Page 176 - shbh24_complete

P. 176

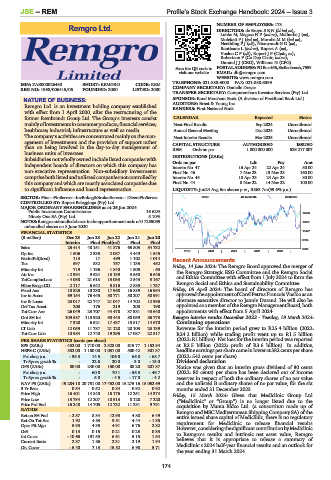

JSE – REM Profile’s Stock Exchange Handbook: 2024 – Issue 3

NUMBER OF EMPLOYEES: 173

Remgro Ltd. DIRECTORS: de BruynSEN(ld ind ne),

REM Lubbe M, MagezaNP(ind ne), Malherbe J (ne),

MoleketiPJ(ind ne), MorobeMM(ind ne),

NeethlingPJ(alt), NieuwoudtGG(ne),

Rantloane L (ind ne), Rupert A (ne),

VoslooCP(alt), Rupert J P (Chair, ne),

Robertson F (Co Dep Chair, ind ne),

Durand J J (CEO), Williams N (CFO)

Scan the QR code to POSTALADDRESS:POBox456,Stellenbosch,7599

visit our website EMAIL: dh@remgro.com

WEBSITE: www.remgro.com

TELEPHONE: 021-888-3000 FAX: 021-888-3399

ISIN: ZAE000026480 SHORT: REMGRO CODE: REM

REG NO: 1968/006415/06 FOUNDED: 2000 LISTED: 2000 COMPANY SECRETARY: Danielle Dreyer

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NATURE OF BUSINESS: SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Remgro Ltd. is an investment holding company established AUDITORS: Ernst & Young Inc.

BANKERS: First National Bank

with effect from 1 April 2000, after the restructuring of the

former Rembrandt Group Ltd. The Group’s interests consist CALENDAR Expected Status

mainlyofinvestmentsinconsumerproducts;financialservices; Next Final Results Sep 2024 Unconfirmed

healthcare; industrial; infrastructure as well as media. Annual General Meeting Dec 2024 Unconfirmed

The company’s activities are concentrated mainly on the man- Next Interim Results Mar 2025 Unconfirmed

agement of investments and the provision of support rather

than on being involved in the day-to-day management of CAPITAL STRUCTURE AUTHORISED ISSUED

business units of investees. REM Ords no par 1 000 000 000 529 217 007

Subsidiaries not wholly owned include listed companies with DISTRIBUTIONS [ZARc]

independent boards of directors on which this company has Ords no par Ldt Pay Amt

Interim No 47 16 Apr 24 22 Apr 24 80.00

non-executive representation. Non-subsidiary investments Final No 46 7 Nov 23 13 Nov 23 160.00

comprisebothlistedandunlistedcompaniesnotcontrolledby Interim No 45 18 Apr 23 24 Apr 23 80.00

this company and which are mostly associated companies due Final No 44 8 Nov 22 14 Nov 22 100.00

to significant influence and board representation. LIQUIDITY: Jun24 Avg 6m shares p.w., R863.7m(59.6% p.a.)

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs GENF 40 Week MA REMGRO

CONTROLLED BY: Rupert Beleggings (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 25 Jan 2024

Public Investment Commissioner 16.62% 14664

Ninety One SA (Pty) Ltd. 5.10%

NOTES:Remgrounbundledsharesintheapportionmentratioof0.7255039 13081

unbundled shares on 8 June 2020.

FINANCIAL STATISTICS 11497

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 9914

Interim Final Final(rst) Final Final

Sales 25 414 48 151 41 876 65 803 54 732 8330

2019 | 2020 | 2021 | 2022 | 2023 |

Op Inc 1 506 2 335 2 057 4 449 1 545

NetIntPd(Rcvd) 113 17 499 1 102 1 014 Recent Announcements

Tax 597 832 757 1 135 452 Friday, 14 June 2024: The Remgro Board approved the merger of

Minority Int 719 1 196 1 840 1 505 - 63 the Remgro Strategic ESG Committee and the Remgro Social

Att Inc - 2 394 9 624 13 139 3 550 6 646

TotCompIncLoss - 4 058 21 618 13 033 2 543 3 167 and Ethics Committee with effect from 1 July 2024 to form the

Remgro Social and Ethics and Sustainability Committee.

