), Pearce G T (CFO) COMPANY SECRETARY: Charissa de Jager

MAJOR ORDINARY SHAREHOLDERS as at 19 Mar 2024 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Public Investment Corporation Group 20.02% SPONSOR: Questco Corporate Advisory (Pty) Ltd.

Allan Gray (Pty) Ltd. 20.01%

M&G Investment Managers (Pty) Ltd. 9.48% AUDITORS: PwC Inc.

POSTAL ADDRESS: PO Box 52264, Saxonwold, 2132 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/SAP SFN Ords 1c ea 100 000 000 32 301 441

COMPANY SECRETARY: Ami Mahendranath DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords 1c ea Ldt Pay Amt

SPONSOR: UBS South Africa (Pty) Ltd. Final No 47 11 Oct 22 17 Oct 22 120.90

AUDITORS: KPMG Inc. Interim No 46 22 Mar 22 28 Mar 22 33.95

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jul24 Avg 14 644 shares p.w., R308 997.9(2.4% p.a.)

SAP Ords 100c ea 725 000 000 602 291 463

GENF 40 Week MA SASFIN

DISTRIBUTIONS [USDc]

Ords 100c ea Ldt Pay Amt

Final No 90 9 Jan 24 15 Jan 24 15.00

3319

Final No 89 10 Jan 23 16 Jan 23 15.00

LIQUIDITY: Jul24 Avg 11m shares p.w., R487.6m(92.4% p.a.) 2839

IDMS 40 Week MA SAPPI

2360

13435

1880

11137

1400

2019 | 2020 | 2021 | 2022 | 2023 | 2024

8838

FINANCIAL STATISTICS

6540 (R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final(rst) Final(rst) Final(rst)

4241

Interest Paid 454 774 481 457 779

Interest Rcvd 829 1 472 1 036 1 025 1 286

1943

2019 | 2020 | 2021 | 2022 | 2023 | 2024 Operating Inc 88 179 211 298 187

FINANCIAL STATISTICS Minority Int - - - - 2

(USD million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20 Attrib Inc 25 109 157 78 - 60

Interim Final Final Final Final TotCompIncLoss 25 109 160 68 - 2

Turnover 2 624 5 809 7 296 5 265 4 609 Ord SH Int 1 677 1 654 1 584 1 432 1 477

Op Inc - 23 380 770 146 - 38 Dep & OtherAcc 5 946 5 629 5 233 4 733 5 139

NetIntPd(Rcvd) 35 59 98 104 88 Liabilities 11 675 12 359 11 602 10 712 12 302

Att Inc - 97 259 536 13 - 135 Inv & Trad Sec 2 526 1 168 1 237 1 348 1 715

TotCompIncLoss - 103 185 375 265 - 325 Adv & Loans 5 572 9 050 8 118 6 718 6 617

Fixed Ass 2 911 2 886 2 705 3 325 3 103 ST Dep & Cash 1 383 2 160 2 559 3 345 4 900

Plantations 533 488 382 477 419 Total Assets 13 352 14 013 13 186 12 187 13 968

Tot Curr Ass 1 926 2 054 2 508 1 921 1 558 PER SHARE STATISTICS (cents per share)

Ord SH Int 2 319 2 445 2 358 1 970 1 632 HEPS-C (ZARc) 79.56 366.18 454.43 438.24 - 151.00

LT Liab 2 123 2 035 2 347 2 907 2 700 DPS (ZARc) - - 154.85 131.02 48.73

Tot Curr Liab 1 352 1 316 1 284 1 309 1 123 NAV PS (ZARc) 5 191.00 5 121.98 5 213.00 4 839.00 4 752.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta - 0.89 - 0.66 0.39 0.31 0.49

HEPS-C (ZARc) - 300.64 946.50 2 051.40 74.25 - 308.37 Price Prd End 2 500 2 345 2 889 3 000 1 771

DPS (ZARc) - 277.37 267.28 - - Price High 3 200 3 150 3 650 3 000 3 484

NAV PS (ZARc) 7 202.07 8 291.34 7 568.55 5 254.47 5 121.87 Price Low 1 946 2 000 2 127 1 225 1 231

3 Yr Beta 0.30 0.81 1.53 1.68 1.35 RATIOS

Price High 5 145 5 835 6 348 5 269 4 799 Ret on SH Fund 2.92 6.58 9.91 5.26 - 3.49

Price Low 3 776 3 627 3 785 2 265 1 720 RetOnTotalAss 1.59 1.50 1.71 2.60 1.49

Price Prd End 5 029 4 404 4 402 4 000 2 654 Interest Mgn 0.06 0.05 0.04 0.05 0.04

RATIOS LiquidFnds:Dep 0.23 0.38 0.49 0.71 0.95

Ret on SH Fnd - 8.37 10.59 22.73 0.66 - 8.27

Oper Pft Mgn - 0.88 6.54 10.55 2.77 - 0.82

D:E 1.03 0.94 1.07 1.54 1.82

Current Ratio 1.42 1.56 1.95 1.47 1.39

Div Cover - 3.09 5.61 - -

187