Page 141 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 141

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - LIG

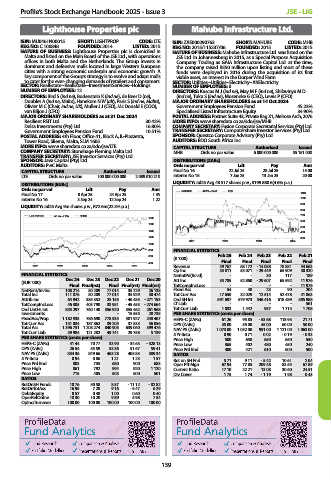

Lighthouse Properties plc Mahube Infrastructure Ltd.

ISIN: MU0461N00015 SHORT: LIGHTPROP CODE: LTE ISIN: ZAE000290763 SHORT: MAHUBE CODE: MHB

REG NO: C 100848 FOUNDED: 2014 LISTED: 2015 REG NO: 2015/115237/06 FOUNDED: 2015 LISTED: 2015

NATURE OF BUSINESS: Lighthouse Properties plc is domiciled in NATURE OF BUSINESS: Mahube Infrastructure Ltd. was listed on the

Malta and listed on the Main Board of the JSE Ltd., with operations JSE Ltd. in Johannesburg in 2015, as a Special Purpose Acquisition

offices in both Malta and the Netherlands. The Group invests in Company. Trading as GAIA Infrastructure Capital Ltd. at the time,

dominant and defensive malls located in large Western European the company raised R550 million upon listing and most of these

cities with a strong economic underpin and economic growth. A funds were deployed in 2016 during the acquisition of its first

key component of the Group’s strategy is to evolve and adapt malls viable asset, an interest in the Dorper Wind Farm.

to cater for the ever-changing demands of retailers and consumers. SECTOR: Utilities--Utilities--Electricity--AltElectricity

SECTOR: RealEstate--RealEstate--InvestmentServices--Holdings NUMBER OF EMPLOYEES: 0

NUMBER OF EMPLOYEES: 12 DIRECTORS: Kuscus M J (ind ne), May M F (ind ne), Shikwinya M D

DIRECTORS: Bird S (ind ne), Bodenstein K (ind ne), de Beer D (ne), (ind ne), Tuku S (ind ne), Moseneke G (CEO), Lewis P (CFO)

Doublet A (ind ne, Malta), Hanekom N W (alt), Paris S (ind ne, Malta), MAJOR ORDINARY SHAREHOLDERS as at 14 Oct 2024

Olivier M C (Chair, ind ne, UK), Muller J J (CEO), Mc Donald E (COO), Government Employees Pension Fund 45.23%

van Biljon J (CFO) Specialised Listed Infrastructure Equity 34.90%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 POSTAL ADDRESS: Postnet Suite 43, Private Bag X1, Melrose Arch, 2076

Resilient REIT Ltd. 30.42% MORE INFO: www.sharedata.co.za/sdo/jse/MHB

Delsa Investments (Pty) Ltd. 16.80% COMPANY SECRETARY: Fusion Corporate Secretarial Services (Pty) Ltd.

Government Employees Pension Fund 10.51% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: 4th Floor, Office 41, Block A, IL-Piazzetta, SPONSOR: Questco Corporate Advisory (Pty) Ltd.

Tower Road, Sliema, Malta, SLM 1605 AUDITORS: BDO South Africa Inc.

MORE INFO: www.sharedata.co.za/sdo/jse/LTE CAPITAL STRUCTURE Authorised Issued

COMPANY SECRETARY: Stonehage Fleming Malta Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MHB Ords no par value 6 000 000 000 55 151 000

SPONSOR: Java Capital (Pty) Ltd. DISTRIBUTIONS [ZARc]

AUDITORS: PwC Malta Ords no par val Ldt Pay Amt

CAPITAL STRUCTURE Authorised Issued Final No 16 22 Jul 25 28 Jul 25 15.00

LTE Ords no par value 100 000 000 000 2 089 010 218 Interim No 15 7 Jan 25 13 Jan 25 20.00

LIQUIDITY: Jul25 Avg 48 517 shares p.w., R199 880.6(4.6% p.a.)

