Page 118 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 118

JSE - FOR Profile’s Stock Exchange Handbook: 2025 - Issue 3

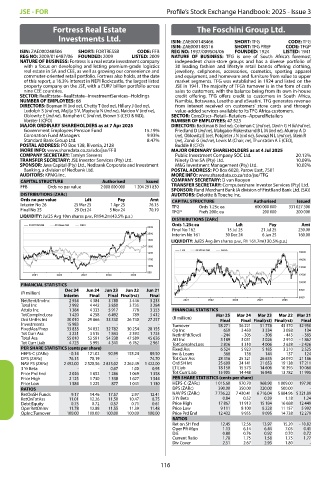

Fortress Real Estate The Foschini Group Ltd.

Investments Ltd. ISIN: ZAE000148466 SHORT: TFG CODE: TFG

ISIN: ZAE000148516 SHORT: TFG PREF CODE: TFGP

ISIN: ZAE000248506 SHORT: FORTRESSB CODE: FFB REG NO: 1937/009504/06 FOUNDED: 1924 LISTED: 1941

REG NO: 2009/016487/06 FOUNDED: 2009 LISTED: 2009 NATURE OF BUSINESS: TFG is one of South Africa’s foremost

NATURE OF BUSINESS: Fortress is a real estate investment company independent chain-store groups and has a diverse portfolio of

with a focus on developing and letting premium-grade logistics 30 leading fashion and lifestyle retail brands offering clothing,

real estate in SA and CEE, as well as growing our convenience and jewellery, cellphones, accessories, cosmetics, sporting apparel

commuter-oriented retail portfolio. Fortress also holds, at the date and equipment, and homeware and furniture from value to upper

of this report, a 16.3% interest in NEPI Rockcastle, the largest listed market segments. TFG was established in 1924 and listed on the

property company on the JSE, with a EUR7 billion portfolio across JSE in 1941. The majority of TFG’s turnover is in the form of cash

nine CEE countries. sales to customers, with the balance being from its own in-house

SECTOR: RealEstate--RealEstate--InvestmentServices--Holdings credit offering. TFG offers credit to customers in South Africa,

NUMBER OF EMPLOYEES: 68 Namibia, Botswana, Lesotho and eSwatini. TFG generates revenue

DIRECTORS: Bosman H (ind ne), Chetty T (ind ne), Hillary J (ind ne), from interest received on customers’ store cards and through

Ludolph S (ind ne), Majija S V, Mayisela N (ind ne), Naidoo V (ind ne), value-added services available to its TFG Africa customers.

Oblowitz E (ind ne), Rampheri C (ind ne), Brown S (CEO & MD), SECTOR: ConsDiscr--Retail--Retailers--ApparelRetailers

Vorster I (CFO) NUMBER OF EMPLOYEES: 47 523

MAJOR ORDINARY SHAREHOLDERS as at 7 Apr 2025 DIRECTORS: Backman B (ind ne), Coleman C (ind ne), Davin G H (ld ind ne),

Government Employees Pension Fund 15.19% Friedland D (ind ne), Makgabo-Fiskerstrand B L M (ind ne), Murray A D

Coronation Fund Managers 9.93% (ne), Oblowitz E (ne), Potgieter J N (ind ne), Sowazi N L (ind ne), Stein R

Standard Bank Group Ltd. 8.47% (ne), Zondi G (ind ne), Lewis M (Chair, ne), Thunström A E (CEO),

POSTAL ADDRESS: PO Box 138, Rivonia, 2128 Buddle R (CFO)

MORE INFO: www.sharedata.co.za/sdo/jse/FFB MAJOR ORDINARY SHAREHOLDERS as at 4 Jul 2025

COMPANY SECRETARY: Tamlyn Stevens Public Investment Company SOC Ltd. 20.13%

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Ninety One SA (Pty) Ltd. 10.09%

SPONSOR: Java Capital (Pty) Ltd., Nedbank Corporate and Investment M&G Investment Management (Pty) Ltd. 10.02%

Banking, a division of Nedbank Ltd. POSTAL ADDRESS: PO Box 6020, Parow East, 7501

AUDITORS: KPMG Inc. MORE INFO: www.sharedata.co.za/sdo/jse/TFG

CAPITAL STRUCTURE Authorised Issued COMPANY SECRETARY: D van Rooyen

FFB Ords no par value 2 000 000 000 1 204 291 830 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd. (SA))

DISTRIBUTIONS [ZARc] AUDITORS: Deloitte & Touche Inc.

