Page 144 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 144

JSE - MC Profile’s Stock Exchange Handbook: 2025 - Issue 3

MC Mining Ltd. Merafe Resources Ltd.

ISIN: AU000000MCM9 SHORT: MC MINING CODE: MCZ ISIN: ZAE000060000 SHORT: MERAFE CODE: MRF

REG NO: ABN008905388 FOUNDED: 1979 LISTED: 2006 REG NO: 1987/003452/06 FOUNDED: 1987 LISTED: 1988

NATURE OF BUSINESS: MC Mining is an ASX/JSE-listed coal NATURE OF BUSINESS: Merafe is listed on the Johannesburg Stock

exploration, development and mining company operating in Exchange (JSE) and A2X in the General Mining sector under the

South Africa. MC Mining’s key projects include the Uitkomst share code MRF. Merafe’s business is the 20.5% participation

Colliery (metallurgical and thermal coal), Makhado Project (hard through its wholly-owned subsidiary, Merafe Ferrochrome, in

coking coal), Vele Colliery (semi-soft coking and thermal coal), and the earnings before interest, tax, depreciation and amortisation

the Greater Soutpansberg Projects (coking and thermal coal). (EBITDA) of the Venture in which Glencore Operations South

SECTOR: Energy--Energy--OilGas&Coal--Coal Africa (Pty) Ltd. (Glencore) has a 79.5% participation. The group’s

NUMBER OF EMPLOYEES: 554 major shareholders are Glencore (Netherlands) B.V. (Glencore BV)

DIRECTORS: Lanlan W (ne), Muhui H (ne), Pavlovski B (ne), and the Industrial Development Corporation of South Africa (IDC).

Senosi M (ne), Wang Dr H (ne), West Dr S (ne), Zhen B H (ne, China), Merafe and Glencore formed the Venture in July 2004 when they

He Y (CEO & MD, ne) pooled their chrome operations to create the largest ferrochrome

MAJOR ORDINARY SHAREHOLDERS as at 3 Sep 2024 producer in the world.

Goldway Capital Investment Ltd. 26.30% SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--General Mining

Senosi Group Investment Holdings (Pty) Ltd. 20.00% NUMBER OF EMPLOYEES: 6 591

Kinetic Crest Ltd. 13.00% DIRECTORS: Green D (ne), Mabusela-Aikhuere N (ind ne),

POSTAL ADDRESS: Ground Floor, Greystone Building, Fourways McGluwa D (ne), Mclaughlan J (ind ne), Tlale K (ind ne), Vuso M J (ind ne),

Golf Park, Roos Street, Fourways, 2191 Phiri S D (Chair, ind ne), Matlala Z (CEO), Chocho D (FD)

MORE INFO: www.sharedata.co.za/sdo/jse/MCZ MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

COMPANY SECRETARY: Blagojce (Bill) Pavlovski Glencore BV 28.82%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Industrial Development Corporation of SA Ltd. 21.88%

SPONSOR: Investec Bank Ltd. POSTAL ADDRESS: PO Box 652157, Benmore, 2010

AUDITORS: Mazars Inc. MORE INFO: www.sharedata.co.za/sdo/jse/MRF

CAPITAL STRUCTURE Authorised Issued COMPANY SECRETARY: CorpStat Governance Services

MCZ Ords no par value - 414 013 349 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: One Capital Sponsor Services (Pty) Ltd.

LIQUIDITY: Jul25 Avg 51 078 shares p.w., R74 439.5(0.6% p.a.) AUDITORS: Deloitte & Touche Inc.

