Page 186 - shbh24_complete

P. 186

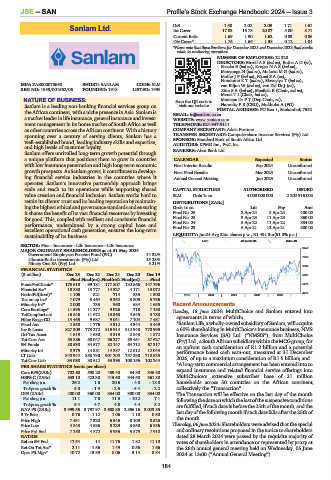

JSE – SAN Profile’s Stock Exchange Handbook: 2024 – Issue 3

D:E 1.58 2.02 2.09 1.71 1.61

Sanlam Ltd. Int Cover 17.03 16.78 20.07 5.00 8.71

Current Ratio 1.69 1.90 1.62 0.83 0.86

SAN

Div Cover* 1.76 1.66 1.38 0.12 1.04

*Please note that these line items for December 2023 and December 2022 final results

relate to continuing operations.

NUMBER OF EMPLOYEES: 22 320

DIRECTORS: BirrellAS(ind ne), BothaAD(ne),

Essoka E (ind ne), KrugerNAS(ind ne),

Manyonga N (ind ne), MokokaMG(ind ne),

MollerJP(ind ne), NkosiSA(ne),

NondumoKT(ind ne), Skweyiya T (ind ne),

ISIN: ZAE000070660 SHORT: SANLAM CODE: SLM van Biljon W (ind ne), van Zyl Dr J (ne),

REG NO: 1959/001562/06 FOUNDED: 1918 LISTED: 1998 ZinnSA(ind ne), Masilela E (Chair, ind ne),

Mvusi T I (Chair, ind ne),

NATURE OF BUSINESS: Scan the QR code to Motsepe Dr P T (Dep Chair, ne),

Hanratty P B (CEO), Mukhuba A (FD)

Sanlam is a leading non-banking financial services group on visit our website POSTAL ADDRESS: PO Box 1, Sanlamhof, 7532

the African continent, with a niche presence in Asia. Sanlam is EMAIL: ir@sanlam.co.za

a market leader in life insurance, generalinsurance and invest- WEBSITE: www.sanlam.com

ment management in its home market of South Africa as well TELEPHONE: 021-947-9111

as other countries across the African continent. With a history COMPANY SECRETARY: Adela Fortune

spanning over a century of serving clients, Sanlam has a TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

well-established brand, leading industry skills and expertise, SPONSOR: Standard Bank of South Africa Ltd.

and high levels of customer loyalty. AUDITORS: KPMG Inc., PwC Inc.

BANKERS: Absa Bank Ltd.

Sanlam offers unrivalled long-term growth potential through

a unique platform that positions them to grow in countries CALENDAR Expected Status

with low insurance penetration and high long-term economic Next Interim Results Sep 2024 Unconfirmed

growth prospects. As Sanlamgrows, it contributes to develop- Next Final Results Mar 2025 Unconfirmed

ing financial service industries in the countries where it Annual General Meeting Jun 2025 Unconfirmed

operates. Sanlam’s innovative partnership approach brings

scale and reach to its operations while supporting shared CAPITAL STRUCTURE AUTHORISED ISSUED

value creation and financial inclusion. Sanlam works hard to SLM Ords 1c ea 4 000 000 000 2 202 916 000

retain its clients’ trust and its leading reputation by maintain- DISTRIBUTIONS [ZARc]

ingthe highest ethicalandgovernancestandards andensuring Ords 1c ea Ldt Pay Amt

it shares the benefit of its vast financial resources by investing Final No 26 2 Apr 24 8 Apr 24 400.00

for good. This, coupled with resilient and consistent financial Final No 25 3 Apr 23 11 Apr 23 360.00

performance, underpinned by a strong capital base and Final No 24 5 Apr 22 11 Apr 22 334.00

Final No 23 6 Apr 21 12 Apr 21 300.00

excellent operational cash generation, ensures the long-term

sustainability of its business. LIQUIDITY: Jun24 Avg 22m shares p.w., R1 491.3m(51.8% p.a.)

