Page 208 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 208

JSE - TRU Profile’s Stock Exchange Handbook: 2025 - Issue 3

Trustco Group Holdings Ltd. Truworths International Ltd.

SUSPENDED COMPANY ISIN: ZAE000028296 SHORT: TRUWTHS CODE: TRU

ISIN: NA000A0RF067 SHORT: TRUSTCO CODE: TTO REG NO: 1944/017491/06 FOUNDED: 1944 LISTED: 1998

REG NO: 2003/058 FOUNDED: 1992 LISTED: 2009 NATURE OF BUSINESS: Truworths International Ltd. is an investment

NATURE OF BUSINESS: Trustco is a diversified, triple listed majority holding and management company based in Cape Town, South

family owned investment group with a culture of creating Africa. The main operating companies, Truworths Ltd. (Truworths,

long-term sustainable growth for all stakeholders. Decisions operating primarily in South Africa) and Office Holdings Ltd.

are biased towards long-term value creation and short-term (Office, operating primarily in the United Kingdom) are leading

hurdles are viewed as catalysts to drive success. The company retailers of fashion clothing, footwear, homeware, and related

primarily invests in high quality, world class assets in the financial merchandise. The company listed on the JSE and the Namibia

services and resources industries. Trustco’s business purpose is Securities Exchange in 1998, and on A2X Markets in 2022.

sustainable, medium- to long-term wealth creation through capital SECTOR: ConsDiscr--Retail--Retailers--ApparelRetailers

appreciation and investment income for our stakeholders on a per NUMBER OF EMPLOYEES: 12 007

share basis, which aligns with our objectives of being a long-term DIRECTORS: Deegan B (ind ne), Dow R G (ind ne), Earp D (ind ne),

but not permanent investor Hawinkels H (ld ind ne), Mokgabudi T (ind ne), Mosololi T F (ind ne),

SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs-- DiversFinServcs Motsepe D R (ind ne), Muller W (ind ne), Sparks R J A (ind ne),

NUMBER OF EMPLOYEES: 567 Taylor T (ind ne), Saven H (Chair, ind ne), Mark M S (CEO),

DIRECTORS: Geyser W J (ind ne, Namb), Taljaard R J (ind ne, Namb), Cristaudo E (Deputy CEO), Proudfoot S (Deputy CEO)

van den Heever J (ind ne, Namb), Heathcote Adv R (Chair, ind ne, MAJOR ORDINARY SHAREHOLDERS as at 10 Jul 2025

Namb), van Rooyen Dr Q (CEO, Namb), van Rooyen Q Z (Deputy CEO, Public Investment Corporation SOC Ltd. 17.10%

alt, Namb), Abrahams F J (FD, Namb) Ninety One SA (Pty) Ltd. 8.90%

POSTAL ADDRESS: PO Box 11363, Windhoek, Namibia Sanlam Investments 5.05%

MORE INFO: www.sharedata.co.za/sdo/jse/TTO POSTAL ADDRESS: PO Box 600, Cape Town, 8000

COMPANY SECRETARY: Komada Holdings (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/TRU

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: C Durham

SPONSOR: Vunani Corporate Finance TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: Nexia SAB&T Inc. SPONSOR: One Capital

AUDITORS: Deloitte & Touche Inc.

CAPITAL STRUCTURE Authorised Issued

TTO Ords NAD0.23c ea 2 500 000 000 1 192 174 774 CAPITAL STRUCTURE Authorised Issued

TRU Ords 0.015c ea 650 000 000 408 498 899

DISTRIBUTIONS [NADc]

Ords NAD0.23c ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 12 26 Jul 16 22 Aug 16 5.00 Ords 0.015c ea Ldt Pay Amt

Interim No 11 20 Nov 15 8 Dec 15 3.40 Interim No 54 17 Mar 25 24 Mar 25 317.00

197.00

7 Oct 24

Final No 53

1 Oct 24

LIQUIDITY: Jul25 Avg 199 335 shares p.w., R70 980.3(0.9% p.a.)

LIQUIDITY: Jul25 Avg 9m shares p.w., R746.5m(110.7% p.a.)

