Page 201 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 201

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - SUN

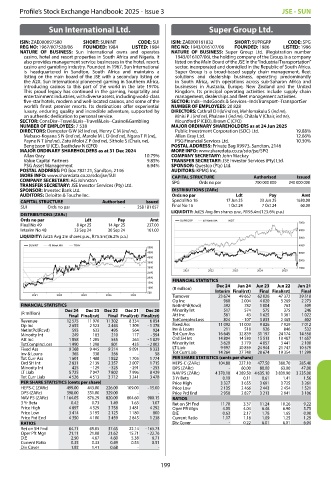

Sun International Ltd. Super Group Ltd.

ISIN: ZAE000097580 SHORT: SUNINT CODE: SUI ISIN: ZAE000161832 SHORT: SUPRGRP CODE: SPG

REG NO: 1967/007528/06 FOUNDED: 1984 LISTED: 1984 REG NO: 1943/016107/06 FOUNDED: 1986 LISTED: 1996

NATURE OF BUSINESS: Sun International owns and operates NATURE OF BUSINESS: Super Group Ltd. (Registration number

casino, hotel and resort properties in South Africa and Nigeria. It 1943/016107/06), the holding company of the Group, is a company

also provides management service businesses in the hotel, resort, listed on the Main Board of the JSE in the “Industrial Transportation”

casino and gambling industry. Founded in 1967, Sun International sector, incorporated and domiciled in the Republic of South Africa.

is headquartered in Sandton, South Africa and maintains a Super Group is a broad-based supply chain management, fleet

listing on the main board of the JSE with a secondary listing on solutions and dealership business, operating predominantly

the A2X. Sun International pioneered gaming in Southern Africa, in South Africa, with operations across sub-Saharan Africa and

introducing casinos to this part of the world in the late 1970s. businesses in Australia, Europe, New Zealand and the United

This proud legacy has continued in the gaming, hospitality and Kingdom. Its principal operating activities include supply chain

entertainment industries, with diverse assets, including world-class management, dealerships and fleet management activities.

five-star hotels, modern and well-located casinos, and some of the SECTOR: Inds--IndsGoods & Services--IndsTransport--TransportSer

world’s finest premier resorts. Its destinations offer experiential NUMBER OF EMPLOYEES: 20 828

luxury, enduring quality and incredible adventure, supported by DIRECTORS: Cathrall D I (ld ind ne), Mehlomakulu S (ind ne),

an authentic dedication to personal service. Mnisi P J (ind ne), Phalane J (ind ne), Chitalu V (Chair, ind ne),

SECTOR: ConsDisr--Travel&Leis--Travel&Leis--Casino&Gambling Mountford P (CEO), Brown C (CFO)

NUMBER OF EMPLOYEES: 7 538 MAJOR ORDINARY SHAREHOLDERS as at 24 Jun 2025

DIRECTORS: Dempster G W (ld ind ne), Henry C M (ind ne), Public Investment Corporation (SOC) Ltd. 19.88%

Mabaso-Koyana S N (ind ne), Marole M L D (ind ne), Ngara T R (ne), Allan Gray Ltd. 12.66%

Payne N T (ind ne), Zatu Moloi Z P (ind ne), Sithole S (Chair, ne), PSG Financial Services Ltd. 10.30%

Bengtsson U (CE), Basthdaw N (CFO) POSTAL ADDRESS: Private Bag X9973, Sandton, 2146

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 MORE INFO: www.sharedata.co.za/sdo/jse/SPG

Allan Gray 10.79% COMPANY SECRETARY: John Mackay

Value Capital Partners 9.85% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

PSG Asset Management 6.94% SPONSOR: Questco (Pty) Ltd.

POSTAL ADDRESS: PO Box 782121, Sandton, 2146 AUDITORS: KPMG Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/SUI CAPITAL STRUCTURE Authorised Issued

COMPANY SECRETARY: AG Johnston SPG Ords no par 700 000 000 340 000 000

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: Deloitte & Touche Inc. Ords no par Ldt Pay Amt

CAPITAL STRUCTURE Authorised Issued Special No 16 17 Jun 25 23 Jun 25 1630.00

SUI Ords no par - 258 181 057 Final No 15 1 Oct 24 7 Oct 24 60.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul25 Avg 8m shares p.w., R195.4m(123.6% p.a.)

