Page 181 - shbh24_complete

P. 181

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – RFG

RFG Holdings Ltd.

RFG

ISIN: ZAE000191979 SHORT: RFG CODE: RFG

REG NO: 2012/074392/06 FOUNDED: 2012 LISTED: 2014

NATURE OF BUSINESS: RFG is a leading producer of convenience meal

solutions for customers throughout South Africa, sub-Saharan Africa and Using the wrong

multiple major global markets.

Founded in 1896, RFG was listed on the JSE Ltd. in 2014. Since the listing

the group has concluded 10 acquisitions to expand and diversify its

product offering and customer base and extend its market-leading brands tool for the job?

into new product categories.

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products

NUMBER OF EMPLOYEES: 3 488

DIRECTORS: Leeuw T P (ld ind ne), Maitisa S (ind ne), Naidoo S (ind ne),

Njobe B (ind ne), Smart C (ne), Willis G J H (ne), Muthien Dr Y

G(Chair, ind ne), Hanekom P (CEO), Schoombie C C (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 02 Oct 2023

Capitalworks Private Equity GP (Pty) Ltd. 37.30%

Old Mutual 17.30%

PSG Konsult 8.40%

POSTAL ADDRESS: Private Bag X3040, Paarl, 7620

MORE INFO: www.sharedata.co.za/sdo/jse/RFG

COMPANY SECRETARY: B Lakey

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: Ernst & Young

CAPITAL STRUCTURE AUTHORISED ISSUED

RFG Ords no par value 1 800 000 000 262 762 018

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Final No 9 16 Jan 24 22 Jan 24 62.00

Final No 8 17 Jan 23 23 Jan 23 45.80

Do you feel limited by your existing

LIQUIDITY: Jul24 Avg 711 462 shares p.w., R9.2m(14.1% p.a.)

financial management tools?

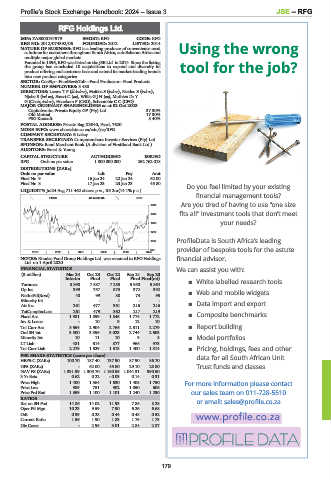

FOOD 40 Week MA RFG

Are you tired of having to use “one size

1800

1604 fits all” investment tools that don’t meet

your needs?

1408

1213

1017 ProfileData is South Africa’s leading

821 provider of bespoke tools for the astute

2019 | 2020 | 2021 | 2022 | 2023 | 2024

NOTES: Rhodes Food Group Holdings Ltd. was renamed to RFG Holdings financial advisor.

Ltd. on 1 April 2020.

FINANCIAL STATISTICS We can assist you with:

(R million) Mar 24 Oct 23 Oct 22 Sep 21 Sep 20

Interim Final Final Final Final(rst)

Turnover 3 898 7 887 7 255 5 950 5 864 White labelled research tools

Op Inc 399 757 573 372 392

NetIntPd(Rcvd) 40 99 88 73 95 Web and mobile widgets

Minority Int - - 1 - -

Att Inc 261 477 361 216 216 Data import and export

TotCompIncLoss 261 479 362 217 219

Fixed Ass 1 981 1 899 1 845 1 774 1 772 Composite benchmarks

Inv & Loans - 10 9 12 10

Tot Curr Ass 3 554 2 904 2 766 2 511 2 279 Report building

Ord SH Int 3 500 3 396 3 023 2 744 2 603

Minority Int 10 11 10 9 8 Model portfolios

LT Liab 481 614 877 966 973

Tot Curr Liab 2 279 1 529 1 513 1 400 1 314 Pricing, holdings, fees and other

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 100.70 187.40 137.90 87.90 86.70 data for all South African Unit

DPS (ZARc) - 62.00 45.80 29.10 28.80 Trust funds and classes

NAV PS (ZARc) 1 331.99 1 305.70 1 150.55 1 044.31 990.50

3 Yr Beta 0.62 0.22 - 0.03 0.14 0.31

Price High 1 400 1 364 1 630 1 408 1 750 For more information please contact

Price Low 989 751 902 1 050 606

Price Prd End 1 359 1 100 1 101 1 240 1 290 our sales team on 011-728-5510

RATIOS

Ret on SH Fnd 14.86 14.02 11.93 7.86 8.28 or email: sales@profile.co.za

Oper Pft Mgn 10.23 9.59 7.90 6.26 6.68

D:E 0.39 0.28 0.44 0.48 0.52

Current Ratio 1.56 1.90 1.83 1.79 1.73

Div Cover - 2.95 3.01 2.84 2.87

179