Page 122 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 122

JSE - GOL Profile’s Stock Exchange Handbook: 2025 - Issue 3

Goldrush Holdings Ltd. Grand Parade Investments Ltd.

ISIN: ZAE000145041 SHORT: GOLDRUSH CODE: GRSP ISIN: ZAE000119814 SHORT: GRANPRADE CODE: GPL

REG NO: 2009/012403/06 FOUNDED: 2009 LISTED: 2010 REG NO: 1997/003548/06 FOUNDED: 1997 LISTED: 2008

NATURE OF BUSINESS: Goldrush Holdings Ltd. was established in NATURE OF BUSINESS: Grand Parade Investments (“GPI”) is an

2009 as a joint venture between Regarding Capital Management investor in quality assets in the gaming sector. The Company

(Pty) Ltd. (“RECM”) (a fund management firm) and Calibre Capital was founded in 1997 for the purpose of partnering with Sun

(RF) (Pty) Ltd. (“Calibre”) (a private equity firm). The listing of the International South Africa (Pty) Ltd. as its primary black economic

non-cumulative redeemable participating preference shares (JSE empowerment partner in the Western Cape. R28 million was raised

share code: “RACP”) was successfully completed in June 2010. RAC from over 10 000 previously disadvantaged community members.

and RECM are controlled by Piet Viljoen and Jan van Niekerk and Since then, GPI has grown its investment portfolio within the

they, together with Theunis de Bruyn, control Calibre. gaming industry and currently holds interests in some of the best

SECTOR: Add--Debt--Preference Shares--Pref Shares performing gaming assets in South Africa. GPI listed on the main

NUMBER OF EMPLOYEES: 0 board of the JSE in 2008.

DIRECTORS: Rossini T (ind ne), Viljoen P G, Walters R (ind ne), SECTOR: ConsDisr--Travel&Leis--Travel&Leis--Casino&Gambling

Matlala Z (Chair, ind ne), Van Niekerk J C (FD) NUMBER OF EMPLOYEES: 0

MAJOR PREFERENCE SHAREHOLDERS as at 31 Mar 2025 DIRECTORS: Finch K (ind ne), Geach Prof W (ind ne), Kader R (ld ind ne),

Astoria Investment Ltd. 16.50% Tajbhai M (ne), Orrie G (Chair, ne), Bortz G M (CEO), Ahmed G (FD)

Maximus Corporation (Pty) Ltd. 7.00% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2024

Steyn Capital SNN QI Hedge Fund 5.90% GMB Liquidity Corporation (Pty) Ltd. 51.54%

POSTAL ADDRESS: PO Box 44, Greenpoint, 8001 Sun International Ltd. 22.98%

MORE INFO: www.sharedata.co.za/sdo/jse/GRSP GPI Management Services (Pty) Ltd. 5.14%

COMPANY SECRETARY: Guy Simpson POSTAL ADDRESS: PO Box 6563, Roggebaai, 8012

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/GPL

SPONSOR: Questco (Pty) Ltd. COMPANY SECRETARY: Statucor (Pty) Ltd.

AUDITORS: Forvis Mazars TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued SPONSOR: PSG Capital (Pty) Ltd.

GRSP Prefs no par value 200 000 000 45 453 457 AUDITORS: Moore Cape Town Inc.

LIQUIDITY: Jul25 Avg 66 877 shares p.w., R446 585.9(7.7% p.a.) CAPITAL STRUCTURE Authorised Issued

