Page 206 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 206

JSE - TRA Profile’s Stock Exchange Handbook: 2025 - Issue 3

Transpaco Ltd. Trellidor Holdings Ltd.

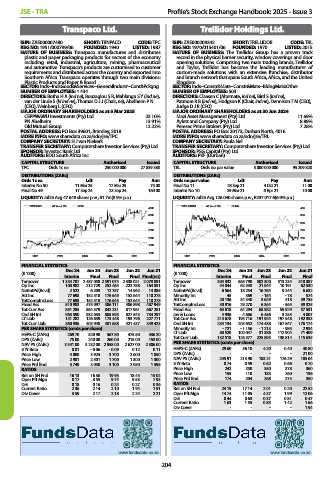

ISIN: ZAE000007480 SHORT: TRNPACO CODE: TPC ISIN: ZAE000209342 SHORT: TRELLIDOR CODE: TRL

REG NO: 1951/000799/06 FOUNDED: 1940 LISTED: 1987 REG NO: 1970/015401/06 FOUNDED: 1970 LISTED: 2015

NATURE OF BUSINESS: Transpaco manufactures and distributes NATURE OF BUSINESS: The Trellidor Group has a proven track

plastic and paper packaging products for sectors of the economy record in the physical barrier security, window coverings and door

including retail, industrial, agriculture, mining, pharmaceutical opening solutions. Comprising two main trading brands, Trellidor

and automotive. Transpaco’s products are customised to customer and Taylor, Trellidor has become the leading manufacturer of

requirements and distributed across the country and exported into custom-made solutions with an extensive franchise, distributor

Southern Africa. Transpaco operates through two main divisions: and branch network that spans South Africa, Africa, and the United

Plastic Products and Paper & Board. Kingdom.

SECTOR: Inds--IndsGoods&Services--GeneralIndustr--Cont&Pckgng SECTOR: Inds--Constr&Mats--Constr&Mats--BldngMats:Other

NUMBER OF EMPLOYEES: 1 434 NUMBER OF EMPLOYEES: 503

DIRECTORS: Botha H A (ind ne), Bouzaglou S R, Mahlangu S Y (ind ne), DIRECTORS: Claasen C (Alternate, ind ne), Bird S (ind ne),

van der Linde S (ld ind ne), Thomas D J J (Chair, ne), Abelheim P N Patmore R B (ind ne), Hodgson K (Chair, ind ne), Dennison T M (CEO),

(CEO), Weinberg L (CFO) Judge D J R (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 5 Mar 2025 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

CEPPWAWU Investments (Pty) Ltd. 23.10% Mazi Asset Management (Pty) Ltd. 11.69%

PN Abelheim 13.91% Aylett and Company (Pty) Ltd. 8.89%

Old Mutual Group 12.22% Peresec Prime Brokers (Pty) Ltd. 7.28%

POSTAL ADDRESS: PO Box 39601, Bramley, 2018 POSTAL ADDRESS: PO Box 20173, Durban North, 4016

MORE INFO: www.sharedata.co.za/sdo/jse/TPC MORE INFO: www.sharedata.co.za/sdo/jse/TRL

COMPANY SECRETARY: H J van Niekerk COMPANY SECRETARY: Paula Nel

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: BDO South Africa Inc. AUDITORS: PKF (Durban)

CAPITAL STRUCTURE Authorised Issued CAPITAL STRUCTURE Authorised Issued

TPC Ords 1c ea 250 000 000 27 839 388 TRL Ords no par value 5 000 000 000 95 209 820

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt Ords no par value Ldt Pay Amt

Interim No 50 11 Mar 25 17 Mar 25 75.00 Final No 11 28 Sep 21 4 Oct 21 11.00

Final No 49 17 Sep 24 23 Sep 24 160.00 Interim No 10 29 Mar 21 6 Apr 21 10.00

LIQUIDITY: Jul25 Avg 47 648 shares p.w., R1.7m(8.9% p.a.) LIQUIDITY: Jul25 Avg 126 040 shares p.w., R237 017.6(6.9% p.a.)

