Page 202 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 202

JSE - SUP Profile’s Stock Exchange Handbook: 2025 - Issue 3

Supermarket Income REIT plc Sygnia Ltd.

ISIN: GB00BF345X11 SHORT: SUPR CODE: SRI ISIN: ZAE000208815 SHORT: SYGNIA CODE: SYG

REG NO: 24/10799126 FOUNDED: 2017 LISTED: 2024 REG NO: 2007/025416/06 FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Supermarket Income REIT plc (SUPR) is a NATURE OF BUSINESS: Sygnia is a financial services group based

United Kingdom-based Real Estate Investment Trust (REIT) and a in South Africa and the United Kingdom and is listed on the

leading investor in omnichannel supermarket properties across Johannesburg Stock Exchange and the A2X exchange. The Group

the United Kingdom (UK) and France. SUPR invests in supermarket focuses on the provision of investment management solutions and

properties forming a key part of the future model of grocery. administration services to institutional and retail clients located

SUPR’s core UK grocery market has grown by 35% since SUPR listed predominantly in South Africa.

on the LSE, from GBP185 billion in 2017 to GBP252 billion in 2024. SECTOR: Fins--FinServcs--InvBnkng&BrokerServcs--AssMgrs&Custodians

SECTOR: RealEstate--RealEstate--REITS--Retail NUMBER OF EMPLOYEES: 337

NUMBER OF EMPLOYEES: 0 DIRECTORS: Boyd J (ind ne), Cavaleros G (ld ind ne), Corelli J, Jakoet A

DIRECTORS: Austen J, Blundell R (ne), Davies F, Prior V, Shah S (ne), (ind ne), Bhorat H I (Chair, ne), Wierzycka M F (CEO), Ismail R (CFO)

Vanderspar C, Hewson N (Chair, ind ne), Abraham R (CEO), Perkins MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2024

M (CFO) Sapayoa Investments (Pty) Ltd. 29.98%

MAJOR ORDINARY SHAREHOLDERS as at 26 Mar 2025 SJB Peile 29.26%

Schroders plc 5.08% Clifford Street Holdings Ltd. 6.90%

BlackRock Inc. 5.00% POSTAL ADDRESS: PO Box 51591, Waterfront, 8002

Ameriprise Financial Inc. 4.70% MORE INFO: www.sharedata.co.za/sdo/jse/SYG

POSTAL ADDRESS: The Scalpel, 18th Floor, 52 Lime Street, London, COMPANY SECRETARY: Leanne van Wyk

United Kingdom, EC3M 7AF TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/SRI SPONSOR: Standard Bank of South Africa Ltd.

COMPANY SECRETARY: Hanway Advisory Ltd. AUDITORS: Forvis Mazars

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

SPONSOR: PSG Capital (Pty) Ltd. SYG Ords no par value 500 000 000 155 545 696

AUDITORS: BDO LLP

CAPITAL STRUCTURE Authorised Issued DISTRIBUTIONS [ZARc]

Pay

Ldt

Amt

SRI Ords of GBP1p ea - 1 246 239 185 Ords no par value 24 Jun 25 30 Jun 25 98.00

Interim No 20

DISTRIBUTIONS [GBPp] Final No 19 20 Dec 24 30 Dec 24 127.00

Ords of GBP1p ea Ldt Pay Amt LIQUIDITY: Jul25 Avg 337 068 shares p.w., R7.8m(11.3% p.a.)

Final No 3 22 Jul 25 22 Aug 25 1.53

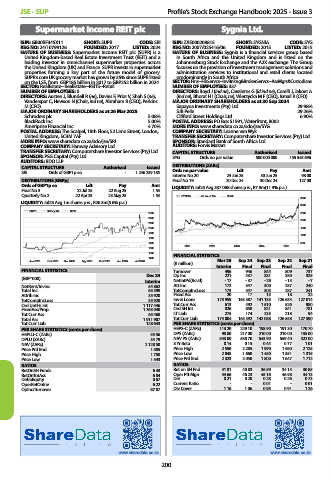

Quarterly No 2 22 Apr 25 23 May 25 1.53 SYGNIA 40 Week MA GENF

3500

LIQUIDITY: Jul25 Avg 1m shares p.w., R26.3m(5.6% p.a.)

3000

SUPR 80 Day MA REIV

2300 2500

2200

2000

2100

2000 1500

1900

1000

1800

1700 500

2021 2022 2023 2024 2025

1600

1500

1400 FINANCIAL STATISTICS

Jan 2025 Feb 2025 Mar 2025 Apr 2025 May 2025 Jun 2025 Jul 2025 Mar 25 Sep 24 Sep 23 Sep 22 Sep 21

(R million) Interim Final Final Final Final

FINANCIAL STATISTICS Turnover 496 946 844 809 737

Dec 24 Op Inc 221 437 381 380 325

(GBP ‘000)

Interim NetIntPd(Rcvd) - 17 - 37 - 29 - 15 - 7

NetRent/InvInc 54 862 Att Inc 172 347 300 287 240

Total Inc 65 398 TotCompIncLoss 173 347 303 287 241

Attrib Inc 35 920 Fixed Ass 20 17 15 18 22

TotCompIncLoss 35 920 Inv & Loans 173 959 163 387 141 133 126 633 127 014

Ord UntHs Int 1 117 446 Tot Curr Ass 613 492 1 510 526 980

FixedAss/Prop 1 763 040 Ord SH Int 826 850 821 841 781

Tot Curr Ass 65 460 LT Liab 275 174 233 218 94

Total Ass 1 911 907 Tot Curr Liab 174 004 163 392 142 088 126 558 127 590

Tot Curr Liab 128 643 PER SHARE STATISTICS (cents per share)

PER SHARE STATISTICS (cents per share) HEPS-C (ZARc) 113.20 229.10 198.90 191.30 170.70

HEPLU-C (ZARc) 55.56 DPS (ZARc) 98.00 217.00 210.00 210.00 135.00

DPLU (ZARc) 34.79 NAV PS (ZARc) 543.00 558.70 543.90 559.40 522.00

NAV (ZARc) 2 128.50 3 Yr Beta 0.14 0.15 0.44 0.77 1.01

Price Prd End 1 585 Price High 2 550 2 285 1 990 1 950 2 125

Price High 1 750 Price Low 2 045 1 660 1 450 1 351 1 315

Price Low 1 543 Price Prd End 2 323 2 050 1 800 1 647 1 712

RATIOS RATIOS

RetOnSH Funds 6.43 Ret on SH Fnd 41.81 40.83 36.59 34.15 30.85

RetOnTotAss 6.84 Oper Pft Mgn 44.66 46.23 45.16 46.98 44.13

Debt:Equity 0.67 D:E 0.21 0.20 0.28 0.26 0.73

OperRetOnInv 6.22 Current Ratio - - 0.01 - 0.01

OpInc:Turnover 87.87 Div Cover 1.16 1.06 0.95 0.91 1.26

www.sharedata.co.za www.sharedata.co.za

200