Page 204 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 204

JSE - TEX Profile’s Stock Exchange Handbook: 2025 - Issue 3

Texton Property Fund Ltd. Tharisa plc

ISIN: ZAE000190542 SHORT: TEX CODE: TEX ISIN: CY0103562118 SHORT: THARISA CODE: THA

REG NO: 2005/019302/06 FOUNDED: 2011 LISTED: 2011 REG NO: HE223412 FOUNDED: 2006 LISTED: 2014

NATURE OF BUSINESS: Texton is a JSE-listed Real Estate Investment NATURE OF BUSINESS: Tharisa is an integrated resource group

Trust (“REIT”) that offers shareholders direct access to its high- critical to the energy transition and decarbonisation of economies. It

quality property portfolio. Texton’s portfolio is valued at R2.1 billion incorporates mining, processing, exploration and the beneficiation,

as at 30 June 2024 (2023: R2.2 billion) and aims to deliver long- marketing, sales, and logistics of Platinum Group Metals (PGMs) and

term income and capital growth. Texton is focused on investing in chrome concentrates, using innovation and technology as enablers.

high-quality properties in centralised nodes in both SA and the UK The Company is committed to reducing its carbon emissions by

across office, industrial and retail properties. 30% by 2030 and the development of a roadmap to become net

SECTOR: RealEstate--RealEstate--REITS--Office carbon neutral by 2050.

NUMBER OF EMPLOYEES: 19 SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--General

DIRECTORS: Franco R A (ne), Hannington A J (snr ind ne), Mining

van der Vent W C (ind ne), Golding M J A (Chair, ne), Rens J (CEO), NUMBER OF EMPLOYEES: 4 879

Welleman H S P (CFO), Macey J (ld ind ne) DIRECTORS: Bell C (ld ind ne), Chen H (ne), Davey R (ind ne, UK),

MAJOR ORDINARY SHAREHOLDERS as at 14 Feb 2025 Kamal O M (ind ne), Lo S W M (ne, China), Salter Dr J D (ld ind ne, UK),

Oak Tech Trading (Pty) Ltd. 29.45% Zvaravanhu G (ind ne), Pouroulis L C (Chair), Pouroulis P (CEO),

Thibault REIT Ltd. 22.77% Jones M G (CFO)

Kloof Capital South Africa (Pty) Ltd. 14.30% MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024

POSTAL ADDRESS: PO Box 653129, Benmore, 2010 Medway Developments Ltd. 40.75%

MORE INFO: www.sharedata.co.za/sdo/jse/TEX Rance Holdings Ltd. 12.73%

COMPANY SECRETARY: CorpStat Governance Services (Pty) Ltd. Fujian Wuhang Stainless Steel Co Ltd. 8.84%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 62425, Paphos, Cyprus, 8064

SPONSOR: Investec Bank Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/THA

AUDITORS: BDO South Africa Inc. COMPANY SECRETARY: Lysandros Lysandrides, Sanet Findlay

CAPITAL STRUCTURE Authorised Issued TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TEX Ords of no par 2 000 000 000 330 059 664 SPONSOR: Investec Bank Ltd.

AUDITORS: BDO Cyprus

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE Authorised Issued

Ords of no par Ldt Pay Amt THA Ords USD0.001 10 000 000 000 302 596 743

Share Premium No 1 20 May 25 26 May 25 79.87

Special No 1 20 May 25 26 May 25 20.13 DISTRIBUTIONS [USDc]

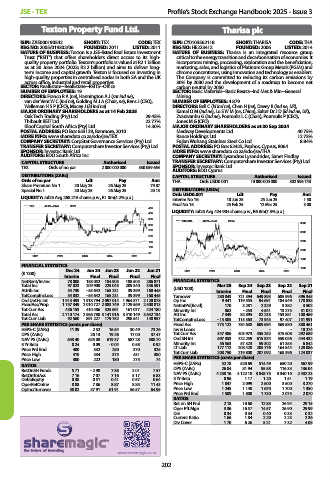

LIQUIDITY: Jul25 Avg 268 215 shares p.w., R1.0m(4.2% p.a.) Ords USD0.001 Ldt Pay Amt

Interim No 16 10 Jun 25 25 Jun 25 1.50

TEX 40 Week MA REIV Final No 15 25 Feb 25 12 Mar 25 3.00

450

LIQUIDITY: Jul25 Avg 424 904 shares p.w., R6.8m(7.3% p.a.)

