Page 184 - shbh24_complete

P. 184

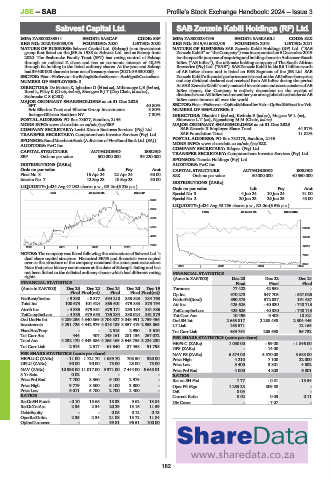

JSE – SAB Profile’s Stock Exchange Handbook: 2024 – Issue 3

Sabvest Capital Ltd. SAB Zenzele Kabili Holdings (RF) Ltd.

SAB SAB

ISIN: ZAE000283511 SHORT: SABCAP CODE: SBP ISIN: ZAE000284196 SHORT: SABKABILI CODE: SZK

REG NO: 2020/030059/06 FOUNDED: 2020 LISTED: 2020 REG NO: 2019/616052/06 FOUNDED: 2019 LISTED: 2021

NATURE OF BUSINESS: Sabvest Capital Ltd. (Sabcap) is an investment NATURE OF BUSINESS: SAB Zenzele Kabili Holdings (RF) Ltd. (“SAB

group first listed on the JSE in 1988 as Sabvest Ltd. and as Sabcap from Zenzele Kabili” or “the Company”) was incorporated on 5 December 2019

2020. The Seabrooke Family Trust (SFT) has voting control of Sabcap forthe specific purposeofacquiring andholdingsharesinAnheuser-Busch

through an unlisted Z share and has an economic interest of 40,5% InBev (“AB InBev”), the ultimate holding company of The South African

through its holding in the listed ordinary shares. At the year-end Sabcap Breweries (Pty) Ltd. (“SAB”). SAB Zenzele Kabili holds R6.1 billion worth

had39400 000 sharesinissuenetoftreasuryshares(2021: 39530 000). of AB InBev shares and is listed on BEE Segment of the JSE Ltd. SAB

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians Zenzele Kabili’sfinancialperformance is based onthe ABInBevshare price

NUMBER OF EMPLOYEES: 0 and any dividend declared and received from AB InBev during the period.

DIRECTORS: De Matteis K, Ighodaro O (ld ind ne), Mthimunye L E (ind ne), As SAB Zenzele Kabili’s only material investment and asset consists of AB

Rood L, Pillay K (Chair, ind ne), Shongwe B J T (Dep Chair, ld ind ne), InBev shares, the Company is entirely dependent on the receipt of

Seabrooke C S (CEO) dividends from AB InBev and remember you are a global shareholder as AB

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 InBev owns interest all over the world.

SFT 40.80% SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

Eric Ellerine Trust and Ellerine Group Investments 8.80% NUMBER OF EMPLOYEES: 0

InsingerGilissen Bankiers NV 7.30% DIRECTORS: Dlamini I (ind ne), Kwinda E (ind ne), MogaseWL(ne),

POSTAL ADDRESS: PO Box 78677, Sandton, 2146 ShinwanaLT(ne), Ngoasheng M M (Chair, ind ne)

MORE INFO: www.sharedata.co.za/sdo/jse/SBP MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023

COMPANY SECRETARY: Levitt Kirson Business Services (Pty) Ltd. SAB Zenzele II Employee Share Trust 44.37%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SAB Foundation Trust 11.82%

SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA)) POSTAL ADDRESS: PO Box 782178, Sandton, 2146

AUDITORS: PwC Inc. MORE INFO: www.sharedata.co.za/sdo/jse/SZK

COMPANY SECRETARY: Rilapax (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SBP Ords no par value 500 000 000 39 220 000 SPONSOR: Tamela Holdings (Pty) Ltd.

DISTRIBUTIONS [ZARc] AUDITORS: PwC Inc.