Ords no par Ldt Pay Amt SUPRGRP 40 Week MA INDT

Final No 49 8 Apr 25 14 Apr 25 237.00 7000

Interim No 48 23 Sep 24 30 Sep 24 161.00 6000

LIQUIDITY: Jul25 Avg 2m shares p.w., R75.5m(36.2% p.a.) 5000

SUNINT 40 Week MA TRAV 4000

5000

4500 3000

4000

2000

3500

3000 1000

2021 2022 2023 2024 2025

2500

2000

1500 FINANCIAL STATISTICS Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

1000 (R million)

500 Interim Final(rst) Final Final(rst) Final

2021 2022 2023 2024 2025 Turnover 23 674 49 662 62 026 47 372 39 518

Op Inc 960 2 004 4 020 3 269 2 273

FINANCIAL STATISTICS NetIntPd(Rcvd) 392 782 1 004 763 509

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 Minority Int 517 574 575 375 246

(R million) Att Inc 561 43 1 625 1 361 1 022

Final Final(rst) Final Final(rst) Final(rst)

Revenue 12 575 11 970 11 302 8 334 6 054 TotCompIncLoss 824 - 107 3 833 2 465 402

Op Inc 2 655 2 523 2 443 1 309 - 1 378 Fixed Ass 11 092 11 003 9 826 7 929 7 012

NetIntPd(Rcvd) 593 633 495 564 924 Inv & Loans 211 518 926 846 532

Minority Int 249 183 210 117 - 594 Tot Curr Ass 16 645 32 839 31 197 24 174 14 558

Att Inc 1 858 1 205 555 263 - 1 829 Ord SH Int 14 804 14 530 15 513 13 487 11 657

TotCompIncLoss 1 990 1 298 801 435 - 2 002 Minority Int 3 629 3 779 4 057 3 441 2 100

Fixed Ass 9 268 9 445 9 214 9 091 9 333 LT Liab 9 997 30 839 24 944 21 747 10 579

Inv & Loans 365 338 356 - 58 Tot Curr Liab 14 264 27 748 28 674 19 354 11 299

Tot Curr Ass 1 601 1 488 1 822 1 705 1 774 PER SHARE STATISTICS (cents per share)

Ord SH Int 2 831 2 139 2 357 2 007 1 715 HEPS-C (ZARc) 104.80 227.10 477.50 380.70 285.40

Minority Int 425 - 129 - 325 - 291 - 253 DPS (ZARc) - 60.00 80.00 63.00 47.00

LT Liab 5 725 7 047 7 802 7 996 8 429 NAV PS (ZARc) 4 370.10 4 289.50 4 635.10 3 839.90 3 235.00

Tot Curr Liab 4 526 4 513 3 712 3 241 3 478 3 Yr Beta 0.19 0.11 0.61 1.41 1.56

PER SHARE STATISTICS (cents per share) Price High 3 327 3 655 3 691 3 725 3 261

HEPS-C (ZARc) 499.00 443.00 226.00 109.00 - 15.00 Price Low 2 135 2 466 2 443 2 454 1 521

DPS (ZARc) 398.00 351.00 329.00 - - Price Prd End 2 950 2 827 3 213 2 941 3 106

NAV PS (ZARc) 1 164.05 876.29 820.00 804.60 980.15 RATIOS

3 Yr Beta 0.42 0.73 1.49 1.63 1.07 Ret on SH Fnd 11.70 3.37 11.24 10.26 9.22

Price High 4 897 4 529 3 758 3 481 4 292 Oper Pft Mgn 4.05 4.04 6.48 6.90 5.75

Price Low 3 414 3 195 2 125 1 180 800 D:E 0.63 2.17 1.78 1.65 0.90

Price Prd End 4 350 4 100 3 459 2 845 1 238 Current Ratio 1.17 1.18 1.09 1.25 1.29

RATIOS Div Cover - 0.22 6.01 6.01 6.04

Ret on SH Fnd 64.71 69.05 37.65 22.14 - 165.73

Oper Pft Mgn 21.11 21.08 21.62 15.71 - 22.76

D:E 2.50 4.67 4.60 5.38 6.71

Current Ratio 0.35 0.33 0.49 0.53 0.51

Div Cover 1.92 1.41 0.68 - -

199