Page 125 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 125

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - HAR

Harmony Gold Mining Company Ltd. NUMBER OF EMPLOYEES: 46 078

DIRECTORS: Motsepe Dr P T (Chair, ne),

Nondumo K T (Dep Chair, ind ne), Msimang

ISIN: ZAE000015228 Dr M (ld ind ne), Nel B (Group CEO), Lekubo B

SHORT: HARMONY P (FD), Mashego Dr H E (Executive Director),

CODE: HAR Nqwababa B (ind ne), Pillay V P (ind ne),

REG NO: 1950/038232/06 Prinsloo M (ind ne), Sibiya G R (ind ne), Turner

FOUNDED: 1950 P L (ind ne), Wetton J L (ind ne), Gule W M

LISTED: 1951 (ind ne), Matlala Z (ind ne), Moshe M (ind ne)

Scan the QR code to POPULAR BRAND NAMES: Harmony

NATURE OF BUSINESS: visit our website POSTAL ADDRESS: PO Box 2, Randfontein, 1760

Harmony Gold Mining Company Ltd. (‘Harmony’) is a gold EMAIL: HarmonyIR@harmony.co.za

mining specialist with a growing international copper WEBSITE: www.harmony.co.za

footprint. The company has operations and projects in TELEPHONE: 011-411-6073

South Africa, Australia and Papua New Guinea (PNG), one COMPANY SECRETARY: Shela Mohatla

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

of the world’s premier new gold-copper regions. Harmony SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

is South Africa’s largest gold producer by volume and AUDITORS: Ernst & Young Inc.

a global leader in secondary mining through our gold BANKERS: Nedbank Ltd.

tailings retreatment business. SEGMENTAL REPORTING as at 31 Dec 24 (as a % of Revenue)

Our shares are listed on the Johannesburg Stock Exchange South Africa 89.75%

International

10.25%

(JSE) (HAR) and our American Depositary shares trade on

the New York Stock Exchange (NYSE) (HMY). CALENDAR Expected Status

Confirmed

In FY24, Harmony produced 1.56Moz of gold and at year Next Final Results 28 Aug 2025 Unconfirmed

Annual General Meeting

Nov 2025

end employed 46 078 people. Harmony’s attributable Next Interim Results Mar 2026 Unconfirmed

gold and gold equivalent Mineral Reserves amount to

40.3Moz as at 30 June 2024. CAPITAL STRUCTURE Authorised Issued

HAR Ords no par value 1 200 000 000 634 767 724

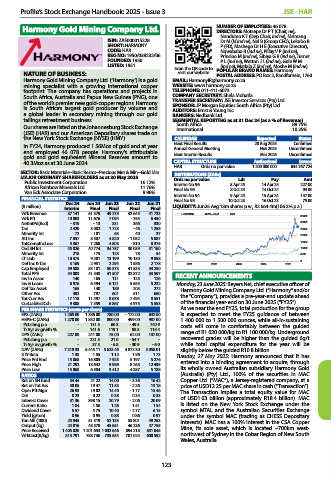

SECTOR: Basic Materials--Basic Resrcs--Precious Met & Min--Gold Min DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 30 May 2025 Ords no par value Ldt Pay Amt

Public Investment Corporation 16.12% Interim No 96 8 Apr 25 14 Apr 25 227.00

African Rainbow Minerals Ltd. 11.76% Final No 95 8 Oct 24 14 Oct 24 94.00

Van Eck Associate Corporation 9.96% Interim No 94 9 Apr 24 15 Apr 24 147.00

FINANCIAL STATISTICS Final No 93 10 Oct 23 16 Oct 23 75.00

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

(R million) LIQUIDITY: Jun25 Avg 13m shares p.w., R2 664.4m(106.2% p.a.)

