Page 171 - shbh24_complete

P. 171

Profile’s Stock Exchange Handbook: 2024 – Issue 3 JSE – QUA

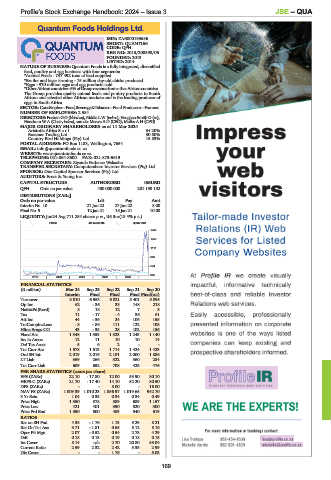

Quantum Foods Holdings Ltd.

QUA

ISIN: ZAE000193686

SHORT: QUANTUM

CODE: QFH

REG NO: 2013/208598/06

FOUNDED: 2013

LISTED: 2014

NATURE OF BUSINESS: Quantum Foods is a fully integrated, diversified

feed, poultry and egg business with four segments:

*Animal Feeds - 737 492 tons of feed supplied

*Broiler and layer farming - 75 million day-old chicks produced

*Eggs - 970 million eggs and egg products sold

*OtherAfricancountries-6%ofGrouprevenuefromotherAfricancountries

The Group provides quality animal feeds and poultry products to South

African and selected other African markets and is the leading producer of

eggs in South Africa.

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers

NUMBER OF EMPLOYEES: 2 584

DIRECTORS: Fortuin G G (ld ind ne), Riddle L W (ind ne), Vaughan-Smith G (ne),

Hanekom W A (Chair, ind ne), van der Merwe A D (CEO), Muller A H (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 11 Mar 2024

Aristotle Africa S.a.r.l. 34.20%

Braemar Trading Ltd. 30.80%

Country Bird Holdings (Pty) Ltd. 15.83%

POSTAL ADDRESS: PO Box 1183, Wellington, 7654

EMAIL: info@quantumfoods.co.za

WEBSITE: www.quantumfoods.co.za

TELEPHONE: 021-864-8600 FAX: 021-873-5619

COMPANY SECRETARY: Ziyanda Patience Wakashe

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: One Capital Sponsor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

QFH Ords no par value 400 000 000 201 198 152

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

Interim No 10 21 Jun 22 27 Jun 22 8.00

Final No 9 12 Jan 21 18 Jan 21 10.00

LIQUIDITY: Jun24 Avg 711 254 shares p.w., R6.3m(18.4% p.a.)

FOOD 40 Week MA QUANTUM

1649

1380

1111

843

574

305

2019 | 2020 | 2021 | 2022 | 2023 |

FINANCIAL STATISTICS

(R million) Mar 24 Sep 23 Sep 22 Sep 21 Sep 20

Interim Final Final Final Final(rst)

Turnover 3 010 6 953 6 021 5 401 5 095

Op Inc 62 - 36 33 148 218

NetIntPd(Rcvd) 8 18 12 7 3

Tax 11 - 17 - 4 36 61

Att Inc 44 - 36 24 106 155

TotCompIncLoss - 3 - 89 111 122 108

Hline Erngs-CO 43 - 35 28 102 156

Fixed Ass 1 348 1 353 1 323 1 243 1 140

Inv in Assoc 12 11 10 10 14

Def Tax Asset 5 6 2 - -

Tot Curr Ass 1 578 1 513 1 714 1 424 1 423

Ord SH Int 2 019 2 016 2 101 2 000 1 886

LT Liab 369 266 322 360 284

Tot Curr Liab 609 652 708 425 476

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 22.10 - 17.80 12.00 53.90 80.10

HEPS-C (ZARc) 21.70 - 17.40 14.10 52.20 80.50

DPS (ZARc) - - 8.00 - 16.00

NAV PS (ZARc) 1 009.39 1 010.23 1 056.97 1 019.65 942.70

3 Yr Beta 1.04 0.35 0.34 0.34 0.49

Price High 1 350 578 589 689 1 157

Price Low 421 401 350 520 300

Price Prd End 1 350 500 483 540 619

RATIOS

Ret on SH Fnd 4.38 - 1.76 1.13 5.29 8.21

Ret On Tot Ass 3.71 - 1.81 0.65 5.12 8.16

Oper Pft Mgn 2.07 - 0.52 0.54 2.73 4.29

D:E 0.18 0.13 0.19 0.18 0.15

Int Cover 8.14 n/a 2.70 20.80 85.04

Current Ratio 2.59 2.32 2.42 3.35 2.99

Div Cover - - 1.76 - 5.03

169