Page 187 - shbh24_complete

P. 187

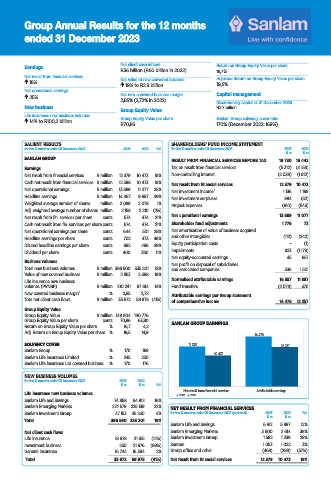

Group Annual Results for the 12 months

ended 31 December 2023

Earnings Net client cash inflows Return on Group Equity Value per share

R36 billion (R60 billion in 2022) 16,7%

Net result from financial services Adjusted Return on Group Equity Value per share

18% Net value of new convered business

19% to R2.9 billion 19,5%

Net operational earnings

25% Net new convered business margin Capital management

2,85% (2,72% in 2022) Discretionary capital at 31 December 2023

New business R2.7 billion

Group Equity Value

Life insurance new business volumes

14% to R100,2 billion Group Equity Value per share Sanlam Group solvency cover ratio

R70,86 170% (December 2022: 169%)

SALIENT RESULTS SHAREHOLDERS’ FUND INCOME STATEMENT

for the 12 months ended 31 December 2023 2023 2022 % for the 12 months ended 31 December 2023 2023 2022

R’m R’m

SANLAM GROUP

RESULT FROM FINANCIAL SERVICES BEFORE TAX 19 730 16 443

Earnings Tax on result from financial services (5 312) (4 158)

Net result from financial services R million 12 379 10 473 18% Non-controlling interest (2 039) (1 812)

Cash net result from financial services R million 12 398 10 473 18% Net result from financial services 12 379 10 473

Net operational earnings R million 13 889 11 077 25% Net investment income` 1 136 1 199

Headline earnings R million 14 467 9 687 49% Net investment surpluses 984 (52)

Weighted average number of shares million 2 089 2 078 1% Project expenses (610) (543)

Adj. weighted average number of shares million 2 158 2 210 (2%)

Net result from fin. services per share cents 574 474 21% Net operational earnings 13 889 11 077

Cash net result from fin. services per share cents 574 474 21% Shareholder fund adjustments 1 776 73

Net operational earnings per share cents 644 501 28% Net amortisation of value of business acquired

Headline earnings per share cents 702 473 48% and other intangibles (112) (242)

Diluted headline earnings per share cents 692 466 49% Equity participation costs – (1)

Dividend per share cents 400 360 11% Impairments 623 (1 178)

Net equity-accounted earnings 45 657

Business volumes Net profit on disposal of subsidiaries

Total new business volumes R million 396 500 335 201 18% and associated companies 336 1 501

Value of new covered business R million 2 853 2 388 19%

Life insurance new business Normalised attributable earnings 16 557 11 887

volumes (PVNBP) R million 100 241 87 814 14% Fund transfers (2 079) 370

New covered business margin` % 2,85 2,72 Attributable earnings per Group statement

Tota net client cash flows R million 35 672 59 975 (41%) of comprehensive income 14 478 12 257

Group Equity Value

Group Equity Value R million 149 904 140 776

Group Equity Value per share cents 70,86 63,80 SANLAM GROUP EARNINGS

Return on Group Equity Value per share % 16,7 4,2

Adj. Return on Group Equity Value per share % 19,5 14,9

14 478

SOLVENCY COVER 12 379 12 257

Sanlam Group % 170 169 10 473

Sanlam Life insurance Limited % 245 230

Sanlam Life Insurance Ltd covered business % 170 176

NEW BUSINESS VOLUMES

for the 12 months ended 31 December 2023 2023 2022

R’m R’m %

Net result from financial services Attributable earnings

Life insurance new business volumes 2023 2022

Sanlam Life and Savings 74 858 64 812 16%

Sanlam Emerging Markets 274 579 225 139 22% NET RESULT FROM FINANCIAL SERVICES

Sanlam Investment Group 47 153 45 250 4% for the 12 months ended 31 December 2023 (reviewed) 2023 2022 %

R’m R’m

Total 396 590 335 201 18%

Sanlam Life and Savings 6 612 5 897 12%

Net client cash fl ows Sanlam Emerging Markets 3 600 2 614 38%

Life insurance 18 678 21 615 (14%) Sanlam Investment Group 1 582 1 239 28%

Investment business 250 21 976 (99%) Santam 1 053 1 022 3%

General Insurance 16 744 16 384 2% Group office and other (468) (299) (57%)

Total 35 672 59 975 (41%) Net result from financial services 12 379 10 473 18%

29/04/2024 15:18:24

JSE R&E book AR2023 v20240429.indd 1 29/04/2024 15:18:24

JSE R&E book AR2023 v20240429.indd 1