Page 131 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 131

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - INV

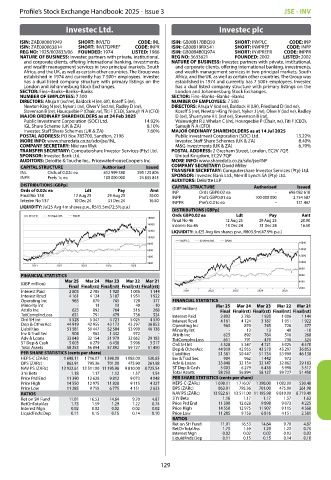

Investec Ltd. Investec plc

ISIN: ZAE000081949 SHORT: INVLTD CODE: INL ISIN: GB00B17BBQ50 SHORT: INVPLC CODE: INP

ISIN: ZAE000063814 SHORT: INVLTDPREF CODE: INPR ISIN: GB00B19RX541 SHORT: INVPREF CODE: INPP

REG NO: 1925/002833/06 FOUNDED: 1974 LISTED: 1986 ISIN: GB00B4B0Q974 SHORT: INVPREFR CODE: INPPR

NATURE OF BUSINESS: Investec partners with private, institutional, REG NO: 3633621 FOUNDED: 2002 LISTED: 2002

and corporate clients, offering international banking, investments, NATURE OF BUSINESS: Investec partners with private, institutional,

and wealth management services in two principal markets, South and corporate clients, offering international banking, investments,

Africa, and the UK, as well as certain other countries. The Group was and wealth management services in two principal markets, South

established in 1974 and currently has 7 500+ employees. Investec Africa, and the UK, as well as certain other countries. The Group was

has a dual listed company structure with primary listings on the established in 1974 and currently has 7 500+ employees. Investec

London and Johannesburg Stock Exchanges. has a dual listed company structure with primary listings on the

SECTOR: Fins--Banks--Banks--Banks London and Johannesburg Stock Exchanges.

NUMBER OF EMPLOYEES: 7 500 SECTOR: Fins--Banks--Banks--Banks

DIRECTORS: Ahuja V (ind ne), Baldock H (ne, UK), Koseff S (ne), NUMBER OF EMPLOYEES: 7 500

Newton-King N (ne), Nyker J (ne), Olver V (ind ne), Radley D (ne), DIRECTORS: Ahuja V (ind ne), Baldock H (UK), Friedland D (ind ne),

Stevenson B (ne), Hourquebie P (Chair, ne), Titi F (CEO), Samujh N A (CFO) Koseff S (ne), Newton-King N (ne), Nyker J (ne), Olver V (ind ne), Radley

MAJOR ORDINARY SHAREHOLDERS as at 24 Feb 2025 D (ne), Shuenyane K L (ind ne), Stevenson B (ne),

Public Investment Corporation (SOC) Ltd. 14.92% Wainwright R J, Whelan C (Ire), Hourquebie P (Chair, ne), Titi F (CEO),

IGL Share Scheme (UK & ZA) 8.10% Samujh N A (CFO)

Investec Staff Share Schemes (UK & ZA) 7.60% MAJOR ORDINARY SHAREHOLDERS as at 14 Jul 2025

POSTAL ADDRESS: PO Box 785700, Sandton, 2196 Public Investment Corporation (SOC) Ltd. 13.22%

MORE INFO: www.sharedata.co.za/sdo/jse/INL Investec Staff Share Schemes (UK & ZA) 8.40%

COMPANY SECRETARY: Niki van Wyk M&G Investments (UK & ZA) 6.70%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: 2 Gresham Street, London, EC2V 7QP,

SPONSOR: Investec Bank Ltd. United Kingdom, EC2V 7QP

AUDITORS: Deloitte & Touche Inc., PricewaterhouseCoopers Inc. MORE INFO: www.sharedata.co.za/sdo/jse/INP

CAPITAL STRUCTURE Authorised Issued COMPANY SECRETARY: David Miller

INL Ords of 0.02c ea 612 999 388 295 125 806 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

INPR Prefs 1c ea 100 000 000 24 835 843 SPONSOR: Investec Bank Ltd., Merrill Lynch SA (Pty) Ltd.

AUDITORS: Deloitte LLP

DISTRIBUTIONS [GBPp] CAPITAL STRUCTURE Authorised Issued

Ords of 0.02c ea Ldt Pay Amt INP Ords GBP0.02 ea - 696 082 618

Final No 138 12 Aug 25 29 Aug 25 20.00 INPP Prefs GBP0.01 ea 100 000 000 2 754 587

Interim No 137 10 Dec 24 31 Dec 24 16.50 INPPR Prefs 0.01c ea - 131 447

LIQUIDITY: Jul25 Avg 4m shares p.w., R515.5m(72.5% p.a.)

