Page 129 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 129

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - HUL

Hulamin Ltd. Hyprop Investments Ltd.

ISIN: ZAE000096210 SHORT: HULAMIN CODE: HLM ISIN: ZAE000190724 SHORT: HYPROP CODE: HYP

REG NO: 1940/013924/06 FOUNDED: 1940 LISTED: 2007 REG NO: 1987/005284/06 FOUNDED: 1987 LISTED: 1988

NATURE OF BUSINESS: Hulamin Ltd. (“Hulamin” or “the Company”) NATURE OF BUSINESS: Hyprop is a retail focused REIT, owning

and its subsidiaries (“ the Group”) is a leading, focused, midstream and managing a c. R40 billion portfolio of mixed-use precincts

aluminium semi-fabricator of aluminium products located in underpinned by dominant retail centres in key economic nodes

Pietermaritzburg and Richards Bay, KwaZulu-Natal. It purchases in South Africa and Eastern Europe. Hyprop’s multi-skilled,

primary aluminium and supplies its range of high-value, niche diverse team of experts practice conscious retail, underpinned

rolled products, aluminium containers and complex extrusions by a sustainable business, models meaningful social impact and a

to manufacturers of finished products in South Africa and other robust governance framework to create long-term value for all its

countries around the world. Hulamin’s largest activity is aluminium stakeholders.

rolling which contributes over 90% to its revenue, with the balance SECTOR: RealEstate--RealEstate--REITS--Retail

comprising extruded products and aluminium food containers. NUMBER OF EMPLOYEES: 294

SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--Aluminium DIRECTORS: Dallamore A A (ind ne), Dotwana L (ind ne), Ellerine K

NUMBER OF EMPLOYEES: 1 910 (ne), Inskip R J D (ld ind ne), Isaacs M R (ind ne), Jasper Z (ind ne),

DIRECTORS: Baloyi P (ind ne), Boles C A (ind ne), Khumalo V N (ne), Mzobe B S (ind ne), Noussis S (Chair, ind ne), Nauta A W (CIO),

Mehlomakulu Dr B (ind ne), Monnakgotla Z (ind ne), Ngwenya S P (ne), Wilken M C (CEO), Till B C (CFO)

Tostmann A (ind ne), Watson G H M (ne), Zondi G (alt), Leeuw T P (Chair, MAJOR ORDINARY SHAREHOLDERS as at 4 Dec 2024

ind ne), Gounder M (CEO), Nirghin P (CFO), Yanta L (Acting Chair, ind ne) Government Employees Pension Fund (SA) 20.18%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024 Ninety One SA (Pty) Ltd. 10.00%

Industrial Development Corporation of SA Ltd. 29.17% Allan Gray 9.29%

Mr. Volker Schuette 8.19% POSTAL ADDRESS: PO Box 52509, Saxonwold, 2132

JL Biccard 5.11% MORE INFO: www.sharedata.co.za/sdo/jse/HYP

POSTAL ADDRESS: PO Box 74, Pietermaritzburg, 3200 COMPANY SECRETARY: Fundiswa Nkosi

MORE INFO: www.sharedata.co.za/sdo/jse/HLM TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Luvivi (Pty) Ltd. SPONSOR: Java Capital (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: KPMG Inc.

SPONSOR: Questco (Pty) Ltd. CAPITAL STRUCTURE Authorised Issued

AUDITORS: Ernst & Young Inc. HYP Ords no par value 500 000 000 399 419 089

CAPITAL STRUCTURE Authorised Issued DISTRIBUTIONS [ZARc]

HLM Ords 10c ea 800 000 000 324 318 436 Ords no par value Ldt Pay Amt

DISTRIBUTIONS [ZARc] Interim No 71 1 Apr 25 7 Apr 25 113.43

Ords 10c ea Ldt Pay Amt Final No 70 8 Oct 24 14 Oct 24 280.00

Final No 9 9 Apr 19 15 Apr 19 18.00 LIQUIDITY: Jul25 Avg 5m shares p.w., R193.3m(60.5% p.a.)

