Page 119 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 119

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - FRO

Frontier Transport Holdings Ltd. Gemfields Group Ltd.

ISIN: ZAE000300505 SHORT: FRONTIERT CODE: FTH ISIN: GG00BG0KTL52 SHORT: GEMFIELDS CODE: GML

REG NO: 2015/250356/06 FOUNDED: 2015 LISTED: 2018 REG NO: 47656 FOUNDED: 2007 LISTED: 2008

NATURE OF BUSINESS: The current portfolio is rooted in the NATURE OF BUSINESS: Gemfields is a world-leading responsible

commuter bus and luxury coach segments. Through its principal miner and marketer of coloured gemstones. Gemfields is the

subsidiary Golden Arrow Bus Services, with over 160 years of operator and 75% owner of both the Kagem emerald mine in

proven operational expertise. The company aims to harness the Zambia (believed to be the world’s single largest producing

combined institutional knowledge and skills sets to pursue further emerald mine) and the Montepuez ruby mine in Mozambique

prospects in bus and coach operations and potential entrées into (one of the most significant recently discovered ruby deposits in

freight, rail and logistics operations. the world). In addition, Gemfields also holds controlling interests

SECTOR: ConsDisr--Travel&Leis--Travel&Leis--Travel&Tour in various other gemstone mining and prospecting licences in

NUMBER OF EMPLOYEES: 0 Zambia, Mozambique, Ethiopia and Madagascar.

DIRECTORS: Govender K (ne), Govender L (ld ind ne), Magugu M F SECTOR: Basic Materials--Basic Resrcs--Precious Met & Min--Dia & Gem

(ind ne), Seftel L (ind ne), Watson R D (ind ne), Shaik Y (Chair, ne), NUMBER OF EMPLOYEES: 3 783

Meyer F E (CEO), Wilkin M L (CFO) DIRECTORS: Daly K (ne), du Preez L J (ne), Mmela K (ld ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2024 Reilly M (ind ne, UK), Sacco P E (ne), Scott S (ind ne),

HCI 81.88% Cleaver B (Chair, ne), Gilbertson S (CEO), Lovett D (CFO, UK)

POSTAL ADDRESS: PO Box 115, Cape Town, 8000 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2024

MORE INFO: www.sharedata.co.za/sdo/jse/FTH Assore International Holdings Ltd. 29.14%

COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd. Rational Expectations (Pty) Ltd. 13.82%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Oasis Group Holdings 7.74%

SPONSOR: Investec Bank Ltd. POSTAL ADDRESS: PO Box 186, Royal Chambers, St. Julian’s Avenue,

AUDITORS: BDO Cape Inc. St. Peter Port, Guernsey, Channel Islands, GY1 4HP

CAPITAL STRUCTURE Authorised Issued MORE INFO: www.sharedata.co.za/sdo/jse/GML

FTH Ords no par val 1 000 000 000 293 291 217 COMPANY SECRETARY: Toby Hewitt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DISTRIBUTIONS [ZARc] SPONSOR: Investec Bank Ltd.

Ords no par val Ldt Pay Amt AUDITORS: Ernst & Young LLP

Final No 14 17 Jun 25 23 Jun 25 37.20 CAPITAL STRUCTURE Authorised Issued

Interim No 13 10 Dec 24 17 Dec 24 25.90 GML Ords USD0.001c ea - 1 724 230 526

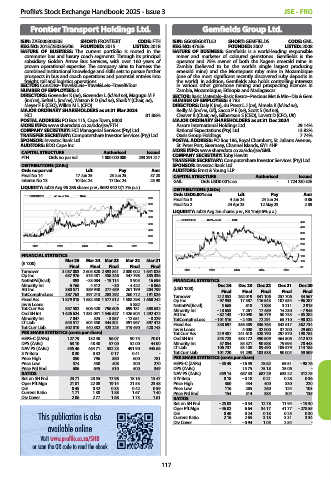

LIQUIDITY: Jul25 Avg 96 286 shares p.w., R692 942.0(1.7% p.a.)

