Page 128 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 128

JSE - HUD Profile’s Stock Exchange Handbook: 2025 - Issue 3

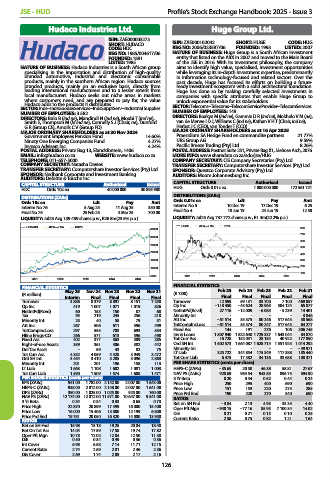

Hudaco Industries Ltd. Huge Group Ltd.

ISIN: ZAE000003273

SHORT: HUDACO ISIN: ZAE000102042 SHORT: HUGE CODE: HUG

CODE: HDC REG NO: 2006/023587/06 FOUNDED: 1993 LISTED: 2007

REG NO: 1985/004617/06 NATURE OF BUSINESS: Huge Group is a South African investment

FOUNDED: 1891 entity that listed on the AltX in 2007 and moved to the Main Board

LISTED: 1985 of the JSE in 2016. With its investment philosophy, the company

NATURE OF BUSINESS: Hudaco Industries is a South African group aims to identify high value, specialised, investment opportunities

specialising in the importation and distribution of high-quality while leveraging its in-depth investment expertise, predominantly

branded automotive, industrial and electronic consumable in information technology-focused and related sectors. Over the

products, mainly in the southern African region. Hudaco sources past decade, Huge has focused its efforts on building a future-

branded products, mainly on an exclusive basis, directly from ready investment ecosystem with a solid architectural foundation.

leading international manufacturers and to a lesser extent from Huge has done so by making carefully selected investments in

local manufacturers. Hudaco seeks out niche areas in markets companies with specific attributes that enable Huge Group to

where customers need, and are prepared to pay for, the value unlock exponential value for its stakeholders.

Hudaco adds to the products it distributes. SECTOR: Telecoms--Telecoms--TelecomServiceProvider--TelecomServices

SECTOR: Inds--IndsGoods&Services--IndsSupptServ--Industrial Supplies NUMBER OF EMPLOYEES: 148

NUMBER OF EMPLOYEES: 3 582

DIRECTORS: Bulo B (ind ne), Mandindi N (ind ne), Moabi T (ind ne), DIRECTORS: Boakye M (ind ne), Gammie D R (ind ne), Mokholo V M (ne),

Smith E, Thompson M (ld ind ne), Connelly S J (Chair, ne), Dunford van de Merwe I D J, Williams C (ind ne), Kathan V H T (Chair, ind ne),

G R (Group CE), Amoils C V (Group FD) Herbst J C (CEO), van Tonder T (CCO)

MAJOR ORDINARY SHAREHOLDERS as at 30 Nov 2024 MAJOR ORDINARY SHAREHOLDERS as at 16 Apr 2025

Government Employees Pension Fund 14.60% Praesidium SA Hedge Fund en commandite partners 21.77%

Ninety One Emerging Companies Fund 4.27% UBS Group AG 9.59%

Invesco Advisers Inc. 4.24% Pacific Breeze Trading (Pty) Ltd. 8.26%

POSTAL ADDRESS: Private Bag 13, Elandsfontein, 1406 POSTAL ADDRESS: Postnet Suite 251, Private Bag X1, Melrose Arch, 2076

EMAIL: info@hudaco.co.za WEBSITE: www.hudaco.co.za MORE INFO: www.sharedata.co.za/sdo/jse/HUG

TELEPHONE: 011-657-5000 COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

COMPANY SECRETARY: Natasha Davies TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Questco Corporate Advisory (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking AUDITORS: Moore Johannesburg Inc.

AUDITORS: Deloitte & Touche Inc. CAPITAL STRUCTURE Authorised Issued

CAPITAL STRUCTURE Authorised Issued HUG Ords 0.01c ea 1 000 000 000 172 561 721

HDC Ords 10c ea 40 000 000 30 895 980

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ldt

Pay

Ords 10c ea Ldt Pay Amt Ords 0.01c ea 10 Dec 19 17 Dec 19 Amt

Interim No 5

6.25

Interim No 76 5 Aug 25 11 Aug 25 350.00 Final No 4 18 Jun 19 24 Jun 19 12.50

Final No 75 25 Feb 25 3 Mar 25 700.00

LIQUIDITY: Jul25 Avg 139 439 shares p.w., R26.8m(23.5% p.a.) LIQUIDITY: Jul25 Avg 737 772 shares p.w., R1.4m(22.2% p.a.)