Ords no par value Ldt Pay Amt CAPITAL STRUCTURE AUTHORISED ISSUED

Final No 8 16 Apr 24 22 Apr 24 60.00 SZK Ords no par value 50 000 000 40 550 000

Interim No 7 12 Sep 23 18 Sep 23 30.00

DISTRIBUTIONS [ZARc]

LIQUIDITY: Jul24 Avg 47 082 shares p.w., R3.2m(6.2% p.a.)

Ords no par value Ldt Pay Amt

EQII 40 Week MA SABCAP Special No 3 4 Jun 24 10 Jun 24 31.00

Special No 2 20 Jun 23 26 Jun 23 45.00

9400

LIQUIDITY: Jul24 Avg 50 756 shares p.w., R2.0m(6.5% p.a.)

8052

FINA 40 Week MA SABKABILI

6704

5356 20983

4008 16500

2660 12016

2020 | 2021 | 2022 | 2023 |

NOTES: The company was listed following the restructure of Sabvest Ltd.’s 7533

dual share capital structure. Historical SENS and financials were copied

over as the structure of the company remained the same post restructure. 3050

Note that price history commences at the date of Sabcap’s listing and has 2021 | 2022 | 2023 | 2024

not been linked to the delisted ordinary shares which had different voting FINANCIAL STATISTICS

rights.

(Amts in ZAR’000) Dec 23 Dec 22 Dec 21

FINANCIAL STATISTICS Final Final Final

(Amts in ZAR’000) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 Turnover 77 422 42 953 -

Final Final(rst) Final Final Final(rst) Op Inc 970 273 347 703 - 557 025

NetRent/InvInc - 9 330 - 8 377 594 210 353 823 234 763 NetIntPd(Rcvd) 390 579 372 837 191 687

Total Inc 100 673 101 624 865 601 479 883 373 794 Att Inc 425 626 - 40 330 - 748 713

Attrib Inc - 4 335 679 581 679 171 293 184 381 886 TotCompIncLoss 425 626 - 40 330 - 748 713

TotCompIncLoss - 4 335 679 553 735 234 338 024 361 379 Tot Curr Ass 10 496 9 403 10 821

Ord UntHs Int 4 289 256 4 340 869 3 704 327 3 048 991 2 759 456 Ord SH Int 2 665 817 2 258 438 2 304 445

Investments 4 291 726 4 342 979 4 016 189 3 357 419 2 953 065 LT Liab 168 571 - 12 165

FixedAss/Prop - - 2 515 2 990 3 610 Tot Curr Liab 489 754 285 698 96 732

Tot Curr Ass 444 407 243 161 281 136 267 072 PER SHARE STATISTICS (cents per share)

Total Ass 4 292 170 4 343 386 4 265 169 3 645 755 3 224 230 HEPS-C (ZARc) 1 050.00 - 99.00 - 1 846.00

Tot Curr Liab 2 914 2 517 61 540 87 458 91 798

DPS (ZARc) - 14.00 -

PER SHARE STATISTICS (cents per share) NAV PS (ZARc) 6 574.00 5 570.00 5 683.00

HEPLU-C (ZARc) - 11.00 1 721.70 1 689.70 708.50 920.00 Price High 4 210 7 100 22 000

DPLU (ZARc) 90.00 90.00 75.00 25.00 75.00 Price Low 3 400 3 801 4 502

NAV (ZARc) 10 936.00 11 017.00 9 371.00 7 444.00 6 648.01 Price Prd End 4 000 4 208 6 801

3 Yr Beta 0.02 - - - - RATIOS

Price Prd End 7 700 8 360 6 100 2 975 - Ret on SH Fnd 7.77 - 0.81 - 15.54

Price High 9 779 8 500 6 100 3 800 - Oper Pft Mgn 1 253.23 809.50 -

Price Low 6 011 5 700 2 700 2 400 - D:E 0.03 - -

RATIOS Current Ratio 0.02 0.03 0.11

RetOnSH Funds - 0.10 15.66 18.33 9.62 13.84 Div Cover - - 7.07 -

RetOnTotAss 2.35 2.34 20.29 13.16 11.59

Debt:Equity - - 0.08 0.12 0.13

OperRetOnInv 2.35 2.34 21.08 13.72 11.84

OpInc:Turnover - - 99.81 96.51 100.00

182