Page 205 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 205

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - THU

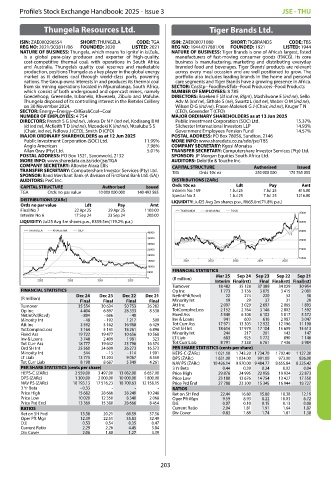

Thungela Resources Ltd. Tiger Brands Ltd.

ISIN: ZAE000296554 SHORT: THUNGELA CODE: TGA ISIN: ZAE000071080 SHORT: TIGBRANDS CODE: TBS

REG NO: 2021/303811/06 FOUNDED: 2020 LISTED: 2021 REG NO: 1944/017881/06 FOUNDED: 1921 LISTED: 1944

NATURE OF BUSINESS: Thungela, which means ‘to ignite’ in isiZulu, NATURE OF BUSINESS: Tiger Brands is one of Africa’s largest, listed

is a global pure-play producer and exporter of high-quality, manufacturers of fast-moving consumer goods (FMCG). Its core

cost-competitive thermal coal, with operations in South Africa business is manufacturing, marketing and distributing everyday

and Australia. Thungela’s quality coal reserves and marketable branded food and beverages. Tiger Brands’ products are relevant

production, positions Thungela as a key player in the global energy across every meal occasion and are well positioned to grow. The

market as it delivers coal through world-class ports, powering portfolio also includes leading brands in the home and personal

nations. The Group owns interests in and produces its thermal coal care segments and Tiger Brands have a growing presence in Africa.

from six mining operations located in Mpumalanga, South Africa, SECTOR: CnsStp--FoodBev&Tob--Food Producers--Food Products

which consist of both underground and opencast mines, namely NUMBER OF EMPLOYEES: 8 785

Goedehoop, Greenside, Isibonelo, Khwezela, Zibulo and Mafube. DIRECTORS: Braeken F (ld ind ne, Blgm), Mashilwane E (ind ne), Sello

Thungela disposed of its controlling interest in the Rietvlei Colliery Adv M (ind ne), Sithole S (ne), Swartz L (ind ne), Weber O M (ind ne),

on 30 November 2024. Wilson D G (ind ne), Fraser-Moleketi G J (Chair, ind ne), Kruger T N

SECTOR: Energy--Energy--OilGas&Coal--Coal (CEO), Govender T (CFO)

NUMBER OF EMPLOYEES: 4 754 MAJOR ORDINARY SHAREHOLDERS as at 13 Jun 2025

DIRECTORS: French S G (ind ne), Jekwa Dr N Y (ind ne), Kodisang B M Public Investment Corporation (SOC) Ltd. 15.37%

(ld ind ne), McKeith T D (ind ne), Mzondeki K (ind ne), Ntsaluba S S Silchester International Investors LLP 14.93%

(Chair, ind ne), Ndlovu J (CEO), Smith D (CFO) Government Employees Pension Fund 14.57%

MAJOR ORDINARY SHAREHOLDERS as at 12 Jun 2025 POSTAL ADDRESS: PO Box 78056, Sandton, 2146

Public Investment Corporation (SOC) Ltd. 11.99% MORE INFO: www.sharedata.co.za/sdo/jse/TBS

Anglo American 7.96% COMPANY SECRETARY: Kgosi Monaisa

Allan Gray (Pty) Ltd. 5.01% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 1521, Saxonwold, 2132 SPONSOR: JP Morgan Equities South Africa Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/TGA AUDITORS: Deloitte & Touche Inc.

COMPANY SECRETARY: Altovise Alaxa Ellis CAPITAL STRUCTURE Authorised Issued

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TBS Ords 10c ea 250 000 000 175 765 055

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd. (SA))

AUDITORS: PwC Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE Authorised Issued Ords 10c ea Ldt Pay Amt

415.00

TGA Ords no par value 10 000 000 000 140 492 585 Interim No 159 1 Jul 25 7 Jul 25 1216.00

Special No 3

1 Jul 25

7 Jul 25

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul25 Avg 2m shares p.w., R665.6m(71.8% p.a.)

