Page 146 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 146

JSE - MOM Profile’s Stock Exchange Handbook: 2025 - Issue 3

Momentum Group Ltd. Mondi plc

ISIN: ZAE000269890 SHORT: MOMENTUM CODE: MTM ISIN: GB00BMWC6P49 SHORT: MONDIPLC CODE: MNP

REG NO: 2000/031756/06 FOUNDED: 2000 LISTED: 2001 REG NO: 6209386 FOUNDED: 2007 LISTED: 2007

NATURE OF BUSINESS: The Momentum Group is one of South NATURE OF BUSINESS: Mondi is a global leader in packaging and

Africa’s largest diversified financial services companies, offering a paper, contributing to a better world by producing products that

diverse range of services including protection (life and non-life), are sustainable by design. We employ 24 000 people in more than

investment, long-term savings and healthcare administration 30 countries and operate an integrated business with expertise

through specialised and empowered businesses under the brands spanning the entire value chain, enabling us to offer our customers

Momentum, Metropolitan and Guardrisk. The Group is listed on a broad range of innovative solutions for consumer and industrial

the JSE with additional listings on A2X financial markets and the end-use applications. Sustainability is at the centre of our strategy,

Namibia Securities Exchange. with our ambitious commitments to 2030 focused on circular

SECTOR: Fins--Insurance--Life Insurance--Life Insurance driven solutions, created by empowered people, taking action on

NUMBER OF EMPLOYEES: 15 821 climate.

DIRECTORS: Marais J (Group CEO), de Beer L (ind ne), Dunkley N J (ind ne), SECTOR: Inds--IndsGoods&Services--GeneralIndustr--Cont&Pckgng

Gobalsamy T (ind ne), Jurisich Prof S (ind ne), Leautier Dr F (ind ne, Tzn), NUMBER OF EMPLOYEES: 24 000

Matlakala P (ind ne), Mbethe D M, Meyer H P (ne), Park D J (ind ne), DIRECTORS: Brandtzaeg S R (ind ne), Clark S (snr ind ne), Govil S (ind ne),

Rapeti S (ind ne), Sieberhagen J J (ind ne), Soondarjee T D (ind ne), Groth A (ind ne), Macozoma S (ind ne), Strank Dame A (ind ne), Yea P

Baloyi P C (Chair, ind ne), Cooper P Acting Chair, ind ne), (Chair, ind ne), King A (CEO), Young S (Sen Deputy Gvnr, ind ne, UK),

Ketola R (Group CFO) Powell M (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Oct 2024 MAJOR ORDINARY SHAREHOLDERS as at 10 Jun 2025

Public Investment Corporation SOC Ltd. 15.70% Public Investment Corporation SOC Ltd. 9.94%

Government Employees Pension Fund 15.15% BlackRock, Inc. 7.06%

Allan Gray (Pty) Ltd. 10.02% Coronation Fund Managers 7.01%

POSTAL ADDRESS: PO Box 7400, Centurion, 0046 POSTAL ADDRESS: Ground Floor, Building 5, The Heights,

MORE INFO: www.sharedata.co.za/sdo/jse/MTM Brooklands, Weybridge, Surrey, United Kingdom, KT13 0NY

COMPANY SECRETARY: Gcobisa Tyusha MORE INFO: www.sharedata.co.za/sdo/jse/MNP

TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd. COMPANY SECRETARY: Jenny Hampshire

SPONSOR: Merrill Lynch SA (Pty) Ltd. t/a BofA Securities TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

AUDITORS: Ernst & Young Inc. SPONSOR: Merrill Lynch SA (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued AUDITORS: PwC LLP

MTM Ords 0.0001c ea 2 000 000 000 1 362 044 968 CAPITAL STRUCTURE Authorised Issued

DISTRIBUTIONS [ZARc] MNP Ords EUR 20c ea 3 177 608 605 441 412 530

Ords 0.0001c ea Ldt Pay Amt DISTRIBUTIONS [EURc]

Interim No 44 8 Apr 25 14 Apr 25 85.00 Ords EUR 20c ea Ldt Pay Amt

Final No 43 15 Oct 24 21 Oct 24 65.00 Final No 36 1 Apr 25 16 May 25 46.67

LIQUIDITY: Jul25 Avg 18m shares p.w., R546.4m(69.3% p.a.) Interim No 35 20 Aug 24 27 Sep 24 23.33

LIQUIDITY: Jul25 Avg 4m shares p.w., R1 196.0m(47.3% p.a.)

