Page 132 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 132

JSE - INV Profile’s Stock Exchange Handbook: 2025 - Issue 3

Invicta Holdings Ltd. iOCO Ltd.

ISIN: ZAE000029773 SHORT: INVICTA CODE: IVT ISIN: ZAE000071072

REG NO: 1966/002182/06 FOUNDED: 1966 LISTED: 1987 SHORT: IOCO

CODE: IOC

NATURE OF BUSINESS: The Invicta Group consists of five operational REG NO: 1998/014669/06

segments, namely: 1. Replacement parts, Services, & Solutions: FOUNDED: 1998

Industrial (“RPI: Industrial”); 2. Replacement parts, Services & LISTED: 1998

Solutions: Auto-agri (RPA: Auto-agri”); 3. Capital Equipment (“CE: NATURE OF BUSINESS: iOCO is a leading technology solutions provider

Capital equipment”); 4. Replacement parts, Services & Solutions: in Africa, offering IT and Operational Technology (OT) services, as

Earthmoving equipment (RPE: Earthmoving”); and 5. Kian Ann well as Outsourced Knowledge Solutions. Its services include IT-

Group. OT convergence, digital transformation, software development,

SECTOR: Inds--IndsGoods&Services--IndsSupptServ--Industrial Supplies cloud services, automation, data analytics, and IT infrastructure

NUMBER OF EMPLOYEES: 3 000 management. iOCO also provides workforce solutions, such as

DIRECTORS: Barnard C, Davidson F (ind ne), Makwana P M (ld ind ne), recruitment, payroll, and compliance, alongside fraud prevention,

Sherrell L (ne), van Heerden I (ne), Wally R A (ind ne), Wiese Adv J D cybersecurity, and Legal as a Service. Serving private and public

(ne), Wiese Dr C H (Chair, ne), Joffe S (CEO), Rajmohamed N (CFO) sectors, iOCO is expanding globally, delivering seamless digital

MAJOR ORDINARY SHAREHOLDERS as at 20 Aug 2024 enablement solutions across Africa, the Middle East, and Europe.

Titan Sharedealers (Pty) Ltd. 42.49% SECTOR: Technology--Technology--Software & CompSer--ComputerService

Foord Asset Management 5.81% NUMBER OF EMPLOYEES: 4 500

Sades Holdings (Pty) Ltd. 3.97% DIRECTORS: Marshall A B (ind ne), Mokou N (ind ne), Motloutsi V (ind ne),

POSTAL ADDRESS: PO Box 33431, Jeppestown, 2043 Moleketi P J (Chair, ne), Summerton R (Joint CEO), Venter D (Joint CEO),

MORE INFO: www.sharedata.co.za/sdo/jse/IVT Kooblall A (CFO)

COMPANY SECRETARY: Sade Lekena MAJOR ORDINARY SHAREHOLDERS as at 4 Apr 2025

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Lebashe Investment Group 17.00%

SPONSOR: Nedbank Corporate and Investment Banking, a division of HSBC Private Bank Suisse Omnibusclient 13.98%

Nedbank Ltd. Mianzo Asset Management (Pty) Ltd. 10.63%

AUDITORS: Ernst & Young POSTAL ADDRESS: PO Box 59, Bruma, 2026

CAPITAL STRUCTURE Authorised Issued EMAIL: ir@iocogroup.com

WEBSITE: ioco.tech

IVT Ords 5c ea 134 000 000 91 920 783 TELEPHONE: 011-607-8100

DISTRIBUTIONS [ZARc] COMPANY SECRETARY: Mpeo Nkuna

Ords 5c ea Ldt Pay Amt TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Final No 53 19 Aug 25 25 Aug 25 115.00 SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Final No 52 30 Jul 24 5 Aug 24 105.00 AUDITORS: Moore Johannesburg Inc.

LIQUIDITY: Jul25 Avg 480 781 shares p.w., R15.3m(27.2% p.a.) CAPITAL STRUCTURE Authorised Issued

IOC Ords no par value 7 500 000 000 638 083 421

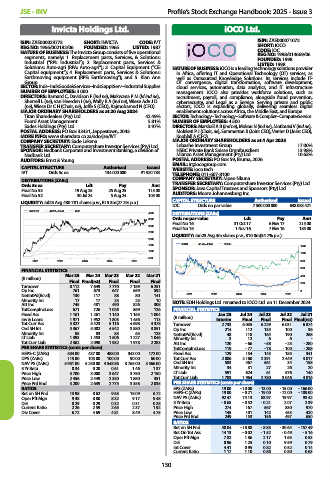

INVICTA 40 Week MA IIND

4000 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

3500

Final No 16 31 Oct 17 6 Nov 17 215.00

3000

Final No 15 1 Nov 16 7 Nov 16 185.00

2500

LIQUIDITY: Jun25 Avg 4m shares p.w., R10.0m(34.7% p.a.)

