Page 124 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 124

JSE - GRO Profile’s Stock Exchange Handbook: 2025 - Issue 3

Growthpoint Properties Ltd. Hammerson plc

ISIN: ZAE000179420 SHORT: GROWPNT CODE: GRT ISIN: GB00BK7YQK64 SHORT: HAMMERSON CODE: HMN

REG NO: 1987/004988/06 FOUNDED: 1987 LISTED: 1987 REG NO: 360632 FOUNDED: 1940 LISTED: 2016

NATURE OF BUSINESS: Growthpoint is the largest South African NATURE OF BUSINESS: Hammerson is the largest UK-listed, pure-

primary JSE-listed REIT with a quality portfolio of 528 (FY23: 535) play owner and manager of prime retail and leisure anchored city

properties across three major business units: destinations across the UK, France and Ireland.

*South Africa (SA) SECTOR: RealEstate--RealEstate--REITS--Retail

*Growthpoint Investment Partners (GIP) NUMBER OF EMPLOYEES: 138

*Offshore portfolio. DIRECTORS: Annous H (ind ne), Brunel M (ind ne, Fr), Butterworth M

The South African business, representing 53.7% of total property (snr ind ne, UK), Metz A (ind ne, USA), Welch C (ind ne, UK), Noel R

assets, is diversified across the retail, office, industrial, and trading (Chair, ne, UK), Gagné R (CE, Can), Raja H (CFO)

and development (T&D) sectors, located in economic nodes in the MAJOR ORDINARY SHAREHOLDERS as at 10 Feb 2025

major metropolitan areas. It also includes a 50% investment in the APG Asset Management NV 19.97%

V&A Waterfront (V&A) which is a mixed-use portfolio in Cape Town. Coronation Fund Managers 7.12%

The T&D sector develops commercial property for Growthpoint’s BlackRock, Inc. 4.99%

own balance sheet as well as for third parties. POSTAL ADDRESS: Marble Arch House, 66 Seymour Street, London,

SECTOR: RealEstate--RealEstate--REITS--Diversified W1H 5BX

NUMBER OF EMPLOYEES: 649 MORE INFO: www.sharedata.co.za/sdo/jse/HMN

DIRECTORS: Berkeley F M (ind ne), Hamman M (ind ne), Lebina K P COMPANY SECRETARY: Alex Dunn

(ind ne), Raphiri C D (ind ne), Sangqu A H (ld ind ne), Wilton E (ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Gasant R (Chair, ind ne), Sasse L N (Group CE), de Klerk E K (MD), AUDITORS: PwC LLP

Völkel G (FD) CAPITAL STRUCTURE Authorised Issued

MAJOR ORDINARY SHAREHOLDERS as at 8 May 2025 HMN Ords of 5p ea - 488 884 956

Public Investment Corporation (PIC) obo GEPF 19.00%

Ninety One SA (Pty) Ltd. 10.10% DISTRIBUTIONS [GBPp]

Old Mutual Investment Group (SA) (Pty) Ltd. 6.20% Ords of 5p ea Ldt Pay Amt

POSTAL ADDRESS: PO Box 78949, Sandton, 2146 Final No 15 22 Apr 25 3 Jun 25 8.07

MORE INFO: www.sharedata.co.za/sdo/jse/GRT Interim No 14 20 Aug 24 30 Sep 24 7.56

COMPANY SECRETARY: Johan de Koker LIQUIDITY: Jul25 Avg 3m shares p.w., R188.4m(29.7% p.a.)

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd. HAMMERSON 40 Week MA REIV

AUDITORS: Ernst & Young Inc. 200000

CAPITAL STRUCTURE Authorised Issued

GRT Ords no par value 5 000 000 000 3 430 787 066 150000

DISTRIBUTIONS [ZARc] 100000

Ords no par Ldt Pay Amt

Interim No 78 14 Apr 25 22 Apr 25 61.00

Final No 77 15 Oct 24 21 Oct 24 58.30 50000

LIQUIDITY: Jul25 Avg 54m shares p.w., R700.2m(81.3% p.a.)

