Page 123 - Profile's Stock Exchange Handbook - 2025 Issue 3

P. 123

Profile’s Stock Exchange Handbook: 2025 - Issue 3 JSE - GRE

Greencoat Renewables plc Grindrod Ltd.

ISIN: IE00BF2NR112 SHORT: GRP CODE: GCT ISIN: ZAE000072328 SHORT: GRINDROD CODE: GND

REG NO: 598470 FOUNDED: 2017 LISTED: 2025 ISIN: ZAE000071106 SHORT: GRINDROD PREF CODE: GNDP

NATURE OF BUSINESS: Greencoat Renewables plc is an owner and REG NO: 1966/009846/06 FOUNDED: 1966 LISTED: 1986

operator of renewable energy infrastructure assets in Europe. It is NATURE OF BUSINESS: Grindrod, listed on the JSE Securities

listed on the Euronext Growth Market of Euronext Dublin and the Exchange, is based in South Africa and is represented by

AIM market of the London Stock Exchange under the ticker GRP. It subsidiaries, joint venture and associated companies in 23

is managed by Schroders Greencoat LLP. countries worldwide, employing more than 4 000 skilled and

SECTOR: Utilities--Utilities--Electricity--AltElectricity dedicated people.

NUMBER OF EMPLOYEES: 0 SECTOR: Inds--IndsGoods & Services--IndsTransport--TransportSer

DIRECTORS: Gilvarry E (snr ind ne), Graziano M (ind ne), Lindqvist E NUMBER OF EMPLOYEES: 4 378

(ind ne), Niamh M (ind ne), Murphy R (Chair, ind ne) DIRECTORS: Carolus C A (ind ne), Grindrod W J (ne), Khumalo A

MAJOR ORDINARY SHAREHOLDERS as at 18 Jun 2025 (ind ne), Magara B (ind ne), Malik D (ind ne), Ndlovu R (ind ne),

BlackRock Inc. 9.55% Sowazi N L (ld ind ne), Zatu Moloi Z P (ind ne), Ally F B (CFO),

KBI Global Investors 7.05% Mbambo X F (Group CEO)

Newton Investment Management 5.18% MAJOR ORDINARY SHAREHOLDERS as at 23 Jun 2025

POSTAL ADDRESS: Riverside One, Sir John Rogerson’s Quay, Dublin 2, Public Investment Corporation SOC Ltd. 20.18%

D02 X576, Ireland Government Employees Pension Fund 18.09%

MORE INFO: www.sharedata.co.za/sdo/jse/GCT Grindrod Investments (Pty) Ltd. 11.02%

COMPANY SECRETARY: Ocorian Administration (UK) Ltd. POSTAL ADDRESS: PO Box 1, Durban, 4000

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/GND

SPONSOR: Valeo Capital (Pty) Ltd. COMPANY SECRETARY: Vicky Commaille

AUDITORS: BDO TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

CAPITAL STRUCTURE Authorised Issued SPONSOR: Nedbank Corporate and Investment Banking, a division of

Nedbank Ltd.

GCT Ords EUR0.01c ea - 1 113 535 009 AUDITORS: PricewaterhouseCoopers Inc.

LIQUIDITY: Jul25 Avg 506 947 shares p.w., R8.1m(2.4% p.a.) CAPITAL STRUCTURE Authorised Issued

GND Ords 0.002c ea 2 750 000 000 698 031 586

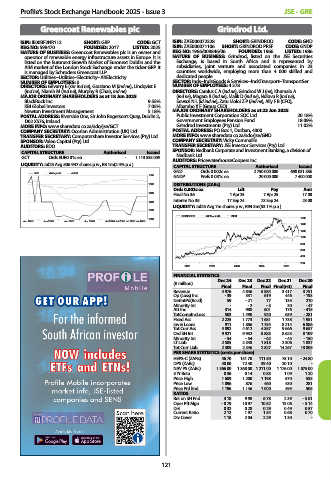

GRP 40 Day MA ALSH

1850 GNDP Prefs 0.031c ea 20 000 000 7 400 000

1800 DISTRIBUTIONS [ZARc]

Ords 0.002c ea Ldt Pay Amt

1750

Final No 36 1 Apr 25 7 Apr 25 17.00

Interim No 35 17 Sep 24 23 Sep 24 23.00

1700

LIQUIDITY: Jul25 Avg 7m shares p.w., R94.3m(53.1% p.a.)

1650

GRINDROD 40 Week MA INDT

1600 1600

Jun 2025 Jun 2025 Jun 2025 Jun 2025 Jul 2025 Jul 2025 Jul 2025 Jul 2025

1400

1200

1000

800

600

400

200

2021 2022 2023 2024 2025

FINANCIAL STATISTICS

Dec 24 Dec 23 Dec 22 Dec 21 Dec 20

(R million) Final Final Final Final(rst) Final

Revenue 4 976 4 846 5 884 3 417 3 751

Op (Loss) Inc - 39 531 619 446 - 193

NetIntPd(Rcvd) 59 - 21 77 135 210

Minority Int - - 2 - 3 30 - 47

Att Inc 314 988 601 176 - 415

TotCompIncLoss 503 1 490 920 639 - 281

Fixed Ass 2 225 1 773 1 681 1 738 1 951

Inv & Loans 911 1 886 1 754 8 214 6 886

Tot Curr Ass 4 892 4 612 4 357 9 666 9 657

Ord SH Int 9 921 9 932 8 883 8 623 8 109

Minority Int - 54 - 54 - 62 - 45 - 150

LT Liab 2 585 2 348 1 818 2 306 1 837

Tot Curr Liab 2 309 2 346 2 827 14 267 13 808

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 46.70 151.70 111.50 75.10 - 24.80

DPS (ZARc) 40.00 72.40 39.40 20.10 -

NAV PS (ZARc) 1 366.00 1 368.00 1 211.00 1 176.00 1 075.00

3 Yr Beta 0.36 0.14 0.85 1.09 1.20

Price High 1 609 1 200 1 198 570 535

Price Low 1 096 876 460 430 281

Price Prd End 1 196 1 146 1 000 495 505

RATIOS

Ret on SH Fnd 3.18 9.98 6.78 2.39 - 5.81

Oper Pft Mgn - 0.79 10.97 10.52 13.06 - 5.14

D:E 0.32 0.28 0.29 0.49 0.57

Current Ratio 2.12 1.97 1.54 0.68 0.70

Div Cover 1.18 2.04 2.29 1.30 -

121