2000

1500 IOCO 40 Week MA SCOM 1200

1000

1000

500

2021 2022 2023 2024 2025 800

FINANCIAL STATISTICS 600

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 400

(R million)

Final Final(rst) Final Final Final

Turnover 8 112 7 649 7 770 7 189 6 251 200

Op Inc 761 673 647 659 592 0

NetIntPd(Rcvd) 130 117 88 80 141 2021 2022 2023 2024 2025

Minority Int 17 17 25 23 10 NOTE: EOH Holdings Ltd. renamed to iOCO Ltd. on 11 December 2024.

Att Inc 745 481 490 826 308

TotCompIncLoss 671 726 1 026 869 126 FINANCIAL STATISTICS

Fixed Ass 1 161 1 261 1 140 1 165 1 004 (R million) Jan 25 Jul 24 Jul 23 Jul 22 Jul 21

Inv & Loans 1 971 1 952 1 805 1 456 113 Interim Final Final Final Final(rst)

Tot Curr Ass 5 327 5 423 5 116 4 698 4 378 Turnover 2 733 6 035 6 229 6 031 6 874

Ord SH Int 5 367 5 002 4 542 3 880 3 851 Op Inc 214 112 135 100 36

Minority Int 85 83 85 63 125 NetIntPd(Rcvd) 48 118 164 190 268

LT Liab 1 393 1 453 1 506 1 227 1 046 Minority Int 3 12 6 6 -

Tot Curr Liab 2 362 2 090 1 932 1 978 2 283 Att Inc 120 - 66 - 58 - 25 - 280

PER SHARE STATISTICS (cents per share) TotCompIncLoss 119 - 77 - 78 - 100 - 288

HEPS-C (ZARc) 534.00 437.00 488.00 343.00 172.00 Fixed Ass 129 154 145 185 341

DPS (ZARc) 115.00 105.00 100.00 90.00 60.00 Tot Curr Ass 2 086 2 160 2 391 2 449 3 017

NAV PS (ZARc) 5 931.00 5 250.00 4 548.86 3 765.00 3 566.00 Ord SH Int 583 467 561 34 158

3 Yr Beta 0.34 0.20 0.61 1.46 1.37 Minority Int 34 31 27 26 20

Price High 3 700 3 000 3 647 3 750 2 150 LT Liab 591 624 61 576 140

Price Low 2 456 2 449 2 350 1 850 351 Tot Curr Liab 1 783 1 964 2 780 3 046 4 816

Price Prd End 3 200 2 639 2 775 3 358 2 035 PER SHARE STATISTICS (cents per share)

RATIOS EPS (ZARc) 19.00 - 10.00 - 13.00 - 15.00 - 166.00

Ret on SH Fnd 13.98 8.62 9.63 18.09 6.72 HEPS-C (ZARc) 19.00 - 0.21 - 19.00 - 72.00 - 109.00

Oper Pft Mgn 9.38 8.80 8.32 9.17 9.48 NAV PS (ZARc) 92.47 74.13 88.97 19.97 93.42

D:E 0.29 0.29 0.32 0.31 0.28 3 Yr Beta - 0.65 - 0.52 - 0.21 2.07 2.39

Current Ratio 2.26 2.59 2.65 2.37 1.92 Price High 274 167 567 830 970

Div Cover 6.72 4.69 4.81 8.49 4.75 Price Low 145 101 142 453 420

Price Prd End 249 153 156 497 650

RATIOS

Ret on SH Fnd 40.04 - 10.88 - 8.85 - 30.64 - 157.49

Ret On Tot Ass 14.13 - 0.02 - 1.52 - 0.49 - 5.16

Oper Pft Mgn 7.82 1.86 2.17 1.65 0.53

D:E 0.96 1.25 0.10 9.59 0.79

Int Cover 4.41 0.95 0.82 0.52 0.14

Current Ratio 1.17 1.10 0.86 0.80 0.63

130