Page 145 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 145

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - MET

Metair Investments Ltd. Metrofile Holdings Ltd.

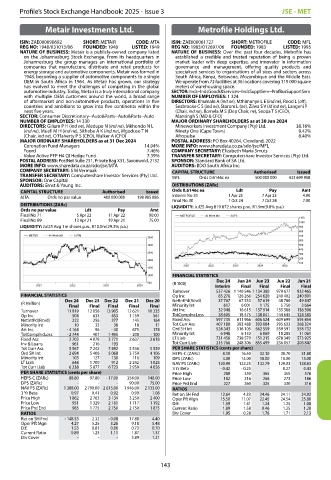

ISIN: ZAE000090692 SHORT: METAIR CODE: MTA ISIN: ZAE000061727 SHORT: METROFILE CODE: MFL

REG NO: 1948/031013/06 FOUNDED: 1948 LISTED: 1949 REG NO: 1983/012697/06 FOUNDED: 1983 LISTED: 1995

NATURE OF BUSINESS: Metair is a publicly-owned company listed NATURE OF BUSINESS: Over the past four decades, Metrofile has

on the Johannesburg Stock Exchange. From its headquarters in established a credible and trusted reputation of being a proven

Johannesburg the group manages an international portfolio of market leader with deep expertise, and innovator in information

companies that manufacture, distribute and retail products for governance and management, offering quality products and

energy storage and automotive components. Metair was formed in specialised services to organisations of all sizes and sectors across

1948, becoming a supplier of automotive components to a single South Africa, Kenya, Botswana, Mozambique and the Middle East.

OEM in South Africa in 1964. As Metair has grown, our strategy We operate from 72 facilities at 36 locations covering 119 000 square

has evolved to meet the challenges of competing in the global meters of warehousing space.

automotive industry. Today, Metair is a truly international company SECTOR: Inds--IndsGoods&Services--IndsSupptServ--ProfBusSupportServ

with multiple OEM customers around the world, a broad range NUMBER OF EMPLOYEES: 1 324

of aftermarket and non-automotive products, operations in five DIRECTORS: Khumalo A (ind ne), Mthimunye L E (ind ne), Rood L (alt),

countries and ambitions to grow into five continents within the Seabrooke C S (ind ne), Storom L (ne), Zilwa S V (ld ind ne), Langeni P

next five years. (Chair, ind ne), Bomela M S (Dep Chair, ne), Seopa T S (CEO),

SECTOR: Consumer Discretionary--Auto&Parts--Auto&Parts--Auto Mansingh S (MD & CFO)

NUMBER OF EMPLOYEES: 14 330 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

DIRECTORS: Giliam P H (ind ne), Medupe N (ind ne), Mkhondo N L Mineworkers Investment Company (Pty) Ltd. 38.16%

(ind ne), Muell M H (ind ne), Sithebe A K (ind ne), Mgoduso T N Ninety One (Cape Town) 9.42%

(Chair, ind ne), O’Flaherty P S (CEO), Walker A (CFO) Afropulse 8.40%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 POSTAL ADDRESS: PO Box 40264, Cleveland, 2022

Coronation Fund Managers 14.04% MORE INFO: www.sharedata.co.za/sdo/jse/MFL

Foord 7.46% COMPANY SECRETARY: Elizabeth Maria Smuts

Value Active PFP H4 QI Hedge Fund 7.39% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PostNet Suite 231, Private Bag X31, Saxonwold, 2132 SPONSOR: Standard Bank of SA Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/MTA AUDITORS: BDO South Africa Inc.

COMPANY SECRETARY: S M Vermaak CAPITAL STRUCTURE Authorised Issued

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MFL Ords 0.6146c ea 500 000 000 433 699 958

SPONSOR: One Capital

AUDITORS: Ernst & Young Inc. DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE Authorised Issued Ords 0.6146c ea Ldt Pay Amt

MTA Ords no par value 400 000 000 198 985 886 Interim No 31 1 Apr 25 7 Apr 25 4.00

7.00

7 Oct 24

1 Oct 24

Final No 30

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul25 Avg 819 872 shares p.w., R1.9m(9.8% p.a.)