Interim Final Final Final Final

Wrk Revenue 37 141 61 379 49 275 42 645 41 733 HARMONY 40 Week MA MINI 35000

Wrk Pft 10 003 11 676 7 094 - 755 6 450

NetIntPd(Rcd) - 319 - 13 331 366 330 30000

Tax 2 420 3 082 1 723 - 46 1 258 25000

Minority Int 72 101 63 40 37 20000

Att Inc 7 857 8 587 4 820 - 1 052 5 087

TotCompIncLoss 5 367 7 268 4 803 - 810 8 375 15000

Ord SH Int 45 826 40 774 34 757 30 039 31 160 10000

Minority Int 218 175 123 78 54 5000

LT Liab 10 375 9 201 13 199 10 130 9 858

Def Inc & Tax 3 169 2 951 2 294 1 586 2 178 2021 2022 2023 2024 2025 0

Cap Employed 59 588 53 101 50 373 41 833 43 250

Total PPE 44 003 41 348 41 507 32 872 33 597 RECENT ANNOUNCEMENTS

Inv In Assoc 140 165 111 125 126

Inv & Loans 6 976 6 494 6 121 5 555 5 232 Monday, 23 June 2025: Beyers Nel, chief executive officer of

Def Tax Asset 165 140 189 203 272 Harmony Gold Mining Company Ltd. (“Harmony” and/or

Other Ass 482 797 601 511 660 the “Company”), provides a pre-year-end update ahead

Tot Curr Ass 17 118 11 497 8 678 7 494 8 551

CurLiabExclCsh 9 308 7 359 6 867 4 975 5 553 of the financial year-end on 30 June 2025 (“FY25”).

PER SHARE STATISTICS (cents per share) As we near the end FY25, total production for the group

EPS (ZARc) 1 265.00 1 386.00 780.00 - 172.00 842.00 is expected to meet the FY25 guidance of between

HEPS-C (ZARc) 1 270.00 1 852.00 800.00 499.00 987.00 1 400 000 to 1 500 000 ounces, while all-in-sustaining

Pct chng p.a. - 131.5 60.3 - 49.4 740.9 costs will come in comfortably between the guided

Tr 5yr av grwth % - 141.6 119.1 98.5 115.4 range of R1 020 000/kg to R1 100 000/kg. Underground

DPS (ZARc) 227.00 241.00 75.00 62.00 137.00

Pct chng p.a. - 221.3 21.0 - 54.7 - recovered grades will be higher than the guided 6g/t

Tr 5yr av grwth % - 37.5 - 6.8 - 30.9 - 6.0 while total capital expenditure for the year will be

NAV (ZARc) 7 219.33 6 445.11 5 623.46 4 872.30 5 058.01 slightly below the guided R10.8 billion.

3 Yr Beta 1.33 1.55 1.12 1.96 1.73 Tuesday, 27 May 2025: Harmony announced that it has

Price Prd End 15 068 16 805 7 925 5 197 5 276 entered into a binding agreement to acquire, through

Price High 21 292 18 642 9 969 8 265 12 495

Price Low 15 068 6 584 3 412 4 387 5 188 its wholly owned Australian subsidiary Harmony Gold

RATIOS (Australia) (Pty) Ltd., 100% of the securities in MAC

Ret on SH fund 34.44 21.22 14.00 - 3.36 16.42 Copper Ltd. (“MAC”), a Jersey-registered company, at a

Ret on Tot Ass 30.05 19.47 11.55 - 2.26 13.18 price of USD12.25 per MAC share in cash (“Transaction”).

Oper Pft Mgn 26.93 19.02 14.40 - 1.77 15.46 The Transaction implies a total equity value for MAC

D:E 0.23 0.22 0.38 0.34 0.33 of USD1.03 billion (approximately R18.4 billion). MAC

Interest Cover 31.36 898.15 20.79 - 2.06 20.09

Current Ratio 1.84 1.56 1.26 1.51 1.54 is listed on the New York Stock Exchange under the

Dividend Cover 5.57 5.75 10.40 - 2.77 6.15 symbol MTAL and the Australian Securities Exchange

Yield (g/ton) 0.96 0.95 0.88 0.86 0.97 under the symbol MAC (trading as CHESS Depositary

Ton Mll (‘000) 25 945 51 319 52 135 53 801 49 253 Interests). MAC has a 100% interest in the CSA Copper

Output (kg) 24 816 48 578 45 651 46 236 47 755 Mine, its sole asset, which is located ~700km west-

Price Received 1 405 020 1 201 653 1 032 646 894 218 851 045

WrkCost(R/kg) 813 791 758 736 735 634 701 024 600 592 northwest of Sydney in the Cobar Region of New South

Wales, Australia.

123