Page 174 - shbh24_complete

P. 174

JSE – RCL Profile’s Stock Exchange Handbook: 2024 – Issue 3

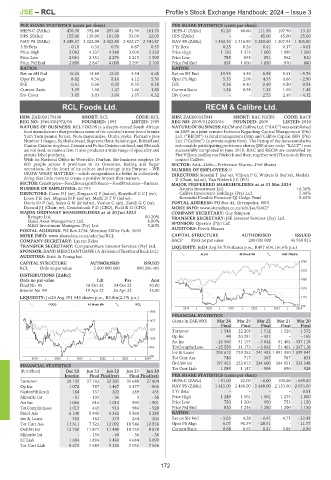

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 476.30 392.80 297.40 81.90 161.70 HEPS-C (ZARc) 81.20 60.60 111.50 107.90 13.10

DPS (ZARc) 155.00 129.00 101.00 53.00 22.00 DPS (ZARc) - - 45.00 45.00 25.00

NAV PS (ZARc) 3 249.37 3 222.00 2 422.80 2 422.77 2 341.87 NAV PS (ZARc) 1 432.30 1 316.90 1 280.50 1 207.94 1 105.80

3 Yr Beta - 0.10 0.32 0.76 0.87 0.35 3 Yr Beta 0.25 0.26 0.41 0.17 - 0.01

Price High 3 083 4 337 4 240 3 000 2 550 Price High 1 150 1 375 1 600 1 099 1 300

Price Low 2 061 2 351 2 276 1 215 1 500 Price Low 785 895 881 562 810

Price Prd End 2 800 2 847 4 008 2 291 2 100 Price Prd End 851 1 000 1 030 970 880

RATIOS RATIOS

Ret on SH Fnd 16.26 14.80 12.01 4.34 6.68 Ret on SH Fnd 15.93 4.38 8.58 9.31 - 9.76

Oper Pft Mgn 8.82 8.34 8.16 4.12 5.50 Oper Pft Mgn 5.33 2.08 4.55 4.66 - 2.90

D:E 0.41 0.36 0.35 0.35 0.38 D:E 0.36 0.40 0.40 0.50 0.54

Current Ratio 1.39 1.38 1.47 1.66 1.80 Current Ratio 1.34 0.98 1.32 1.50 1.43

Div Cover 3.05 3.03 3.04 1.65 6.32 Div Cover - - 2.53 2.48 - 4.12

RCL Foods Ltd. RECM & Calibre Ltd.

RCL REC

ISIN: ZAE000179438 SHORT: RCL CODE: RCL ISIN: ZAE000145041 SHORT: RAC PREFS CODE: RACP

REG NO: 1966/004972/06 FOUNDED: 1891 LISTED: 1989 REG NO: 2009/012403/06 FOUNDED: 2009 LISTED: 2010

NATURE OF BUSINESS: RCL FOODS is a deeply-rooted South African NATUREOF BUSINESS:RECMandCalibre Ltd.(“RAC”)wasestablished

food manufacturer that produces some of the country’s most-loved brands: in 2009 as a joint venture between Regarding Capital Management (Pty)

Yum Yum peanut butter, Nola mayonnaise, Ouma rusks, Pieman’s pies, Ltd. (“RECM”) (a fund management firm) and Calibre Capital (RF) (Pty)

Number 1 mageu, Sunbake bread, Supreme flour, Selati sugar, Bobtail and Ltd. (“Calibre”) (a private equity firm). The listing of the non-cumulative

Canine Cuisine dog food, Catmor and Feline Cuisine cat food, and Molatek redeemable participating preference shares (JSE share code: “RACP”) was

animal feed, to name a few. It also produces a wide range of speciality and successfully completed in June 2010. RAC and RECM are controlled by

private label products. Piet Viljoen and Jan van Niekerk and they, together with Theunis de Bruyn,

With its National Office in Westville, Durban, the business employs 10 control Calibre.