Ords no par value Ldt Pay Amt

Final No 71 5 Apr 22 11 Apr 22 90.00 METROFILE 40 Week MA SUPS

Final No 69 13 Apr 21 19 Apr 21 75.00 1100

1000

LIQUIDITY: Jul25 Avg 1m shares p.w., R10.0m(29.3% p.a.) 900

800

METAIR 40 Week MA AUTM 700

3500

600

3000 500

400

2500

300

200

2000

100

2021 2022 2023 2024 2025

1500

1000 FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

500 (R ’000)

2021 2022 2023 2024 Interim Final Final Final Final

Turnover 537 426 1 140 546 1 134 380 979 677 933 465

FINANCIAL STATISTICS Op Inc 83 276 126 268 254 620 240 402 240 801

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 NetIntPd(Rcvd) 37 767 67 533 57 619 48 780 49 447

(R million)

Final Final Final Final Final Minority Int 617 6 001 1 175 5 750 3 664

Turnover 11 819 12 056 13 905 12 621 10 235 Att Inc 32 948 16 615 137 914 133 588 138 306

Op Inc 504 633 453 1 159 561 TotCompIncLoss 38 605 18 475 138 041 144 645 124 585

NetIntPd(Rcvd) 222 256 377 145 164 Fixed Ass 597 735 611 966 606 524 609 699 595 454

Minority Int 10 33 36 18 11 Tot Curr Ass 407 180 393 488 393 084 295 633 268 324

Att Inc - 4 164 96 - 40 675 174 Ord SH Int 524 343 516 105 562 559 559 591 558 732

TotCompIncLoss - 2 744 407 1 495 - 208 - 100 Minority Int 6 948 6 133 6 069 18 285 11 061

Fixed Ass 2 703 4 078 3 771 2 637 2 618 LT Liab 731 456 738 579 151 215 678 349 573 925

Inv & Loans 961 216 193 - - Tot Curr Liab 215 766 248 306 855 499 236 057 208 847

Tot Curr Ass 5 567 7 242 7 492 5 536 5 539 PER SHARE STATISTICS (cents per share)

Ord SH Int 2 694 5 406 5 068 3 759 4 106 HEPS-C (ZARc) 8.10 16.50 32.10 30.70 31.80

Minority Int 103 127 130 116 109 DPS (ZARc) 4.00 14.00 18.00 18.00 15.00

LT Liab 644 1 700 912 2 242 1 028 NAV PS (ZARc) 120.90 122.25 132.79 129.03 128.83

Tot Curr Liab 6 238 5 877 6 723 2 959 4 056 3 Yr Beta - 0.42 - 0.25 - 0.27 0.43

PER SHARE STATISTICS (cents per share) Price High 280 330 365 355 376

HEPS-C (ZARc) 88.80 97.80 - 17.00 354.00 148.00 Price Low 182 216 266 273 186

DPS (ZARc) - - - 90.00 75.00 Price Prd End 227 260 325 330 316

NAV PS (ZARc) 1 388.00 2 790.00 2 615.00 1 946.00 2 133.00 RATIOS

3 Yr Beta 0.97 0.41 0.92 0.99 1.08 Ret on SH Fnd 12.64 4.33 24.46 24.11 24.92

Price High 1 862 2 763 3 134 3 250 2 400 Oper Pft Mgn 15.50 11.07 22.45 24.54 25.80

Price Low 951 1 329 2 161 1 717 1 192 D:E 1.39 1.41 1.24 1.25 1.08

Price Prd End 985 1 775 2 750 2 750 1 875 Current Ratio 1.89 1.58 0.46 1.25 1.28

RATIOS Div Cover 1.95 0.28 1.78 1.71 2.13

Ret on SH Fnd - 148.53 2.32 - 0.08 17.88 4.40

Oper Pft Mgn 4.27 5.25 3.26 9.18 5.48

D:E 1.53 0.81 0.86 0.73 0.70

Current Ratio 0.89 1.23 1.11 1.87 1.37

Div Cover - - - 3.89 1.21

143