GPL Ords 0.025c ea 2 000 000 000 466 827 641

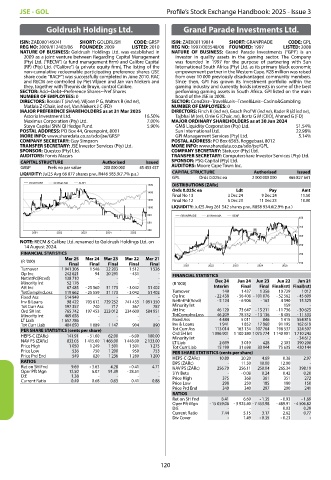

GOLDRUSH 40 Week MA ALSH

1600 DISTRIBUTIONS [ZARc]

Ords 0.025c ea Ldt Pay Amt

1400

Final No 13 3 Dec 24 9 Dec 24 11.50

1200 Final No 12 5 Dec 23 11 Dec 23 10.00

1000 LIQUIDITY: Jul25 Avg 261 542 shares p.w., R858 934.6(2.9% p.a.)

800 GRANPRADE 40 Week MA GENF

400

600

350

400

2021 2022 2023 2024 2025

300

NOTE: RECM & Calibre Ltd. renamed to Goldrush Holdings Ltd. on

14 August 2024. 250

FINANCIAL STATISTICS 200

(R ’000) Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

Final Final Final Final Final 2021 2022 2023 2024 2025 150

Turnover 1 941 306 1 548 22 203 1 512 1 526

Op Inc 242 621 94 20 291 - 431 - FINANCIAL STATISTICS

NetIntPd(Rcvd) 138 710 - - - -

Minority Int 52 176 - - - - (R ’000) Dec 24 Jun 24 Jun 23 Jun 22 Jun 21

Att Inc 67 485 - 25 560 31 173 - 3 042 51 402 Interim Final Final Final(rst) Final(rst)

TotCompIncLoss 119 662 - 25 559 31 173 - 3 042 51 402 Turnover 149 1 437 1 356 10 729 1 012

Fixed Ass 514 949 - - - - Op Inc - 22 438 - 56 408 - 101 076 - 52 562 - 45 609

Inv & Loans 98 422 703 612 729 252 741 433 1 091 350 NetIntPd(Rcvd) - 5 124 - 6 906 - 163 4 590 15 325

Tot Curr Ass 197 357 740 717 367 787 Minority Int - - - 159 -

Ord SH Int 765 742 197 453 223 012 234 600 584 951 Att Inc 46 120 73 647 - 15 211 - 11 736 - 30 625

Minority Int 469 656 - - - - TotCompIncLoss 46 209 78 532 - 13 136 - 8 405 - 11 533

LT Liab 1 657 786 - - - - Fixed Ass 4 484 5 011 846 1 415 554 815

Tot Curr Liab 404 050 1 089 1 147 904 890 Inv & Loans 1 941 1 852 17 960 91 195 162 619

PER SHARE STATISTICS (cents per share) Tot Curr Ass 113 014 163 134 107 764 198 537 324 507

HEPS-C (ZARc) 141.91 - 51.00 62.00 - 6.00 100.00 Ord SH Int 1 096 901 - 1 100 380 1 075 774 1 140 901 1 710 243

-

-

Minority Int

- 34 612

-

NAV PS (ZARc) 833.05 1 415.00 1 466.00 1 448.00 2 133.00 LT Liab 2 699 3 010 428 2 303 390 208

Price High 1 050 1 249 1 501 1 501 1 275 Tot Curr Liab 15 199 31 698 33 944 75 635 420 144

Price Low 536 750 1 200 950 753 PER SHARE STATISTICS (cents per share)

Price Prd End 549 820 1 236 1 280 1 200 HEPS-C (ZARc) 10.80 20.20 4.69 0.38 2.97

RATIOS DPS (ZARc) - 11.50 10.00 12.00 -

Ret on SH Fnd 9.69 - 3.63 4.28 - 0.41 4.71 NAV PS (ZARc) 256.70 256.11 250.04 265.34 398.19

Oper Pft Mgn 12.50 6.07 91.39 - 28.51 - 3 Yr Beta - - 0.08 0.24 0.42 0.20

D:E 1.38 - - - - Price High 375 368 361 351 272

Current Ratio 0.49 0.68 0.63 0.41 0.88 Price Low 298 250 185 180 150

Price Prd End 340 340 297 200 241

RATIOS

Ret on SH Fnd 8.41 6.69 - 1.35 - 0.93 - 1.69

Oper Pft Mgn - 15 059.06 - 3 925.40 - 7 453.98 - 489.91 - 4 506.82

D:E - - - 0.03 0.29

Current Ratio 7.44 5.15 3.17 2.62 0.77

Div Cover - 1.49 - 0.35 - 0.23 -

120