400

350

THARISA 40 Week MA INDM

3500

300

250 3000

200

2500

150

100

2000

50

2021 2022 2023 2024 2025

1500

FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 2021 2022 2023 2024 2025 1000

(R ’000)

Interim Final Final Final Final

NetRent/InvInc 78 008 158 052 184 905 188 505 286 871 FINANCIAL STATISTICS

Total Inc 97 023 209 900 225 045 209 340 346 591 Mar 25 Sep 24 Sep 23 Sep 22 Sep 21

Attrib Inc 54 730 - 55 642 165 231 39 399 160 445 (USD ’000) Interim Final Final Final Final

TotCompIncLoss 54 832 - 55 642 165 231 39 399 160 445 Turnover 280 843 721 394 649 893 685 996 596 345

Ord UntHs Int 1 913 493 1 918 794 2 097 014 1 964 371 2 120 078 Op Inc 9 441 119 555 94 691 184 549 178 838

FixedAss/Prop 1 757 349 2 010 727 2 083 749 2 129 569 2 508 813 NetIntPd(Rcvd) 170 3 281 2 329 3 382 3 502

Tot Curr Ass 436 153 410 486 325 691 161 077 424 180 Minority Int 862 - 253 4 541 13 275 31 072

Total Ass 2 710 174 2 966 788 3 141 916 3 410 149 3 642 134 Att Inc 7 349 82 895 82 235 153 881 100 469

Tot Curr Liab 92 560 891 227 179 752 298 541 148 957 TotCompIncLoss - 15 385 115 363 73 945 97 407 151 991

PER SHARE STATISTICS (cents per share) Fixed Ass 773 122 784 638 609 694 569 580 380 461

HEPS-C (ZARc) 11.39 2.52 16.54 30.49 73.26 Inv & Loans - - - - 10 274

DPS (ZARc) - 20.13 19.26 17.00 37.47 Tot Curr Ass 347 486 403 973 455 252 375 608 292 689

NAV PS (ZARc) 643.40 625.08 619.37 587.28 588.70 Ord SH Int 697 353 722 259 615 874 559 026 444 432

3 Yr Beta 0.24 0.09 - 0.04 0.58 0.92 Minority Int 56 563 57 323 59 302 61 355 6 842

Price Prd End 400 332 250 370 325 LT Liab 177 112 208 420 205 776 164 544 128 086

168 396

219 800

208 750

124 037

207 092

Tot Curr Liab

Price High 410 334 375 431 380

Price Low 300 222 180 275 74 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 52.78 520.69 514.49 650.20 567.99

RetOnSH Funds 5.71 - 2.90 7.88 2.01 7.57 DPS (ZARc) 26.84 81.94 95.58 116.33 136.04

RetOnTotAss 7.16 7.07 7.16 5.17 6.83 NAV PS (ZARc) 4 238.16 4 122.18 3 848.75 3 340.10 2 432.23

Debt:Equity 0.38 0.51 0.41 0.57 0.64 3 Yr Beta 0.96 1.17 1.20 1.51 1.19

OperRetOnInv 8.88 7.86 8.87 8.85 11.43 Price High 1 847 2 099 2 600 3 500 3 270

OpInc:Turnover 58.02 57.91 61.91 56.57 64.95 Price Low 1 245 1 140 1 670 1 700 1 350

Price Prd End 1 509 1 800 1 730 2 075 2 070

RATIOS

Ret on SH Fnd 2.18 10.60 12.85 26.94 29.15

Oper Pft Mgn 3.36 16.57 14.57 26.90 29.99

D:E 0.34 0.34 0.40 0.33 0.32

Current Ratio 1.66 1.84 2.20 2.23 2.36

Div Cover 1.70 6.26 5.21 7.32 4.08

202