Page 182 - shbh24_complete

P. 182

JSE – RHB Profile’s Stock Exchange Handbook: 2024 – Issue 3

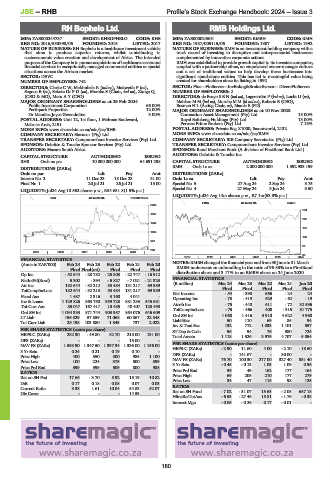

RH Bophelo Ltd. RMB Holdings Ltd.

RHB RMB

ISIN: ZAE000244737 SHORT: RHBOPHELO CODE: RHB ISIN: ZAE000024501 SHORT: RMBH CODE: RMH

REG NO: 2016/533398/06 FOUNDED: 2016 LISTED: 2017 REG NO: 1987/005115/06 FOUNDED: 1987 LISTED: 1992

NATURE OF BUSINESS: RH Bophelo is a healthcare investment vehicle NATURE OF BUSINESS: RMH is an investment holding company with a

that aims to produce superior returns, whilst contributing to track record of investing in disruptive and entrepreneurial businesses

socioeconomic value creation and development of Africa. The intended complemented by innovative corporate actions.

purpose of the Company is to pursue acquisitions of healthcare assets and RMH was established to provide growth capital to its investee companies,

financial services in exceptionally managed commercial entities or special coupled with a partnership ethos, an empowered owner-manager culture

situations across the African market. and a set of traditional values to help develop these businesses into

SECTOR: DEVC significant stand-alone entities. This has led to meaningful value being

NUMBER OF EMPLOYEES: 742 created for shareholders since its listing in 1992.

DIRECTORS: Clarke C W, Makhubela R (ind ne), Makwetla F (ne), SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

Segooa B (ne), Sekete DrPD(ne), Moraba S (Chair, ind ne), Zunga Q NUMBER OF EMPLOYEES: 2

(CEO & MD), Metu A Y (CFO) DIRECTORS: de Bruyn S E N (ind ne), Lagerström P (ind ne), Lucht U (ne),

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2024 MahlareMM(ind ne), Morobe M M (ld ind ne), Roberts B (CEO),

Public Investment Corporation 66.00% Bosman H L (Acting Chair, ne), Marais E (FD)

Perthpark Properties 12.00% MAJOR ORDINARY SHAREHOLDERS as at 10 Nov 2023

Dr Mandisa Joyce Gwendoline 3.00% Coronation Asset Management (Pty) Ltd. 15.00%

POSTAL ADDRESS: Unit 12, 1st floor, 1 Melrose Boulevard, Royal Bafokeng Holdings (Pty) Ltd. 13.00%

Melrose Arch, 2191 Peresec Prime Brokers (Pty) Ltd. 7.16%

MORE INFO: www.sharedata.co.za/sdo/jse/RHB POSTAL ADDRESS: Private Bag X1000, Saxonworld, 2132

COMPANY SECRETARY: Statucor (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/RMH

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: IKB Company Secretaries (Pty) Ltd.

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Mazars South Africa SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Deloitte & Touche Inc.

RHB Ords no par 10 000 000 000 64 691 298 CAPITAL STRUCTURE AUTHORISED ISSUED

RMH Ords 1c ea 2 000 000 000 1 392 933 199

DISTRIBUTIONS [ZARc]

Ords no par Ldt Pay Amt DISTRIBUTIONS [ZARc]

Interim No 2 11 Dec 23 18 Dec 23 31.00 Ords 1c ea Ldt Pay Amt

Final No 1 20 Jul 21 26 Jul 21 15.00 Special No 5 27 Aug 24 2 Sep 24 3.75

Special No 4 27 May 24 3 Jun 24 3.50

LIQUIDITY: Jul24 Avg 18 562 shares p.w., R54 631.8(1.5% p.a.)

LIQUIDITY: Jul24 Avg 14m shares p.w., R7.1m(53.3% p.a.)

EQII 40 Week MA RHBOPHELO

FINA 40 Week MA RMBH

2434

294

1987

242

1540

191

1094

139

647

88

200

2019 | 2020 | 2021 | 2022 | 2023 |

36

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

NOTES: RMBH changed the financial year end from 30 June to 31 March.

(Amts in ZAR’000) Feb 24 Feb 23 Feb 22 Feb 21 Feb 20 RMBH underwent an unbundling in the ratio of 96.83% to a FirstRand

Final Final(rst) Final Final Final

Op Inc - 52 644 - 28 782 - 25 803 - 22 747 - 16 912 distribution share and 3.17% to an RMBH share on 24 June 2020.

NetIntPd(Rcvd) 5 302 - 394 - 5 827 - 7 021 - 21 323 FINANCIAL STATISTICS

Att Inc 182 644 - 32 212 53 484 131 217 69 989 (R million) Mar 24 Mar 23 Mar 22 Mar 21 Jun 20

TotCompIncLoss 182 644 - 32 213 53 484 131 217 69 989 Final Final Final Final Final

24

Fixed Ass 1 487 2 316 3 160 4 041 - Net Income - 54 - 390 666 - 24 - 19

629

- 419

- 62

Operating Inc

- 73

Inv & Loans 1 129 826 863 750 959 723 881 233 545 681

- 72

Tot Curr Ass 85 047 167 417 13 485 40 407 125 498 Attrib Inc - 75 - 440 611 - 315 32 596

TotCompIncLoss

408

31 775

- 466

- 75

Ord SH Int 1 034 333 871 744 903 957 864 076 646 609

LT Liab 156 829 57 859 71 068 60 867 22 548 Ord SH Int 1 068 1 416 3 910 4 622 4 960

Tot Curr Liab 25 198 103 880 1 343 737 2 022 Liabilities 50 110 69 85 94

Inv & Trad Sec 132 772 1 033 1 101 557

PER SHARE STATISTICS (cents per share) ST Dep & Cash 96 94 76 980 724

HEPS-C (ZARc) 282.30 - 49.80 82.70 218.00 131.00 Total Assets 1 118 1 526 3 979 4 707 5 054

DPS (ZARc) - - - 15.00 -

NAV PS (ZARc) 1 598.90 1 347.50 1 397.34 1 336.00 1 156.00 PER SHARE STATISTICS (cents per share)

11.60

3 Yr Beta 0.24 0.21 0.19 0.10 - HEPS-C (ZARc) - 2.90 - 141.67 4.00 - - 2.10 - 18.60 -

80.00

DPS (ZARc)

Price High 400 550 800 985 1 100

76.70

Price Low 100 224 375 500 899 NAV PS (ZARc) - 0.45 100.30 277.00 327.40 351.40

1.09

0.96

1.03

- 0.13

3 Yr Beta

Price Prd End 399 399 509 800 985

RATIOS Price Prd End 36 49 162 177 164

Ret on SH Fnd 17.66 - 3.70 5.92 15.19 10.82 Price High 69 205 210 177 279

Price Low

125

98

34

115

47

D:E 0.17 0.18 0.08 0.07 0.03

Current Ratio 3.38 1.61 10.04 54.83 62.07 RATIOS - 7.02 - 31.07 15.63 - 2.08 657.18

Ret on SH Fund

Div Cover - - - 14.53 -

HlineRetTotAss - 6.53 - 27.46 15.81 - 1.76 - 0.38

Interest Mgn - 0.05 - 0.26 0.17 - 0.01 -

180