Page 27 - Profile's Stock Exchange Handbook - 2025 Issue 1

P. 27

Profile’s Stock Exchange Handbook: 2025 – Issue 1 NSX – LHN

Letshego Holdings (Namibia) Ltd. Mobile Telecommunications Ltd.

LHN MOC

ISIN: NA000A2DVV41 SHORT: LHN CODE: LHN ISIN: NA000A3CR803 SHORT: MTC LTD CODE: MOC

REG NO: 2016/0145 FOUNDED: 2016 LISTED: 2017 REG NO: 94/458 FOUNDED: 1994 LISTED: 2021

NATURE OF BUSINESS: Letshego Holdings (Namibia) Ltd. is a listed NATURE OF BUSINESS: MTC is the largest mobile telecommunications

public company, which operates within the Republic of Namibia. Its main operator in Namibia, with 2.6 million active subscribers. For over 26 years,

business is holding its investment subsidiaries, namely Letshego Bank MTC has grown revenue and retained customers by providing voice and

Namibia Ltd. (“LBN”) and Letshego Micro Financial Services Namibia data services and solutions to post-paid and prepaid individual and

(Pty) Ltd. (“LMFSN”). LHN holds 99.99% of the issued share capital in business customers through its extensive telecommunications

LBN and 100% of the issued share capital in LMFSN. The Group provides transmission and distribution network, serviced by 35 mobile homes, 29

banking and other financial services to Namibian residents. dealerships (airtime sellers and distributors), 24-hour customer contact

SECTOR: Fins—Banks—Banks—Banks centre, digital channels and a network management and technical quality

NUMBER OF EMPLOYEES: 154 centre (For immediate response to customer complaints).

DIRECTORS: Chigiji K (ind ne), EsterhuyseJJ(ind ne), Mutumba J (ind SECTOR: Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

ne), NakaleMM(ind ne), Ochieng R (ne), von BlottnitzSB(ind ne), NUMBER OF EMPLOYEES: 848

Kali Dr E (CEO), Altmann K (CFO) DIRECTORS: GawaxabTC(ind ne), George Dr F (ne), Hiwilepo T (ne),

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2023 Kanime A (ne), Schuckmann W (ind ne), ShipikiRDR(ne), Mberirua T

Letshego Africa Holdings Ltd. 78.46% (Chair, ind ne), Erastus Dr L R (MD), Smit M J (FD)

Kumwe Investment Holdings Ltd. 11.97% MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2023

POSTAL ADDRESS: PO Box 11600, Windhoek, Namibia NPTH 60.13%

MORE INFO: www.sharedata.co.za/sdo/jse/LHN Government Institutions Pension Fund 28.67%

COMPANY SECRETARY: Mignon Klein POSTAL ADDRESS: PO Box 23051, Windhoek, Namibia

TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/MOC

SPONSOR: IJG Securities (Pty) Ltd. COMPANY SECRETARY: Ndahambelela Haikali

AUDITORS: Ernst & Young Namibia TRANSFER SECRETARY: Transfer Secretaries (Pty) Ltd.

SPONSOR: IJG Securities (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED AUDITORS: Deloitte & Touche Inc.

LHN Ords NAD0.02c ea - 500 000 000

CAPITAL STRUCTURE AUTHORISED ISSUED

DISTRIBUTIONS [NADc] MOC Ords NAD3.3c ea 750 000 000 750 000 000

Ords NAD0.02c ea Ldt Pay Amt

Interim No 12 1 Nov 24 22 Nov 24 39.89 DISTRIBUTIONS [NADc]

Final No 11 24 May 24 14 Jun 24 36.38 Ords NAD3.3c ea Ldt Pay Amt

Final No 7 17 Jan 25 7 Feb 25 49.27

LIQUIDITY: Jan25 Avg 14 443 shares p.w., R65 005.2(0.2% p.a.)

Interim No 6 13 Jun 24 5 Jul 24 33.82

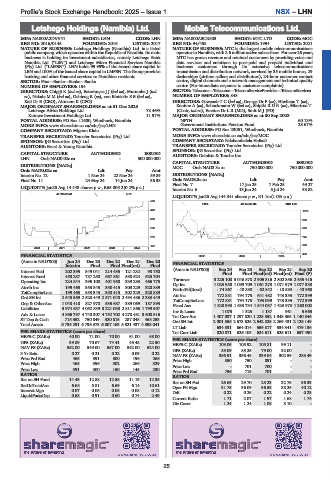

40 Week MA LHN

LIQUIDITY: Jan25 Avg 144 341 shares p.w., R1.1m(1.0% p.a.)