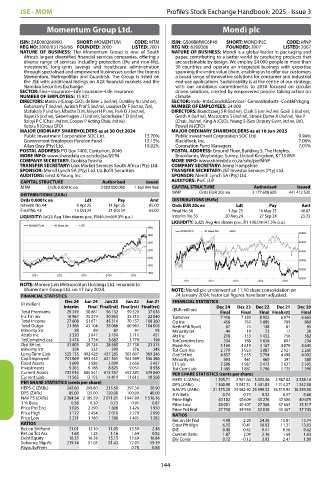

MOMENTUM 40 Week MA LIFE

4000

MONDIPLC 40 Week MA GENI 50000

3500

3000 45000

2500 40000

2000

35000

1500

30000

1000

2021 2022 2023 2024 2025

25000

2021 2022 2023 2024 2025

NOTE: Momentum Metropolitan Holdings Ltd. renamed to

Momentum Group Ltd. on 17 July 2024. NOTE: Mondi plc underwent an 11:10 share consolidation on

FINANCIAL STATISTICS 24 January 2024, historical figures have been adjusted.

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 FINANCIAL STATISTICS

(R million)

Interim Final Final(rst) Final(rst) Final(rst) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Total Premiums 29 349 58 881 56 132 59 520 37 036 (EUR million) Final Final Final Final(rst) Final

Inc Fm Inv 18 967 35 279 30 853 25 513 22 040 Turnover 7 416 7 330 8 902 6 974 6 663

Total Income 27 608 51 671 45 314 70 157 108 360 Op Inc 456 763 1 685 789 868

Total Outgo 21 366 43 104 38 066 60 963 104 008 NetIntPd(Rcvd) 67 74 138 81 95

Minority Int 58 89 87 97 93 Minority Int 44 19 73 17 20

Attrib Inc 3 320 3 847 3 104 3 711 451 Att Inc 218 - 153 1 452 756 582

TotCompIncLoss 3 474 3 724 3 682 3 779 - 194 TotCompIncLoss 334 186 1 636 807 234

Ord SH Int 31 803 29 724 28 580 27 738 21 575 Fixed Ass 5 160 4 619 4 167 4 870 4 641

Minority Int 354 333 290 276 348 Tot Curr Ass 2 779 3 923 3 887 2 921 2 260

Long-Term Liab 525 135 492 428 437 285 383 607 369 246 Ord SH Int 4 857 5 655 5 794 4 498 4 002

Cap Employed 741 069 693 442 621 561 561 589 536 386 Minority Int 493 441 460 391 380

Fixed Assets 3 699 3 586 3 699 3 656 3 437 LT Liab 2 506 1 987 2 472 2 637 2 595

Investments 9 265 9 188 8 825 9 051 8 938 Tot Curr Liab 1 485 1 881 1 796 1 735 1 390

Current Assets 732 016 685 541 615 357 552 381 529 860 PER SHARE STATISTICS (cents per share)

Current Liab 11 563 13 193 14 414 11 615 18 568 HEPS-C (ZARc) 1 205.71 2 901.64 5 003.46 2 987.82 2 558.16

PER SHARE STATISTICS (cents per share) DPS (ZARc) 1 360.90 5 047.51 1 441.83 1 214.27 1 242.58

HEPS-C (ZARc) 243.60 298.60 215.50 297.30 30.90 NAV PS (ZARc) 21 375.20 23 582.92 23 990.52 18 515.94 16 359.50

DPS (ZARc) 85.00 125.00 120.00 100.00 40.00 3 Yr Beta 0.74 0.73 0.52 0.57 0.66

NAV PS (ZARc) 2 364.54 2 185.59 2 071.01 1 947.89 1 516.16 Price High 40 102 40 609 45 276 47 306 40 679

3 Yr Beta 0.58 0.30 0.73 0.91 0.87 Price Low 26 001 30 407 27 568 37 663 25 317

Price Prd End 3 026 2 290 1 806 1 426 1 950 Price Prd End 27 750 39 930 32 010 43 467 37 743

Price High 3 172 2 454 2 010 2 270 2 098 RATIOS

Price Low 2 231 1 760 1 386 1 405 1 282 Ret on SH Fnd 4.90 - 2.20 24.38 15.81 13.74

RATIOS Oper Pft Mgn 6.15 10.41 18.93 11.31 13.03

Ret on SH Fund 21.01 13.10 11.05 13.59 2.48 D:E 0.48 0.42 0.41 0.56 0.62

Ret on Tot Ass 1.68 1.23 1.16 1.64 0.82 Current Ratio 1.87 2.09 2.16 1.68 1.63

Debt:Equity 16.33 16.38 15.15 13.69 16.84 Div Cover 0.72 - 0.12 3.93 2.47 1.99

Solvency Mgn% 219.14 51.05 51.43 72.03 59.19

Payouts:Prem - - - 0.78 0.84

144