Page 130 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 130

JSE - IMP Profile’s Stock Exchange Handbook: 2025 - Issue 3

Impala Platinum Holdings Ltd. Insimbi Industrial Holdings Ltd.

ISIN: ZAE000083648 ISIN: ZAE000116828

SHORT: IMPLATS SHORT: INSIMBI

CODE: IMP CODE: ISB

REG NO: 1957/001979/06 REG NO: 2002/029821/06

FOUNDED: 1957 FOUNDED: 2008

LISTED: 1973 LISTED: 2008

NATURE OF BUSINESS: Impala Platinum Holdings Ltd. is principally NATURE OF BUSINESS: Insimbi is a group of companies that

in the business of producing and supplying platinum group metals sustainably source, process, beneficiate & recycle metals. The core

(PGMs) to industrial economies. business expertise is the ability to source and provide local, regional

SECTOR: Basic Materials--Basic Resrcs--PreciousMet&Min--Plat&PrecMet and global industrial consumers with the required commodity over

NUMBER OF EMPLOYEES: 66 253 its four distinct business segments.

DIRECTORS: Earp D (ind ne), Havenstein R (ind ne), Koshane B T (ne), SECTOR: Basic Materials--Basic Resrcs--Ind Met & Min--Nonferrous Met

Mawasha B (ind ne), Moshe M (ind ne), Mufamadi Dr F S (ind ne), Nkeli NUMBER OF EMPLOYEES: 400

M E K (ind ne), Samuel L, Speckmann P (ind ne), Swanepoel B Z (ld ind DIRECTORS: Winde N (CFO), Botha F (CEO), Dickerson R I (Chair, ld ind ne),

ne), Orleyn Adv N D B (Chair, ind ne), Muller N J (CEO), Kerber M (CFO) Mwale N (ne), Ntshingila C S (ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 30 May 2025 MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2025

Public Investment Corporation 14.57% NS Investco 24.78%

FMR LLC 9.42% African Goshawk (Pty) Ltd. 11.14%

Lingotto 6.46% Pruta Securities 10.40%

POSTAL ADDRESS: Private Bag X18, Northlands, 2116 POSTAL ADDRESS: PO Box 14676, Wadeville, 1422

EMAIL: investor@implats.co.za EMAIL: cosec@insimbi-alloys.co.za

WEBSITE: www.implats.co.za WEBSITE: insimbi-group.co.za

TELEPHONE: 011-731-9000 TELEPHONE: 011-902-6930

COMPANY SECRETARY: Tebogo Llale COMPANY SECRETARY: Fluidrock Governance Group (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Nedbank Corporate and Investment Banking SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche Inc. AUDITORS: Moore Cape Town Inc.

CAPITAL STRUCTURE Authorised Issued CAPITAL STRUCTURE Authorised Issued

IMP Ords no par value 1 044 008 000 904 368 485 ISB Ords 0.000025c ea 12 000 000 000 330 898 356

DISTRIBUTIONS [ZARc] DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Ords 0.000025c ea Ldt Pay Amt

Final No 99 19 Sep 23 26 Sep 23 165.00 Interim No 22 14 Nov 23 20 Nov 23 2.50

Interim No 98 20 Mar 23 27 Mar 23 420.00 Final No 21 4 Jul 23 10 Jul 23 5.00

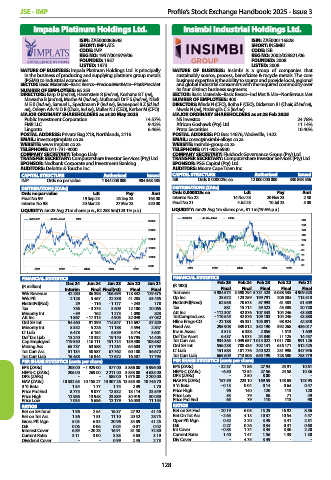

LIQUIDITY: Jun25 Avg 21m shares p.w., R2 258.5m(123.1% p.a.) LIQUIDITY: Jun25 Avg 1m shares p.w., R1.1m(19.6% p.a.)