DISTRIBUTIONS [EURc]

Ords no par val Ldt Pay Amt MAHUBE 40 Week MA EQII

Final No 17 8 Apr 25 24 Apr 25 1.35 1100

Interim No 16 3 Sep 24 12 Sep 24 1.22 1000

LIQUIDITY: Jul25 Avg 9m shares p.w., R72.6m(22.3% p.a.) 900

800

LIGHTPROP 40 Week MA REDS 700

1800

600

1600

500

1400

400

1200 300

2021 2022 2023 2024

1000

800 FINANCIAL STATISTICS

600 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R ’000)

400 Final Final Final Final Final

2021 2022 2023 2024 2025 Revenue 49 767 68 172 - 14 058 78 881 44 663

Op Inc 33 811 53 071 - 29 449 65 909 30 320

FINANCIAL STATISTICS NetIntPd(Rcvd) - - 30 117 189

(EUR ’000) Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 Att Inc 33 785 52 860 - 29 607 65 592 11 976

Final Final(rst) Final Final(rst) Final(rst) TotCompIncLoss - - - - 11 976

NetRent/InvInc 108 214 80 209 77 014 35 729 26 138 Fixed Ass 54 40 23 90 204

Total Inc 111 876 80 209 77 014 35 929 30 474 Tot Curr Ass 17 650 32 029 12 514 52 478 41 863

Attrib Inc 64 942 385 352 25 155 - 46 485 - 271 193 Ord SH Int 591 697 579 973 546 416 618 489 585 988

TotCompIncLoss 46 305 403 790 33 951 - 45 453 - 274 664 LT Liab - - - - 561

Ord UntHs Int 855 297 760 140 356 920 355 462 261 968 Tot Curr Liab 1 032 1 442 957 1 715 1 708

Investments - - - 15 555 28 735 PER SHARE STATISTICS (cents per share)

FixedAss/Prop 1 182 935 786 690 778 935 581 927 248 467 HEPS-C (ZARc) 61.26 95.85 - 53.68 118.93 21.71

Tot Curr Ass 151 034 187 862 39 205 37 533 36 056 DPS (ZARc) 35.00 55.00 45.00 60.00 50.00

Total Ass 1 396 751 1 208 274 840 903 639 060 399 476 NAV PS (ZARc) 1 073.00 1 052.00 991.00 1 121.00 1 063.00

Tot Curr Liab 39 984 121 282 49 741 29 758 5 139 3 Yr Beta 0.90 0.71 0.02 - 0.19 - 0.33

PER SHARE STATISTICS (cents per share) Price High 500 650 650 650 550

HEPS-C (ZARc) 41.44 70.77 33.90 - 34.63 - 528.13 Price Low 365 402 480 450 240

DPS (ZARc) 26.54 55.59 53.36 51.67 59.41 Price Prd End 400 421 610 600 500

NAV PS (ZARc) 834.36 849.66 463.28 405.83 389.34 RATIOS

3 Yr Beta 0.94 0.86 1.21 1.23 1.57 Ret on SH Fnd 5.71 9.11 - 5.42 10.61 2.04

Price Prd End 803 735 680 900 683 Oper Pft Mgn 67.94 77.85 209.48 83.55 67.89

Price High 861 792 994 920 1 120 Current Ratio 17.10 22.21 13.08 30.60 24.51

Price Low 715 405 505 600 501 Div Cover 1.75 1.74 - 1.19 1.98 0.43

RATIOS

RetOnSH Funds 10.76 50.58 8.57 - 11.12 - 82.82

RetOnTotAss 16.95 7.28 9.16 - 5.47 6.29

Debt:Equity 0.57 0.48 1.00 0.60 0.40

OperRetOnInv 18.30 10.20 9.89 5.98 7.54

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00

139