Ords no par value Ldt Pay Amt CAPITAL STRUCTURE Authorised Issued

Interim No 26 25 Mar 25 1 Apr 25 76.15 TFG Ords 1.25c ea 600 000 000 331 027 300

Final No 25 29 Oct 24 5 Nov 24 70.19 TFGP Prefs 200c ea 200 000 200 000

LIQUIDITY: Jul25 Avg 10m shares p.w., R194.2m(43.5% p.a.)

DISTRIBUTIONS [ZARc]

FORTRESSB 40 Week MA REIV Ords 1.25c ea Ldt Pay Amt

2200

Final No 162 15 Jul 25 21 Jul 25 230.00

2000 Interim No 161 30 Dec 24 6 Jan 25 160.00

1800 LIQUIDITY: Jul25 Avg 8m shares p.w., R1 161.7m(130.5% p.a.)

1600

TFG 40 Week MA GERE

1400 18000

1200 16000

1000

14000

800

2021 2022 2023 2024 2025 12000

10000

FINANCIAL STATISTICS

Dec 24 Jun 24 Jun 23 Jun 22 Jun 21 8000

(R million)

Interim Final Final Final(rst) Final 6000

NetRent/InvInc 2 934 4 384 3 788 3 446 3 233 2021 2022 2023 2024 2025

Total Inc 2 992 4 442 3 850 3 735 3 284

Attrib Inc 1 384 4 333 5 917 778 3 353 FINANCIAL STATISTICS

TotCompIncLoss 1 420 4 258 6 492 789 3 412 Mar 25 Mar 24 Mar 23 Mar 22 Mar 21

Ord UntHs Int 30 010 29 866 33 330 26 740 27 257 (R million) Final Final Final(rst) Final(rst) Final

Investments 15 983 - - - - Turnover 58 271 56 221 51 778 43 370 32 950

FixedAss/Prop 33 833 34 032 32 782 30 254 28 155 Op Inc 659 3 450 3 334 3 058 134

Tot Curr Ass 3 231 3 515 1 843 2 393 1 735 NetIntPd(Rcvd) - 244 - 305 - 306 - 443 - 365

Total Ass 55 010 53 591 54 238 47 589 45 626 Att Inc 3 189 3 031 3 026 2 910 - 1 862

Tot Curr Liab 4 723 5 995 4 341 6 762 2 961 TotCompIncLoss 2 826 3 310 4 006 2 628 - 2 426

PER SHARE STATISTICS (cents per share) Fixed Ass 6 524 5 923 5 185 3 210 2 525

HEPS-C (ZARc) - 0.14 121.02 90.99 153.24 89.50 Inv & Loans 368 138 144 137 124

DPS (ZARc) 76.15 70.19 - - 74.70 Tot Curr Ass 28 316 25 321 26 635 24 070 21 186

NAV PS (ZARc) 2 492.00 2 520.56 2 813.02 2 262.49 1 422.00 Ord SH Int 25 609 24 141 21 653 19 138 17 211

3 Yr Beta - - 0.67 1.00 0.95 LT Liab 18 150 15 573 14 606 10 393 10 068

Price Prd End 2 026 1 652 1 286 1 069 1 358 Tot Curr Liab 15 905 14 448 16 845 13 782 11 995

Price High 2 125 1 730 1 338 1 627 1 544 PER SHARE STATISTICS (cents per share)

Price Low 1 584 1 225 877 1 041 1 130 HEPS-C (ZARc) 1 015.60 970.70 968.90 1 009.00 197.90

RATIOS DPS (ZARc) 390.00 350.00 320.00 500.00 -

RetOnSH Funds 9.17 14.46 17.57 2.97 12.41 NAV PS (ZARc) 7 736.22 7 430.41 6 716.04 5 884.96 5 321.89

RetOnTotAss 11.01 12.26 11.50 10.47 8.75 3 Yr Beta 0.84 0.52 0.39 1.18 1.24

Debt:Equity 0.75 0.72 0.57 0.71 0.61 Price High 17 867 11 913 15 184 16 688 12 449

OperRetOnInv 11.78 12.88 11.55 11.39 11.48 Price Low 9 111 8 100 8 228 11 157 5 992

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 Price Prd End 12 432 9 955 9 095 14 738 12 279

RATIOS

Ret on SH Fnd 12.45 12.56 13.97 15.20 - 10.82

Oper Pft Mgn 1.13 6.14 6.44 7.05 0.41

D:E 0.80 0.76 0.92 0.70 0.72

Current Ratio 1.78 1.75 1.58 1.75 1.77

Div Cover 2.51 2.67 2.93 1.80 -

116