LIFE 40 Week MA SANLAM

SECTOR: Fins—Insurance—Life Insurance—Life Insurance

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2024 8450

Government Employees Pension Fund (PIC) 14.32%

Ubuntu-Botho Investments (Pty) Ltd. 13.28% 7656

Ninety One SA (Pty) Ltd. 5.21%

6862

FINANCIAL STATISTICS

(R million) Dec 23 Dec 22 Dec 21 Dec 20 Dec 19 6067

Final Final(rst) Final(rst) Final(rst) Final

FundsFmClients* 175 618 99 181 177 807 132 866 147 796 5273

Financial Ser* 18 830 13 777 14 327 4 171 13 072

NetIntPd(Rcvd)* 1 106 821 714 835 1 500 2019 | 2020 | 2021 | 2022 | 2023 | 4479

Tax on op inc* 7 079 3 464 5 352 3 805 5 756

Minority Int* 2 008 733 960 684 1 655 Recent Announcements

Core Earnings* 11 595 11 277 9 026 718 7 150 Tuesday, 18 June 2024: MultiChoice and Sanlam entered into

TotCompIncLoss 16 846 11 672 13 368 4 545 3 788

Hline Erngs-CO 14 465 9 687 9 041 7 104 7 481 agreements in terms of which:

Fixed Ass 2 550 1 776 4 312 4 344 3 449 *SanlamLife, a wholly-owned subsidiary ofSanlam,will acquire

Inv & Loans 827 309 773 272 815 914 812 948 770 995 a 60% shareholding in MultiChoice’s insurance business, NMS

Def Tax Asset 1 619 1 630 3 319 2 843 1 872 Insurance Services (SA) Ltd. (“NMSIS”), from MultiChoice

Tot Curr Ass 55 886 58 047 86 277 89 451 87 627 (Pty)Ltd., aSouthAfricansubsidiary within theMCGgroup, for

SH Funds 88 530 84 577 82 147 64 712 67 317 an upfront cash consideration of R1.2 billion and a potential

Minority Int 8 375 14 381 14 387 12 512 12 043

LT Liab 840 942 850 790 901 200 757 290 718 625 performance based cash earn-out, measured at 31 December

Tot Curr Liab 33 038 30 612 53 393 108 156 102 244 2026, of up to a maximum consideration of R1.5 billion; and

*A long-term commercial arrangement has been entered into to

PER SHARE STATISTICS (cents per share)

Core EPS(ZARc) 702.60 598.20 459.40 34.80 345.80 expand insurance and related financial service offerings into

HEPS-C (ZARc) 533.10 422.30 415.60 344.50 361.80 MultiChoice’s extensive subscriber base of 21 million

Pct chng p.a. 26.2 1.6 20.6 - 4.8 - 18.8 households across 50 countries on the African continent,

Tr 5yr av grwth % 5.0 - 1.9 - 2.5 - 5.4 - 2.2 collectively the “Transaction”.

DPS (ZARc) 400.00 360.00 334.00 300.00 334.00 The Transaction will be effective on the last day of the month

Pct chng p.a. 11.1 7.8 11.3 - 10.2 7.1 followingthedateonwhich thelastofthesuspensiveconditions

Tr 5yr av grwth % 5.4 4.7 4.8 4.4 8.2 are fulfilled, if such date is before the 25th of the month, and the

NAV PS (ZARc) 3 999.55 3 797.97 3 688.85 2 856.16 3 023.85 last day of the following month if such date falls after the 25th of

3 Yr Beta 0.76 1.12 1.06 1.10 0.50

Price High 7 431 7 320 6 546 8 109 8 525 the month.

Price Low 4 843 4 686 5 229 3 850 6 886 Thursday, 06 June 2024: Shareholders were advised that the special

Price Prd End 7 280 4 872 5 936 5 875 7 910 and ordinary resolutions proposed in the notice to shareholders

RATIOS dated 28 March 2024 were passed by the requisite majority of

Ret on SH Fnd 17.54 14 11.76 1.82 11.10 votes of shareholders in attendance or represented by proxy at

Ret On Tot Ass* 2.11 1.56 1.49 0.56 1.66 the 26th annual general meeting held on Wednesday, 05 June

Oper Pft Mgn* 10.72 13.89 8.06 3.14 8.84 2024 at 13:00 (“Annual General Meeting”).

184