HUGE 40 Week MA FTEL

HUDACO 40 Week MA SUPS 800

35000

700

30000

600

25000

500

20000 400

15000 300

200

10000

100

5000 2021 2022 2023 2024 2025

2021 2022 2023 2024 2025

FINANCIAL STATISTICS FINANCIAL STATISTICS Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R million) May 25 Nov 24 Nov 23 Nov 22 Nov 21 (R ’000) Final Final Final Final Final

Interim

Final

Final

Final

Final

Turnover 3 886 8 379 8 897 8 151 7 258 Turnover 12 599 59 131 33 700 7 100 469 857

Op Inc 419 1 007 1 071 1 019 826 Op Inc - 118 450 - 45 624 28 965 504 124 65 877

NetIntPd(Rcvd) 60 153 150 87 68 NetIntPd(Rcvd) 27 116 - 12 009 - 6 085 - 5 239 14 401

Tax 95 219 245 256 218 Minority Int - - - - 3 846

Minority Int 25 40 58 79 51 Att Inc - 61 514 35 375 80 246 517 643 38 568

Att Inc 267 506 611 596 499 TotCompIncLoss - 61 514 35 374 80 247 517 643 64 277

TotCompIncLoss 297 555 703 693 554 Fixed Ass 144 191 276 106 306 745

Hline Erngs-CO 266 571 613 596 498 Inv & Loans 1 807 940 1 822 640 1 729 337 1 643 044 84 870

Fixed Ass 402 377 363 309 285 Tot Curr Ass 16 728 152 031 28 154 40 922 177 850

Right-of-use Assets 359 361 406 382 442 Ord SH Int 1 602 573 1 664 087 1 628 714 1 551 925 1 014 292

Def Tax Asset - 59 43 82 75 Minority Int - - - - - 49 971

Tot Curr Ass 4 352 4 059 4 428 3 949 3 472 LT Liab 325 722 344 854 175 349 117 388 185 440

34 136

33 688

17 382

Tot Curr Liab

6 475

108 371

Ord SH Int 3 454 3 410 3 285 3 096 2 863

Minority Int 201 201 196 158 113 PER SHARE STATISTICS (cents per share)

LT Liab 1 663 1 108 1 602 1 081 1 003 HEPS-C (ZARc) - 35.65 20.50 46.38 58.81 27.67

Tot Curr Liab 1 590 1 509 1 574 1 608 1 471 NAV PS (ZARc) 928.69 964.54 943.85 896.75 594.90

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.20 0.44 0.52 0.44 0.24

EPS (ZARc) 941.00 1 782.00 2 142.00 2 007.00 1 643.00 Price High 250 295 400 690 690

HEPS-C (ZARc) 938.00 2 012.00 2 148.00 2 007.00 1 641.00 Price Low 151 153 220 275 285

DPS (ZARc) 350.00 1 025.00 1 025.00 925.00 760.00 Price Prd End 190 220 270 340 690

NAV PS (ZARc) 12 174.00 12 012.00 11 571.00 10 647.00 9 541.00 RATIOS

3 Yr Beta 0.34 0.34 0.33 0.65 0.73 Ret on SH Fnd - 3.84 2.13 4.93 33.35 4.40

Price High 22 870 20 899 17 499 16 000 15 400 Oper Pft Mgn - 940.15 - 77.16 85.95 7 100.34 14.02

Price Low 16 000 15 406 13 800 12 199 6 800 D:E 0.21 0.21 0.13 0.10 0.25

Price Prd End 19 751 20 050 16 320 14 000 13 950 Current Ratio 2.58 8.75 0.82 1.21 1.64

RATIOS

Ret on SH Fnd 15.98 15.18 19.25 20.84 18.48

Ret On Tot Ass 14.04 17.59 17.58 19.74 17.82

Oper Pft Mgn 10.78 12.02 12.04 12.50 11.38

D:E 0.50 0.34 0.49 0.36 0.36

Int Cover 6.98 6.58 7.14 11.71 12.15

Current Ratio 2.74 2.69 2.81 2.46 2.36

Div Cover 2.69 1.74 2.09 2.17 2.16

126