Page 170 - shbh24_complete

P. 170

JSE – PUT Profile’s Stock Exchange Handbook: 2024 – Issue 3

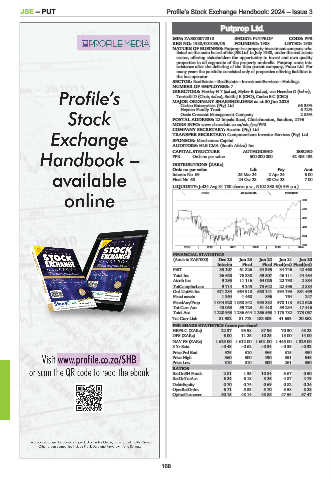

Putprop Ltd.

PUT

ISIN: ZAE000072310 SHORT: PUTPROP CODE: PPR

REG NO: 1988/001085/06 FOUNDED: 1988 LISTED: 1988

NATURE OF BUSINESS: Putprop is a property investment company who

listed on the main board of the JSE Ltd. in July 1988, under the real estate

sector, offering stakeholders the opportunity to invest and own quality

properties in all segments of the property umbrella. Putprop came into

existence after the delisting of the then parent company, Putco Ltd. For

many years the portfolio consisted only of properties offering facilities to

the bus operator.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

NUMBER OF EMPLOYEES: 7

DIRECTORS: Hartley H T (ind ne), Styber R (ind ne), van Heerden G (ind ne),

Torricelli D (Chair, ind ne), Smith J E (CFO), Carleo B C (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2023

Carleo Enterprises (Pty) Ltd. 66.35%

Heynen Family Trust 6.72%

Oasis Crescent Management Company 2.86%

POSTAL ADDRESS: 22 Impala Road, Chislehurston, Sandton, 2196

MORE INFO: www.sharedata.co.za/sdo/jse/PPR

COMPANY SECRETARY: Acorim (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Merchantec Capital

AUDITORS: HLB CMA (South Africa) Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

PPR Ords no par value 500 000 000 42 405 133

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Interim No 69 25 Mar 24 2 Apr 24 6.00

Final No 68 24 Oct 23 30 Oct 23 7.00

LIQUIDITY: Jul24 Avg 31 780 shares p.w., R102 338.6(3.9% p.a.)

REDS 40 Week MA PUTPROP

630

556

482

408

334

260

2019 | 2020 | 2021 | 2022 | 2023 | 2024

FINANCIAL STATISTICS

(Amts in ZAR’000) Dec 23 Jun 23 Jun 22 Jun 21 Jun 20

Interim Final Final Final(rst) Final(rst)

PBIT 35 107 61 826 54 395 34 746 42 468

Total Inc 36 638 76 338 59 507 46 111 44 484

Attrib Inc 9 293 11 116 64 025 22 790 2 884

TotCompIncLoss 9 714 9 245 73 642 22 496 2 884

Ord UntHs Int 671 234 664 910 658 141 594 193 581 499

Fixed assets 1 364 1 468 896 764 247

FixedAss/Prop 1 044 928 1 058 842 953 332 970 113 512 626

Tot Curr Ass 43 053 59 723 51 418 59 234 17 416

Total Ass 1 220 953 1 236 644 1 266 563 1 175 782 773 067

Tot Curr Liab 81 982 81 773 183 303 41 653 20 862

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 22.37 93.98 87.96 70.30 48.23

DPS (ZARc) 6.00 11.25 10.25 15.00 14.00

NAV PS (ZARc) 1 629.00 1 612.00 1 601.00 1 445.00 1 329.00

3 Yr Beta - 0.48 - 0.62 - 0.34 - 0.35 - 0.33

Price Prd End 325 310 365 315 350

Price High 360 500 490 351 548

Price Low 310 310 300 261 350

RATIOS

RetOnSH Funds 2.81 1.35 10.84 3.67 0.50

RetOnTotAss 6.24 6.18 5.26 4.87 4.79

Debt:Equity 0.70 0.74 0.69 0.82 0.24

OperRetOnInv 6.71 5.83 5.70 3.58 8.28

OpInc:Turnover 50.15 48.14 48.86 47.55 57.47

168