Ords no par value Ldt Pay Amt

Final No 7 22 Apr 25 29 Apr 25 1100.00 TIGBRANDS 40 Week MA FOOD

Interim No 6 17 Sep 24 23 Sep 24 200.00 35000

LIQUIDITY: Jul25 Avg 3m shares p.w., R359.5m(119.2% p.a.) 30000

THUNGELA 40 Week MA OILP 25000

40000

35000

20000

30000

25000 15000

20000

10000

15000 2021 2022 2023 2024 2025

10000

FINANCIAL STATISTICS

5000 Mar 25 Sep 24 Sep 23 Sep 22 Sep 21

0 (R million)

2022 2023 2024 2025 Interim Final(rst) Final Final(rst) Final(rst)

Turnover 18 482 35 128 37 389 34 029 30 954

FINANCIAL STATISTICS Op Inc 1 773 3 136 3 075 3 415 2 081

Dec 24 Dec 23 Dec 22 Dec 21 NetIntPd(Rcvd) 22 274 220 52 36

(R million)

Final Final Final Final Minority Int 19 29 37 31 29

Turnover 35 554 30 634 50 753 26 282 Att Inc 2 097 3 029 2 697 2 865 1 893

Op Inc 4 404 6 897 28 333 8 538 TotCompIncLoss 2 152 2 764 3 146 2 802 1 592

NetIntPd(Rcvd) - 894 - 696 - 49 - Fixed Ass 5 940 6 108 6 102 5 817 5 572

Minority Int - 48 - 192 1 217 509 Inv & Loans 941 603 616 2 987 3 047

Att Inc 3 592 5 162 16 988 6 429 Tot Curr Ass 17 971 13 303 12 922 12 196 11 198

TotCompIncLoss 3 164 5 141 18 261 6 896 Ord SH Int 18 614 17 979 17 104 15 609 15 613

Fixed Ass 19 722 19 477 10 656 10 568 Minority Int 244 217 201 142 147

Inv & Loans 3 748 2 499 1 981 323 LT Liab 683 925 1 772 890 1 146

Tot Curr Ass 18 777 19 642 23 798 16 374 Tot Curr Liab 8 791 7 338 6 761 7 436 5 984

Ord SH Int 25 560 24 609 26 273 16 573 PER SHARE STATISTICS (cents per share)

Minority Int 544 - 13 - 114 1 901 HEPS-C (ZARc) 1 021.10 1 743.20 1 734.70 1 702.40 1 127.30

LT Liab 13 775 13 203 9 067 8 550 DPS (ZARc) 1 631.00 1 034.00 991.00 973.00 826.00

Tot Curr Liab 8 198 8 687 5 349 4 261 NAV PS (ZARc) 10 426.14 9 970.00 9 484.77 8 655.84 8 225.42

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.44 0.39 0.24 0.02 0.04

HEPS-C (ZARc) 2 559.00 3 497.00 13 082.00 6 657.00 Price High 29 876 24 995 22 958 19 934 22 873

DPS (ZARc) 1 300.00 2 000.00 10 000.00 1 800.00 Price Low 23 180 13 676 14 754 13 427 17 550

NAV PS (ZARc) 18 193.13 17 516.23 18 700.63 12 158.15 Price Prd End 27 788 23 300 15 345 16 944 18 727

3 Yr Beta - 0.33 - - - RATIOS

Price High 15 682 28 666 38 249 10 246 Ret on SH Fnd 22.44 16.80 15.80 18.38 12.19

Price Low 10 020 12 350 8 340 2 066 Oper Pft Mgn 9.59 8.93 8.22 10.03 6.72

Price Prd End 13 369 15 380 28 666 8 454 D:E 0.07 0.10 0.15 0.13 0.08

RATIOS Current Ratio 2.04 1.81 1.91 1.64 1.87

Ret on SH Fnd 13.58 20.21 69.59 37.56 Div Cover 0.83 1.88 1.74 1.81 1.38

Oper Pft Mgn 12.39 22.51 55.83 32.49

D:E 0.53 0.54 0.35 0.47

Current Ratio 2.29 2.26 4.45 3.84

Div Cover 2.06 1.88 1.27 3.39

203