IMPLATS 40 Week MA MINI INSIMBI 40 Week MA INDM 140

30000

130

25000 120

110

20000

100

90

15000

80

70

10000

60

5000 50

2021 2022 2023 2024 2025 2021 2022 2023 2024 2025

FINANCIAL STATISTICS FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Feb 25 Feb 24 Feb 23 Feb 22 Feb 21

(R million) (R ’000)

Interim Final Final(rst) Final Final Final Final Final Final Final

Wrk Revenue 42 280 86 398 106 594 118 332 129 575 Turnover 4 984 574 5 590 294 5 731 423 6 058 535 4 909 528

Wrk Pft 2 128 5 467 22 338 41 285 53 455 Op Inc 25 672 123 259 199 791 206 504 113 518

NetIntPd(Rcd) 29 - 116 - 1 177 - 243 178 NetIntPd(Rcvd) 62 558 70 673 57 993 61 483 51 509

Tax 736 - 3 275 3 609 12 100 20 065 Tax 881 15 714 39 522 45 389 20 750

Minority Int - 59 162 1 273 1 090 823 Att Inc - 112 307 42 876 107 343 104 246 43 880

Att Inc 1 867 - 17 313 4 905 32 049 47 032 TotCompIncLoss - 110 545 42 876 109 103 104 246 43 880

Ord SH Int 94 460 91 399 114 847 114 697 87 829 Hline Erngs-CO - 22 188 45 331 105 891 98 924 42 848

Minority Int 5 352 5 226 11 188 4 594 2 847 Fixed Ass 295 908 339 812 352 190 392 268 436 017

LT Liab 6 478 6 154 6 539 3 414 3 601 Inv in Assoc 3 513 6 338 2 856 1 513 1 609

Def Tax Liab 13 240 13 332 19 140 16 795 14 405 Def Tax Asset 6 437 5 073 24 840 11 125 14 457

Cap Employed 119 530 116 111 151 714 139 500 108 682 Tot Curr Ass 934 365 1 049 657 1 015 022 1 011 708 991 126

Mining Ass 65 737 63 588 71 264 64 603 57 799 Ord SH Int 556 238 708 435 702 141 616 171 512 425

Tot Curr Ass 51 134 50 587 67 762 60 180 56 672 LT Liab 151 585 181 776 240 522 251 998 347 946

Tot Curr Liab 16 458 16 844 17 672 16 587 17 793 Tot Curr Liab 665 609 713 506 650 199 728 580 763 779

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

EPS (ZARc) 208.00 - 1 929.00 577.00 3 856.00 5 996.00 EPS (ZARc) - 32.37 11.86 27.94 25.91 10.61

HEPS-C (ZARc) 206.00 269.00 2 211.00 3 853.00 4 635.00 HEPS-C (ZARc) - 6.50 12.54 27.56 24.58 10.36

DPS (ZARc) - - 585.00 1 575.00 2 200.00 DPS (ZARc) - 2.50 8.00 - -

NAV (ZARc) 10 532.65 10 158.27 13 307.26 13 555.48 10 746.70 NAV PS (ZARc) 157.59 223.10 169.59 143.69 123.95

3 Yr Beta 1.54 1.77 1.74 2.39 1.70 3 Yr Beta - 0.13 0.04 0.14 0.64 0.47

Price Prd End 8 775 9 077 12 532 18 114 23 549 Price High 96 140 120 113 120

Price High 12 986 13 948 23 889 30 919 30 050 Price Low 53 79 86 71 49

Price Low 7 035 5 686 12 179 16 053 11 154 Price Prd End 65 79 110 113 90

RATIOS RATIOS

Ret on SH fund 1.96 2.64 16.37 27.92 41.40 Ret on SH Fnd - 20.19 6.05 15.29 16.92 8.56

Ret on Tot Ass 1.36 1.81 11.10 20.52 28.75 Ret On Tot Ass - 2.65 4.13 10.37 10.54 4.47

Gross Pft Mgn 5.03 6.33 20.96 34.89 41.25 Oper Pft Mgn 0.52 2.20 3.49 3.41 2.31

D:E 0.06 0.06 0.04 0.01 0.02 D:E 0.27 0.26 0.34 0.41 0.68

Interest Cover 6.89 - 20.28 16.91 81.50 72.80 Int Cover - 0.83 1.74 3.45 3.36 2.20

Current Ratio 3.11 3.00 3.83 3.63 3.19 Current Ratio 1.40 1.47 1.56 1.39 1.30

Dividend Cover - - 0.99 2.45 2.73 Div Cover - 4.75 3.49 - -

128