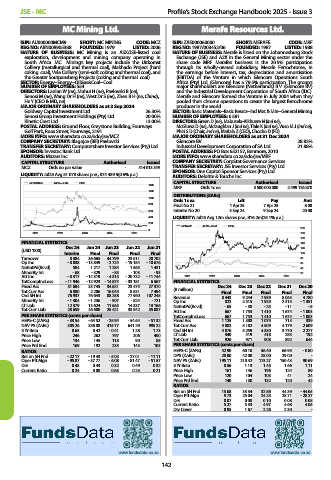

MC MINING 40 Week MA OILP CAPITAL STRUCTURE Authorised Issued

1400

MRF Ords 1c ea 3 500 000 000 2 499 126 870

1200

DISTRIBUTIONS [ZARc]

1000

Ords 1c ea Ldt Pay Amt

800 Final No 21 1 Apr 25 7 Apr 25 8.00

600 Interim No 20 3 Sep 24 9 Sep 24 20.00

400 LIQUIDITY: Jul25 Avg 12m shares p.w., R16.2m(25.1% p.a.)

200

MERAFE 40 Week MA INDM

200

0

2021 2022 2023 2024 2025 180

160

FINANCIAL STATISTICS 140

(USD ’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 120

Interim Final Final Final Final 100

Turnover 8 384 36 665 44 799 23 511 20 702 80

Op Inc - 8 038 - 13 849 - 2 724 - 19 154 - 10 676 60

NetIntPd(Rcvd) 584 1 217 1 284 1 565 1 431 40

Minority Int - 68 - 329 - 83 - 103 - 93 20

Att Inc - 8 317 - 14 319 - 4 315 - 20 732 - 11 744 2021 2022 2023 2024 2025

TotCompIncLoss - 11 946 - 12 923 - 14 874 - 33 181 6 567 FINANCIAL STATISTICS

Fixed Ass 31 684 33 745 34 621 23 475 27 370 Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Tot Curr Ass 6 800 2 206 16 045 8 531 7 494 (R million) Final Final Final Final Final

Ord SH Int 76 937 76 643 88 258 77 960 107 245 Revenue 8 443 9 244 7 939 8 063 4 780

Minority Int - 1 304 - 1 236 - 907 - 824 - 721 Op Inc 822 2 315 1 925 2 315 - 1 351

LT Liab 12 379 13 624 11 663 14 337 13 166 NetIntPd(Rcvd) - 65 - 38 - 25 - 11 - 5

Tot Curr Liab 28 659 26 608 25 421 33 942 35 087 Att Inc 667 1 753 1 410 1 674 - 1 003

PER SHARE STATISTICS (cents per share) TotCompIncLoss 667 1 753 1 410 1 674 - 1 003

HEPS-C (ZARc) - 33.54 - 64.52 - 25.94 - 54.64 - 51.32 Fixed Ass 1 125 1 388 1 075 713 339

NAV PS (ZARc) 305.26 336.88 415.77 641.29 995.22 Tot Curr Ass 4 882 5 182 4 509 4 179 2 609

3 Yr Beta 0.65 0.42 - 0.41 1.28 1.73 Ord SH Int 4 876 5 259 4 330 3 770 2 277

Price High 246 262 797 206 400 LT Liab 340 419 418 283 192

Price Low 134 145 118 90 85 Tot Curr Liab 926 971 908 892 644

Price Prd End 169 192 235 145 103 PER SHARE STATISTICS (cents per share)

RATIOS HEPS-C (ZARc) 42.90 60.10 56.40 66.95 - 0.80

Ret on SH Fnd - 22.17 - 19.43 - 5.03 - 27.01 - 11.11 DPS (ZARc) 28.00 42.00 25.00 29.00 -

Oper Pft Mgn - 95.87 - 37.77 - 6.08 - 81.47 - 51.57 NAV PS (ZARc) 195.11 210.42 173.27 150.43 90.69

D:E 0.43 0.43 0.32 0.49 0.32 3 Yr Beta 0.56 1.13 1.45 1.66 1.11

Current Ratio 0.24 0.08 0.63 0.25 0.21 Price High 161 146 196 124 89

Price Low 120 104 103 41 24

Price Prd End 140 130 132 120 42

RATIOS

Ret on SH Fnd 13.68 33.34 32.56 44.39 - 44.05

Oper Pft Mgn 9.73 25.04 24.25 28.71 - 28.27

D:E 0.07 0.08 0.10 0.08 0.08

Current Ratio 5.27 5.33 4.97 4.68 4.05

Div Cover 0.95 1.67 2.26 2.30 -

www.fundsdata.co.za www.fundsdata.co.za

142