000 people across 8 provinces in its Groceries, Baking and Sugar SECTOR: Add—Debt—Preference Shares—Pref Shares

operations. At the heart of its culture and strategy is its Purpose – WE NUMBER OF EMPLOYEES: 0

GROW WHAT MATTERS – which encapsulates its belief in collectively DIRECTORS: Rossini T (ind ne), Viljoen P G, Walters R (ind ne), Matlala

doing that little more to create a positive impact that matters. Z (Chair, ind ne), Van Niekerk J C (FD)

SECTOR:ConsStaples—Food,Beverage&Tobacco—FoodProducers—Farmers MAJOR PREFERRED SHAREHOLDERS as at 31 Mar 2024

NUMBER OF EMPLOYEES: 20 793 Astoria Investment Ltd. 16.30%

DIRECTORS: CarseHJ(ne), DingaanGP(ind ne), KruythoffGCJ(ne), Calibre Investment Holdings (Pty) Ltd. 7.40%

LouwPR(ne), MagezaNP(ind ne), MsibiDTV(ind ne), Rozendal Flexible Prescient QI Hedge Fund 5.60%

Osiris Dr P (ne), SteynGM(ld ind ne), Vosloo C (alt), ZondiGC(ne), POSTAL ADDRESS: PO Box 44, Greenpoint, 8001

Durand J J (Chair, ne), Cruickshank P D (CEO), Field R H (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/RACP

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023 COMPANY SECRETARY: Guy Simpson

Remgro Ltd. 80.20% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Oasis Asset Management Ltd. 8.90% SPONSOR: Questco (Pty) Ltd.

M&G Investment Managers (Pty) Ltd. 5.20%

POSTAL ADDRESS: PO Box 2734, Westway Office Park, 3635 AUDITORS: Forvis Mazars

MORE INFO: www.sharedata.co.za/sdo/jse/RCL CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Lauren Kelso RACP Prefs no par value 200 000 000 45 958 815

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul24 Avg 58 704 shares p.w., R497 604.1(6.6% p.a.)

SPONSOR:RANDMERCHANTBANK(AdivisionofFirstRandBankLtd.)

ALSH 40 Week MA RAC PREFS

AUDITORS: Ernst & Young Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 2740

RCL Ords no par value 2 000 000 000 890 296 405

2333

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 1926

Final No 95 18 Oct 22 24 Oct 22 30.00

1519

Interim No 94 19 Apr 22 25 Apr 22 15.00

LIQUIDITY: Jul24 Avg 391 545 shares p.w., R3.8m(2.3% p.a.) 1112

FOOD 40 Week MA RCL 705

2019 | 2020 | 2021 | 2022 | 2023 | 2024

1696

FINANCIAL STATISTICS

1477 (Amts in ZAR’000) Mar 24 Mar 23 Mar 22 Mar 21 Mar 20

Final Final Final Final Final

1257

Turnover 1 548 22 203 1 512 1 526 1 572

Op Inc 94 20 291 - 431 - - 185

1038

Att Inc - 25 560 31 173 - 3 042 51 402 - 337 118

TotCompIncLoss - 25 559 31 173 - 3 042 51 402 - 337 118

819

Inv & Loans 703 612 729 252 741 433 1 091 350 1 039 941

600 Tot Curr Ass 740 717 367 787 831

2019 | 2020 | 2021 | 2022 | 2023 | 2024

Ord SH Int 197 453 223 012 234 600 584 951 533 548

FINANCIAL STATISTICS

(R million) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20 Tot Curr Liab 1 089 1 147 904 890 928

Interim Final Final(rst) Final Final(rst) PER SHARE STATISTICS (cents per share)

Turnover 20 130 37 783 32 201 31 688 27 804 HEPS-C (ZARc) - 51.00 62.00 - 6.00 100.00 - 659.00

Op Inc 1 072 787 1 467 1 477 - 806 NAV PS (ZARc) 1 415.00 1 466.00 1 448.00 2 133.00 2 033.00

NetIntPd(Rcvd) 164 337 202 289 455 3 Yr Beta - - - - 0.51

Minority Int - 51 - 103 - 36 3 - 58 Price High 1 249 1 501 1 501 1 275 1 800

Att Inc 1 066 616 1 013 993 - 901 Price Low 750 1 200 950 753 1 150

TotCompIncLoss 1 013 443 916 984 - 928 Price Prd End 820 1 236 1 280 1 200 1 150

Fixed Ass 6 108 5 945 6 362 5 560 5 285 RATIOS

Inv & Loans 392 162 273 264 204 Ret on SH Fnd - 3.63 4.28 - 0.41 4.71 - 32.42

Tot Curr Ass 11 611 7 523 12 092 10 546 10 838 Oper Pft Mgn 6.07 91.39 - 28.51 - - 11.77

Ord SH Int 12 750 11 877 11 449 10 730 9 878 Current Ratio 0.68 0.63 0.41 0.88 0.90

Minority Int - - 156 - 60 - 36 - 56

LT Liab 1 684 1 894 3 430 4 684 5 099

Tot Curr Liab 8 673 7 689 9 155 7 030 7 566

172