500

FTEL 40 Week MA MTC LTD

429 1078

359 960

288 843

218 725

608

147

2020 | 2021 | 2022 | 2023 | 2024 |

490

FINANCIAL STATISTICS 2022 | 2023 | 2024 |

(Amts in NAD’000) Jun 24 Dec 23 Dec 22 Dec 21 Dec 20 FINANCIAL STATISTICS

Interim Final Final Final(rst) Final

Interest Paid 202 395 349 041 214 435 121 232 98 750 (Amts in NAD’000) Sep 24 Sep 23 Sep 22 Sep 21 Sep 20

Final

Final Final(rst) Final(rst) Final (P)

Interest Rcvd 453 287 787 250 667 861 588 524 625 704 Turnover 3 225 100 3 046 878 2 905 316 2 802 356 2 685 416

Operating Inc 224 844 395 100 401 950 339 283 466 775 Op Inc 1 023 950 1 099 709 1 061 273 1 071 979 1 077 338

Attrib Inc 199 465 353 345 350 415 303 229 320 889 NetIntPd(Rcvd) - 74 867 - 48 888 - 62 842 - 18 583 - 40 968

TotCompIncLoss 199 465 353 345 350 415 302 229 320 889 Att Inc 772 881 794 175 641 482 743 335 772 399

Ord SH Int 2 545 569 2 528 449 2 571 048 2 494 486 2 383 449 TotCompIncLoss 772 881 794 175 793 039 743 335 772 399

Dep & OtherAcc 1 048 418 827 978 535 687 389 069 187 893 Fixed Ass 1 828 993 1 633 734 1 544 037 1 423 973 1 260 002

Liabilities 3 974 637 4 052 839 3 221 030 2 811 866 1 799 507

Inv & Loans 1 075 1 525 1 137 961 5 665

Adv & Loans 4 866 797 4 740 307 4 752 702 4 278 481 3 608 616 Tot Curr Ass 1 407 037 1 297 820 1 228 352 1 048 365 1 140 846

ST Dep & Cash 715 352 750 849 320 815 287 048 468 253 Ord SH Int 2 901 856 2 673 625 2 542 825 2 269 431 2 126 149

Total Assets 6 735 291 6 796 373 6 007 163 5 521 437 4 398 041

LT Liab 634 531 664 014 559 817 534 341 479 136

PER SHARE STATISTICS (cents per share) Tot Curr Liab 820 871 626 105 624 611 625 611 657 490

HEPS-C (ZARc) 40.00 71.00 70.00 61.00 68.00

DPS (ZARc) 39.89 70.67 74.41 45.48 22.50 PER SHARE STATISTICS (cents per share) 105.81 99.11 -

HEPS-C (ZARc)

103.05

105.92

NAV PS (ZARc) 552.00 549.00 557.00 542.00 524.00 DPS (ZARc) 83.09 85.25 79.00 32.00 -

3 Yr Beta 0.27 0.21 0.22 0.09 0.22 NAV PS (ZARc) 386.91 356.48 339.04 302.59 283.49

Price Prd End 465 391 300 196 266 Price High 850 750 891 - -

Price High 465 396 302 266 329 Price Low - 701 700 - -

Price Low 391 300 150 145 230 Price Prd End 756 715 701 - -

RATIOS RATIOS

Ret on SH Fund 14.45 12.88 12.58 11.19 12.35 Ret on SH Fnd 26.63 29.70 25.23 32.75 36.33

RetOnTotalAss 6.68 5.81 6.69 6.14 10.61 Oper Pft Mgn 31.75 36.09 36.53 38.25 40.12

Interest Mgn 0.07 0.06 0.08 0.08 0.12 D:E 0.22 0.25 0.22 0.24 0.23

LiquidFnds:Dep 0.68 0.91 0.60 0.74 2.49

Current Ratio 1.71 2.07 1.97 1.68 1.74

Div Cover 1.24 1.24 1.08 3.10 -

25