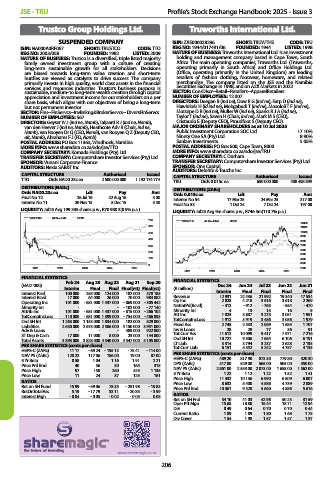

TRUSTCO 40 Week MA GENF

700

TRUWTHS 40 Week MA GERE

12000

600 11000

500 10000

9000

400

8000

300 7000

6000

200

5000

100 4000

0 3000

2021 2022 2023 2024 2025 2000

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

Feb 24 Aug 23 Aug 22 Aug 21 Sep 20 FINANCIAL STATISTICS

(NAD ’000) Interim Final Final Final(rst) Final(rst) (R million) Dec 24 Jun 24 Jul 23 Jun 22 Jun 21

Interest Paid 100 000 255 000 124 000 182 000 378 185 Interim Final Final Final Final

Interest Rcvd 17 000 64 000 26 000 70 000 984 882 Revenue 12 931 22 436 21 992 19 340 17 534

Operating Inc 101 000 - 681 000 1 437 000 - 869 000 - 305 442 Op Inc 2 028 4 218 3 616 3 618 2 269

Minority Int - - - - 102 000 - 77 140 NetIntPd(Rcvd) - 412 - 912 - 765 - 554 - 470

Attrib Inc 101 000 - 681 000 1 437 000 - 815 000 - 266 102 Minority Int 4 13 13 16 5

TotCompIncLoss 110 000 - 681 000 1 399 000 - 754 000 - 466 893 Att Inc 1 825 3 887 3 275 3 051 1 951

Ord SH Int 1 263 000 1 153 000 1 834 000 182 000 829 000 TotCompIncLoss 1 912 3 919 3 486 3 056 1 979

Liabilities 2 630 000 2 675 000 2 506 000 4 150 000 3 951 000 Fixed Ass 2 745 2 533 2 069 1 685 1 707

Adv & Loans - - - 489 000 922 000 Inv & Loans 28 28 77 36 91

ST Dep & Cash 17 000 11 000 8 000 23 000 144 000 Tot Curr Ass 11 612 10 099 9 417 7 971 7 216

Total Assets 3 893 000 3 828 000 4 340 000 4 547 000 5 105 000 Ord SH Int 10 727 9 506 7 654 6 106 6 191

PER SHARE STATISTICS (cents per share) LT Liab 3 314 3 794 3 237 2 628 2 195

5 242

5 352

6 151

4 135

Tot Curr Liab

4 757

HEPS-C (ZARc) 11.17 - 69.24 - 195.13 - 75.41 - 114.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 128.22 117.06 186.00 19.00 87.00

3 Yr Beta 0.58 1.04 1.16 1.91 2.21 HEPS-C (ZARc) 489.20 817.90 873.30 779.80 520.30

Price Prd End 40 56 50 165 315 DPS (ZARc) 317.00 529.00 565.00 505.00 350.00

Price High 97 150 260 425 1 135 NAV PS (ZARc) 2 861.00 2 553.00 2 073.00 1 658.00 1 562.00

3 Yr Beta

1.22

1.41

1.52

1.22

1.12

Price Low 11 24 37 125 161 Price High 11 432 10 136 6 990 6 809 6 007

RATIOS Price Low 8 632 5 400 4 586 4 739 2 889

Ret on SH Fund 15.99 - 59.06 78.35 - 251.98 - 19.83 Price Prd End 10 361 9 328 5 660 4 886 5 616

RetOnTotalAss 5.19 - 17.79 33.11 - 20.85 - 3.99

Interest Mgn - 0.04 - 0.05 - 0.02 - 0.03 0.08 RATIOS

Ret on SH Fnd 34.10 41.03 42.96 50.23 31.59

Oper Pft Mgn 15.68 18.80 16.44 18.71 12.94

D:E 0.49 0.64 0.70 0.70 0.44

Current Ratio 1.89 1.89 1.80 1.68 1.75

Div Cover 1.54 1.98 1.57 1.57 1.37

206