DISTRIBUTIONS [GBPp]

INVLTD 40 Week MA BANK Ords GBP0.02 ea Ldt Pay Amt

16000

Final No 46 12 Aug 25 29 Aug 25 20.00

14000 Interim No 45 10 Dec 24 31 Dec 24 16.50

12000 LIQUIDITY: Jul25 Avg 6m shares p.w., R803.5m(47.9% p.a.)

10000

INVPLC 40 Week MA BANK

8000 16000

14000

6000

12000

4000

2000 10000

2021 2022 2023 2024 2025

8000

FINANCIAL STATISTICS 6000

Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

(GBP million) 4000

Final Final(rst) Final(rst) Final(rst) Final(rst) 2000

Interest Paid 2 803 2 785 1 920 1 006 1 144 2021 2022 2023 2024 2025

Interest Rcvd 4 161 4 124 3 187 1 951 1 922

Operating Inc 963 870 745 728 377 FINANCIAL STATISTICS

Minority Int - 13 13 40 - 10 Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

Attrib Inc 623 892 764 516 268 (GBP million) Final Final(rst) Final(rst) Final(rst) Final(rst)

TotCompIncLoss 651 791 479 738 524 Interest Paid 2 803 2 785 1 920 1 006 1 144

Ord SH Int 5 528 5 347 4 721 5 025 4 570 Interest Rcvd 4 161 4 124 3 187 1 951 1 922

Dep & OtherAcc 44 919 42 955 43 173 43 297 36 853 Operating Inc 963 870 745 728 377

Liabilities 51 581 50 447 52 584 53 990 46 138 Minority Int - 13 13 40 - 10

Inv & Trad Sec 904 962 1 442 972 - Attrib Inc 623 892 764 516 268

Adv & Loans 33 848 32 154 31 979 32 862 29 183 TotCompIncLoss 651 791 479 738 524

ST Dep & Cash 5 003 6 279 6 438 5 998 3 517 Ord SH Int 5 528 5 347 4 721 5 025 4 570

Total Assets 58 253 56 894 57 892 59 727 51 450 Dep & OtherAcc 44 919 42 955 43 519 43 297 36 853

PER SHARE STATISTICS (cents per share) Liabilities 51 581 50 447 51 734 53 990 46 138

HEPS-C (ZARc) 1 698.11 1 716.07 1 398.00 1 083.00 530.85 Inv & Trad Sec 904 962 1 442 972 -

DPS (ZARc) 863.91 795.36 701.00 475.90 261.98 Adv & Loans 33 848 32 154 32 147 32 862 29 183

NAV PS (ZARc) 13 922.61 13 511.00 11 195.98 9 810.00 8 725.54 ST Dep & Cash 5 003 6 279 6 438 5 998 3 517

3 Yr Beta 1.18 1.17 1.12 1.57 1.54 Total Assets 58 253 56 894 58 127 59 727 51 450

Price Prd End 11 390 12 628 9 812 9 073 4 048 PER SHARE STATISTICS (cents per share)

Price High 14 550 12 975 11 828 9 115 4 327 HEPS-C (ZARc) 1 698.11 1 716.07 1 398.00 1 083.00 530.48

Price Low 11 285 9 758 6 775 4 151 2 633 DPS (ZARc) 863.91 795.36 701.00 475.90 261.98

RATIOS NAV PS (ZARc) 13 922.61 13 511.00 11 195.98 9 810.00 8 719.49

Ret on SH Fund 11.01 16.53 14.64 9.70 4.87 3 Yr Beta 1.18 1.17 1.17 1.57 1.63

RetOnTotalAss 1.73 1.59 1.29 1.22 0.74 Price Prd End 11 390 12 628 9 898 9 073 4 225

Interest Mgn 0.02 0.02 0.02 0.02 0.02 Price High 14 550 12 975 11 907 9 115 4 568

LiquidFnds:Dep 0.11 0.15 0.15 0.14 0.10 Price Low 11 285 9 758 6 816 4 151 2 581

RATIOS

Ret on SH Fund 11.01 16.53 14.64 9.70 4.87

RetOnTotalAss 1.73 1.59 1.29 1.22 0.74

Interest Mgn 0.02 0.02 0.02 0.02 0.02

LiquidFnds:Dep 0.11 0.15 0.15 0.14 0.10

129