TRNPACO 40 Week MA GENI TRELLIDOR 40 Week MA CONM

4000 400

3500 350

3000 300

2500 250

2000 200

1500 150

1000 100

2021 2022 2023 2024 2025 2021 2022 2023 2024 2025

FINANCIAL STATISTICS FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

(R ’000) (R ’000)

Interim Final Final Final Final(rst) Interim Final Final Final Final

Turnover 1 334 707 2 487 058 2 591 074 2 338 021 2 078 891 Turnover 304 332 565 790 502 300 513 234 518 387

Op Inc 108 982 212 729 252 464 222 758 164 851 Op Inc 44 844 62 538 21 944 10 191 62 530

NetIntPd(Rcvd) 2 522 6 203 12 757 14 962 14 385 NetIntPd(Rcvd) 6 564 18 254 16 764 9 244 6 632

Att Inc 77 698 152 518 176 645 152 644 110 278 Minority Int 45 369 - 154 - 78 574

TotCompIncLoss 77 698 152 518 176 645 152 644 110 278 Att Inc 28 136 34 340 3 629 418 39 755

Fixed Ass 510 983 475 097 486 111 486 898 487 949 TotCompIncLoss 30 916 29 270 6 364 - 565 39 325

Tot Curr Ass 851 285 864 379 842 231 817 961 667 281 Fixed Ass 63 618 64 294 68 982 59 929 57 591

Ord SH Int 963 590 932 035 885 595 827 543 734 297 Inv & Loans 4 936 4 686 6 456 3 253 4 807

LT Liab 151 282 126 639 175 448 193 796 227 771 Tot Curr Ass 215 678 195 716 191 924 197 548 192 353

Tot Curr Liab 360 936 403 948 401 658 421 437 349 423 Ord SH Int 234 134 203 652 174 438 167 847 176 174

PER SHARE STATISTICS (cents per share) Minority Int - 721 - 1 156 - 1 213 - 985 2 934

HEPS-C (ZARc) 269.70 520.90 567.80 475.50 336.20 LT Liab 80 520 100 047 31 386 112 904 71 409

DPS (ZARc) 75.00 240.00 260.00 215.00 153.00 Tot Curr Liab 132 518 126 577 225 893 138 814 115 635

NAV PS (ZARc) 3 341.00 3 232.00 2 958.00 2 627.00 2 306.00 PER SHARE STATISTICS (cents per share)

3 Yr Beta 0.01 - 0.06 - 0.09 0.12 0.11 HEPS-C (ZARc) 29.60 36.10 4.20 0.40 40.80

Price High 4 000 3 925 3 700 2 600 1 850 DPS (ZARc) - - - - 21.00

Price Low 2 901 2 501 1 700 1 300 1 300 NAV PS (ZARc) 245.91 213.90 183.21 176.29 185.04

Price Prd End 3 749 3 050 3 100 2 050 1 598 3 Yr Beta 0.74 0.59 0.62 0.66 0.70

RATIOS Price High 242 250 350 378 360

Ret on SH Fnd 16.13 16.36 19.95 18.45 15.02 Price Low 155 110 183 260 136

Oper Pft Mgn 8.17 8.55 9.74 9.53 7.93 Price Prd End 174 204 268 275 350

D:E 0.18 0.16 0.24 0.27 0.36 RATIOS

Current Ratio 2.36 2.14 2.10 1.94 1.91 Ret on SH Fnd 24.15 17.14 2.01 0.20 22.52

Div Cover 3.59 2.17 2.18 2.24 2.21 Oper Pft Mgn 14.74 11.05 4.37 1.99 12.06

D:E 0.44 0.63 0.37 0.81 0.47

Current Ratio 1.63 1.55 0.85 1.42 1.66

Div Cover - - - - 1.94

www.fundsdata.co.za www.fundsdata.co.za

204