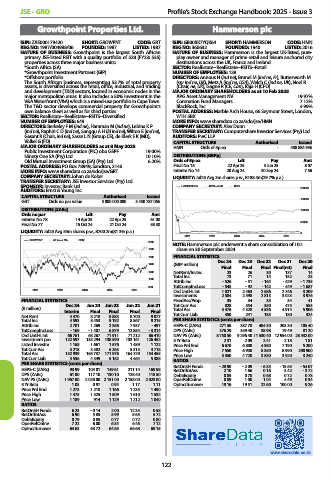

2021 2022 2023 2024 2025 0

GROWPNT 40 Week MA REIV

2000

NOTE: Hammerson plc underwent a share consolidation of 10:1

1800 share on 30 September 2024.

1600 FINANCIAL STATISTICS

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

1400 (GBP million)

Final Final Final Final(rst) Final

1200 NetRent/InvInc 23 26 30 137 14

Total Inc 73 71 14 152 23

1000 Attrib Inc - 526 - 51 - 164 - 429 - 1 735

TotCompIncLoss - 545 - 92 - 142 - 449 - 1 687

800

2021 2022 2023 2024 2025 Ord UntHs Int 1 821 2 463 2 586 2 746 3 209

Investments 2 584 2 598 2 813 3 023 3 976

FINANCIAL STATISTICS FixedAss/Prop 35 34 35 34 41

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 Tot Curr Ass 828 554 350 475 553

(R million) Total Ass 3 476 4 328 4 536 4 914 5 906

Interim Final Final Final Final

Net Rent 4 470 8 218 8 883 8 700 9 077 Tot Curr Liab 450 241 185 180 324

Total Inc 4 593 8 453 9 192 8 867 9 215 PER SHARE STATISTICS (cents per share)

Attrib Inc 2 701 1 269 2 356 7 937 - 497 HEPS-C (ZARc) 271.56 387.70 484.30 203.30 105.40

TotCompIncLoss - 169 - 1 407 6 879 12 854 - 3 314 DPS (ZARc) 376.29 359.40 38.98 79.49 81.20

Ord UntHs Int 66 761 68 267 71 911 71 212 66 410 NAV PS (ZARc) 8 750.50 9 296.40 11 530.40 12 954.00 28 432.00

Investment pro 122 597 135 294 138 590 133 161 126 452 3 Yr Beta 2.31 2.09 2.41 2.18 1.81

Listed Investm 1 168 1 661 1 576 1 489 1 122 Price Prd End 6 670 6 800 4 950 7 190 5 200

Tot Curr Ass 3 218 3 582 5 263 5 315 4 718 Price High 7 550 6 930 8 350 8 990 290 900

Total Ass 152 939 165 737 171 976 164 729 154 455 Price Low 5 350 4 720 3 530 3 920 3 240

Tot Curr Liab 3 556 4 349 5 162 4 464 5 388 RATIOS

PER SHARE STATISTICS (cents per share) RetOnSH Funds - 28.90 - 2.09 - 6.35 - 15.63 - 54.07

HEPS-C (ZARc) 93.99 104.01 149.61 211.14 169.98 RetOnTotAss 2.10 1.66 0.16 3.42 - 3.72

DPS (ZARc) 61.00 117.10 130.10 128.40 118.50 Debt:Equity 0.85 0.70 0.68 0.72 0.78

NAV PS (ZARc) 1 967.00 2 020.00 2 151.00 2 158.00 2 023.00 OperRetOnInv 0.89 1.00 1.04 4.49 0.34

3 Yr Beta 1.03 0.97 0.94 1.17 1.11 OpInc:Turnover 19.16 19.51 22.60 100.00 9.26

Price Prd End 1 273 1 218 1 166 1 235 1 490

Price High 1 475 1 325 1 509 1 610 1 532

Price Low 1 189 914 1 129 1 212 1 040

RATIOS

RetOnSH Funds 6.23 - 0.14 2.00 12.35 0.58

RetOnTotAss 6.90 5.85 5.99 5.65 5.72

Debt:Equity 0.79 0.85 0.77 0.72 0.80

OperRetOnInv 7.22 6.00 6.34 6.46 7.12

OpInc:Turnover 64.63 63.72 64.65 66.68 69.15

www.sharedata.co.za

122