DISTRIBUTIONS [USDc]

FRONTIERT 40 Week MA TRAV Ords USD0.001c ea Ldt Pay Amt

900

Final No 3 4 Jun 24 24 Jun 24 0.86

800 Final No 2 24 Apr 23 12 May 23 2.88

700 LIQUIDITY: Jul25 Avg 2m shares p.w., R3.1m(5.6% p.a.)

600

GEMFIELDS 40 Week MA MINI

500 450

400

400

350

300

300

200

2021 2022 2023 2024 2025 250

200

FINANCIAL STATISTICS 150

(R ’000) Mar 25 Mar 24 Mar 23 Mar 22 Mar 21 100

Final Final Final Final Final 50

Turnover 3 037 003 2 605 820 2 393 841 2 080 002 1 641 025 2021 2022 2023 2024 2025

Op Inc 637 976 575 481 458 248 447 798 385 336

NetIntPd(Rcvd) 893 - 33 084 - 19 114 3 905 16 695 FINANCIAL STATISTICS

Minority Int 6 766 4 512 - 30 - 4 422 - 6 066 Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

Att Inc 380 571 389 940 277 489 261 199 204 799 (USD ’000) Final Final Final Final Final

TotCompIncLoss 387 763 397 213 283 292 260 772 191 026 Turnover 212 852 262 019 341 106 257 706 34 567

Fixed Ass 1 879 818 1 682 550 1 577 512 1 588 298 1 660 242 Op Inc - 97 953 17 387 116 543 107 634 - 96 287

Inv & Loans - - - 5 882 - NetIntPd(Rcvd) 5 668 818 1 888 3 211 2 915

Tot Curr Ass 857 582 606 420 796 606 699 181 588 632 Minority Int - 18 653 7 261 17 489 14 230 - 7 945

Ord SH Int 1 626 624 1 381 031 1 546 627 1 426 504 1 292 472 Att Inc - 82 143 - 10 090 56 779 50 733 - 85 282

Minority Int 7 047 525 - 3 857 - 12 651 - 8 229 TotCompIncLoss - 101 516 - 2 405 72 291 65 710 - 90 322

LT Liab 643 517 504 350 444 301 491 967 597 413 Fixed Ass 338 697 356 589 336 765 342 617 362 734

Tot Curr Liab 502 810 440 382 423 225 419 490 420 743 Inv & Loans - 4 000 32 000 37 200 29 600

PER SHARE STATISTICS (cents per share) Tot Curr Ass 219 487 241 618 328 790 297 570 198 783

HEPS-C (ZARc) 127.79 132.40 96.07 90.75 70.01 Ord SH Int 345 723 438 172 490 509 464 506 412 573

DPS (ZARc) 63.10 48.40 57.00 52.00 44.00 Minority Int 57 054 85 321 90 588 79 695 70 443

NAV PS (ZARc) 555.46 464.71 532.23 491.90 445.68 LT Liab 106 737 83 108 89 490 109 579 114 185

3 Yr Beta 0.30 0.32 0.17 0.41 - Tot Curr Liab 101 720 91 290 103 538 90 004 59 509

Price High 850 796 580 600 781 PER SHARE STATISTICS (cents per share)

Price Low 574 450 408 300 270 HEPS-C (ZARc) - 38.49 - 16.59 78.62 69.51 - 98.76

Price Prd End 686 645 510 500 349 DPS (ZARc) - 15.75 75.18 25.06 -

RATIOS NAV PS (ZARc) 559.14 687.33 687.29 633.22 512.75

Ret on SH Fnd 23.71 28.55 17.98 18.16 15.47 3 Yr Beta 0.18 - 0.18 0.21 0.28 0.36

Oper Pft Mgn 21.01 22.08 19.14 21.53 23.48 Price High 360 434 400 330 220

D:E 0.45 0.42 0.35 0.42 0.59 Price Low 116 285 260 124 103

Current Ratio 1.71 1.38 1.88 1.67 1.40 Price Prd End 154 314 385 304 135

Div Cover 2.06 2.77 1.68 1.73 1.61 RATIOS

Ret on SH Fnd - 25.03 - 0.54 12.78 11.94 - 19.30

Oper Pft Mgn - 46.02 6.64 34.17 41.77 - 278.55

This publication is also D:E 0.40 0.24 0.18 0.25 0.30

3.18

3.31

3.34

Current Ratio

2.16

2.65

available online Div Cover - - 0.94 1.05 2.54 -

Visit www.profile.co.za/SHB

or scan the QR code to read the ebook

117