Hline Erngs-CO 2 117 6 642 5 816 2 885 1 737

Fixed Ass 10 525 10 230 17 968 16 889 16 954 Friday, 05 April 2024: The board of directors of Remgro has

Inv in Assoc 69 154 76 445 50 771 50 207 50 991 approved the appointmentofCarel Petrus FrancoisVoslooas an

Inv & Loans 23 017 22 747 21 047 14 702 12 995 alternate executive director to Jannie Durand. He will also be

Def Tax Asset 208 176 219 208 190 appointed as a member of the Remgro ManagementBoard, both

Tot Curr Ass 26 049 23 707 44 478 37 381 43 640 appointments with effect from 5 April 2024.

Ord SH Int 109 587 115 920 98 443 88 059 86 773 Remgro interim results December 2023 - Tuesday, 19 March 2024:

Minority Int 7 320 6 521 17 437 15 517 14 670 Continuing operations

LT Liab 12 059 11 787 21 128 20 103 23 139 Revenue for the interim period grew to R25.4 billion (2022:

Tot Curr Liab 10 984 12 740 19 295 17 087 22 517 R24.2 billion) while trading profit went up to R1.5 billion

PER SHARE STATISTICS (cents per share) (2022: R1 billion). Net loss for the interim period was reported

EPS (ZARc) - 432.00 1 710.00 2 328.00 615.77 1 152.94 at R2.5 billion (2022: profit of R3.6 billion). In addition,

HEPS-C (ZARc) 382.00 1 180.00 1 031.00 500.42 301.37 headline earnings per share came in lower at 382 cents per share

Pct chng p.a. - 35.3 14.5 106.0 66.0 - 68.7 (2022: 542 cents per share).

Tr 5yr av grwth % - 22.6 20.0 3.8 - 15.0 Dividend declaration

DPS (ZARc) 80.00 240.00 150.00 88.20 201.87 Notice was given that an interim gross dividend of 80 cents

Pct chng p.a. - 60.0 70.1 - 56.3 - 49.7 (2022: 80 cents) per share has been declared out of income

Tr 5yr av grwth % - 6.0 - 4.5 - 17.0 - 4.2 reserves in respect of both the ordinary shares of no par value

NAV PS (ZARc) 19 284.18 20 751.00 17 452.00 15 275.16 15 052.69 and the unlisted B ordinary shares of no par value, for the six

3 Yr Beta 0.54 0.52 0.84 0.92 0.92 months ended 31 December 2023.

Price High 16 401 14 840 15 176 12 251 14 374 Friday, 15 March 2024: Given that Mediclinic Group Ltd.

Price Low 13 754 12 207 10 513 8 128 7 220 (“Mediclinic” or “Group”) is no longer listed due to the

Price Prd End 16 248 14 705 12 732 11 231 9 791 acquisition by Manta Bidco Ltd. (a consortium made up of

RATIOS Remgro and MSC Mediterranean Shipping Company SA) of the

Ret on SH Fnd - 2.87 8.84 12.93 4.88 6.49 entire issued share capital of Mediclinic, there is no regulatory

Ret On Tot Ass 1.92 4.83 9.51 4.44 - 1.35 requirement for Mediclinic to release financial results.

Oper Pft Mgn 5.93 4.85 4.91 6.76 2.82 However,consideringthesignificantcontributionbyMediclinic

D:E 0.13 0.15 0.21 0.23 0.33 to Remgro’s results and intrinsic net asset value, Remgro

Int Cover - 10.65 191.53 6.61 5.15 1.54

Current Ratio 2.37 1.86 2.31 2.19 1.94 believes that it is appropriate to release a summary of

Div Cover - 5.40 7.13 15.52 6.98 5.71 Mediclinic’s 2024 half-year financial results and an outlook for

the year ending 31 March 2024.

174