Final No 8 19 Mar 18 26 Mar 18 15.00

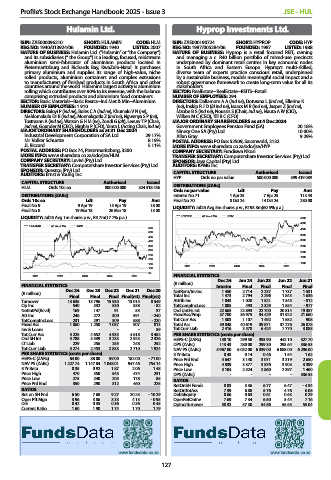

LIQUIDITY: Jul25 Avg 1m shares p.w., R3.7m(17.7% p.a.) HYPROP 40 Week MA REIV 5000

4500

HULAMIN 40 Week MA INDM

550

4000

500

3500

450

400 3000

350 2500

300

2000

250

1500

200

150 2021 2022 2023 2024 2025 1000

100

50

2021 2022 2023 2024 2025 FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

FINANCIAL STATISTICS (R million) Interim Final Final Final Final

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20 NetRent/InvInc 1 450 2 714 2 237 1 737 1 531

(R million)

Final Final Final Final(rst) Final(rst) Total Inc 1 473 2 794 2 296 1 843 1 636

Turnover 13 635 13 796 15 930 13 015 8 549 Attrib Inc 1 043 1 020 1 521 1 345 - 812

Op Inc 540 532 530 538 - 82 TotCompIncLoss 1 005 493 2 329 1 554 - 977

NetIntPd(Rcvd) 169 147 91 55 37 Ord UntHs Int 22 665 22 893 22 700 20 814 19 357

Att Inc 246 272 300 591 - 240 FixedAss/Prop 37 700 36 975 34 429 31 922 21 660

TotCompIncLoss 231 291 309 588 - 220 Tot Curr Ass 1 303 1 107 1 492 1 552 908

Fixed Ass 1 860 1 250 1 037 907 813 Total Ass 39 848 40 619 39 871 37 276 26 878

Inv & Loans - - - - 59 Tot Curr Liab 2 416 3 578 6 424 7 770 3 088

Tot Curr Ass 5 225 4 652 4 933 4 618 3 452 PER SHARE STATISTICS (cents per share)

Ord SH Int 3 788 3 539 3 233 2 923 2 326 HEPS-C (ZARc) 138.10 299.50 393.90 442.10 327.70

LT Liab 229 256 255 248 252 DPS (ZARc) 113.43 280.00 299.30 293.64 336.53

Tot Curr Liab 3 274 2 453 2 833 2 710 1 924 NAV PS (ZARc) 5 967.00 6 032.00 6 339.00 6 088.00 6 296.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.43 0.14 0.46 1.54 1.62

HEPS-C (ZARc) 64.00 88.00 99.00 182.00 - 71.00 Price Prd End 4 647 3 140 3 071 3 319 2 650

NAV PS (ZARc) 1 227.74 1 147.04 1 048.01 947.46 754.14 Price High 4 839 3 377 3 876 3 903 3 399

3 Yr Beta 0.35 0.92 1.87 2.06 1.48 Price Low 3 104 2 524 2 860 2 397 1 460

Price High 470 350 545 474 231 DPS (ZARc) - - - - 336.53

Price Low 275 240 205 178 85 RATIOS

Price Prd End 350 290 312 460 225 RetOnSH Funds 8.83 3.36 6.77 6.47 - 4.34

RATIOS RetOnTotAss 7.39 6.88 5.76 4.76 6.08

Ret on SH Fnd 6.50 7.68 9.27 20.23 - 10.29 Debt:Equity 0.66 0.63 0.61 0.63 0.29

Oper Pft Mgn 3.96 3.86 3.33 4.13 - 0.95 OperRetOnInv 7.69 7.34 6.50 5.44 7.16

D:E 0.42 0.35 0.36 0.36 0.45 OpInc:Turnover 58.32 57.30 54.86 55.65 55.04

Current Ratio 1.60 1.90 1.74 1.70 1.79

www.fundsdata.co.za www.fundsdata.co.za

127